Answered step by step

Verified Expert Solution

Question

1 Approved Answer

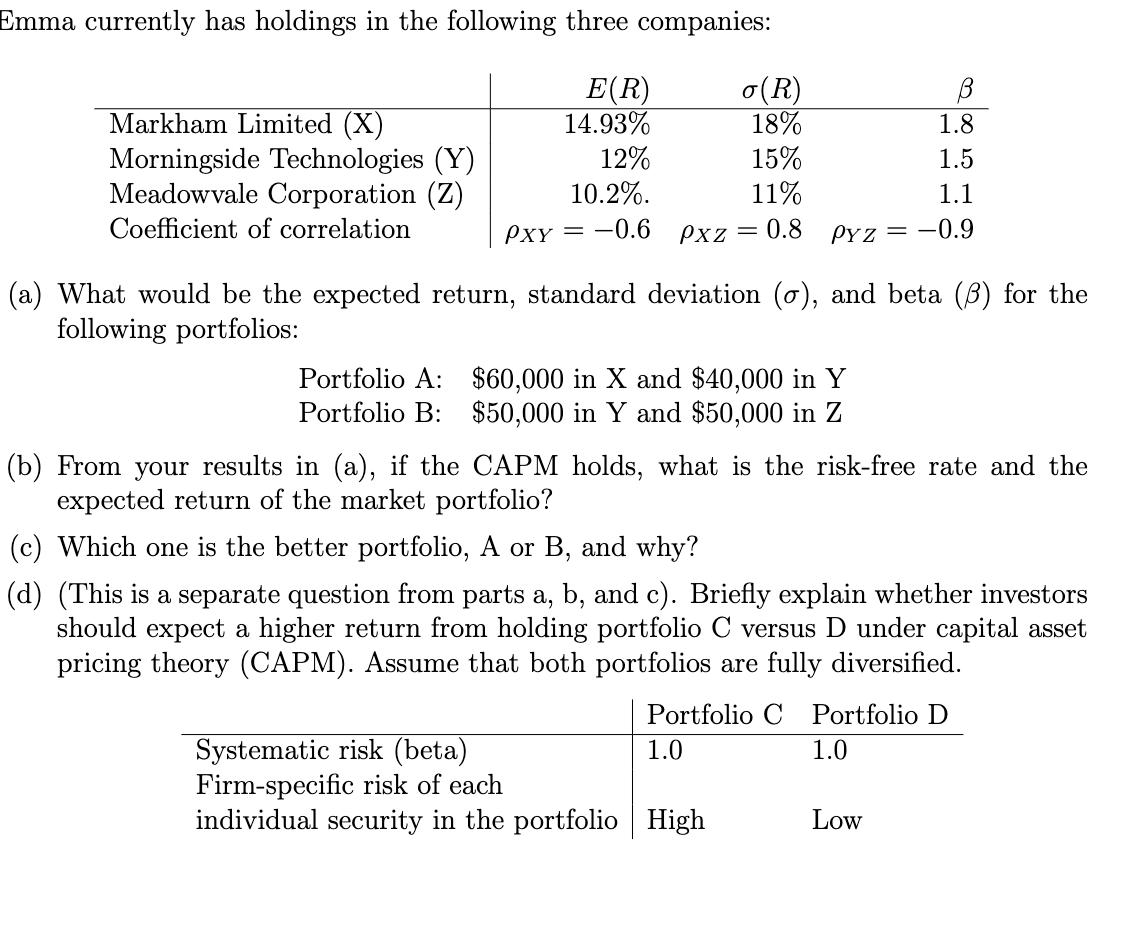

Emma currently has holdings in the following three companies: E(R) 14.93% Markham Limited (X) Morningside Technologies (Y) Meadowvale Corporation (Z) Coefficient of correlation 12%

Emma currently has holdings in the following three companies: E(R) 14.93% Markham Limited (X) Morningside Technologies (Y) Meadowvale Corporation (Z) Coefficient of correlation 12% 10.2%. -0.6 Portfolio A: Portfolio B: PXY = o(R) 18% 15% 11% Pxz = 0.8 (a) What would be the expected return, standard deviation (o), and beta (3) for the following portfolios: 1.5 1.1 PYZ = -0.9 $60,000 in X and $40,000 in Y $50,000 in Y and $50,000 in Z B 1.8 (b) From your results in (a), if the CAPM holds, what is the risk-free rate and the expected return of the market portfolio? Systematic risk (beta) Firm-specific risk of each individual security in the portfolio High (c) Which one is the better portfolio, A or B, and why? (d) (This is a separate question from parts a, b, and c). Briefly explain whether investors should expect a higher return from holding portfolio C versus D under capital asset pricing theory (CAPM). Assume that both portfolios are fully diversified. Portfolio C Portfolio D 1.0 1.0 Low

Step by Step Solution

★★★★★

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the expected return ER standard deviation and beta for the given portfolios well use th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started