Question

Emma Co is a publicly traded company. On January 1, 2019, the company acquired $2,000,000, 8%, 10-years bonds from Saba Co. The yield-to-maturity is

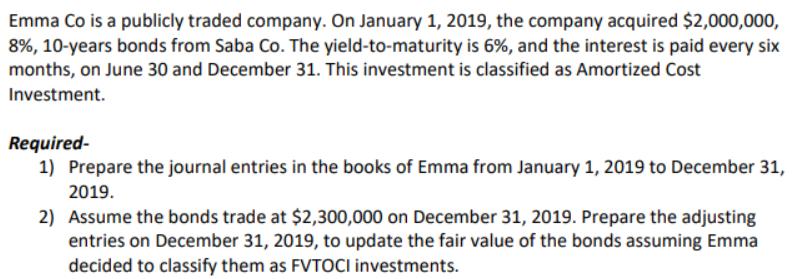

Emma Co is a publicly traded company. On January 1, 2019, the company acquired $2,000,000, 8%, 10-years bonds from Saba Co. The yield-to-maturity is 6%, and the interest is paid every six months, on June 30 and December 31. This investment is classified as Amortized Cost Investment. Required- 1) Prepare the journal entries in the books of Emma from January 1, 2019 to December 31, 2019. 2) Assume the bonds trade at $2,300,000 on December 31, 2019. Prepare the adjusting entries on December 31, 2019, to update the fair value of the bonds assuming Emma decided to classify them as FVTOCI investments.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Journal entries from January 1 2019 to December 31 2019 January 1 2019 Investment in B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

34th Edition

0135919460, 978-0135919460

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App