Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Emma Ltd conducted an impairment test at 30 June 2020. As a part of that exercise, it measured the recoverable amount of the entity,

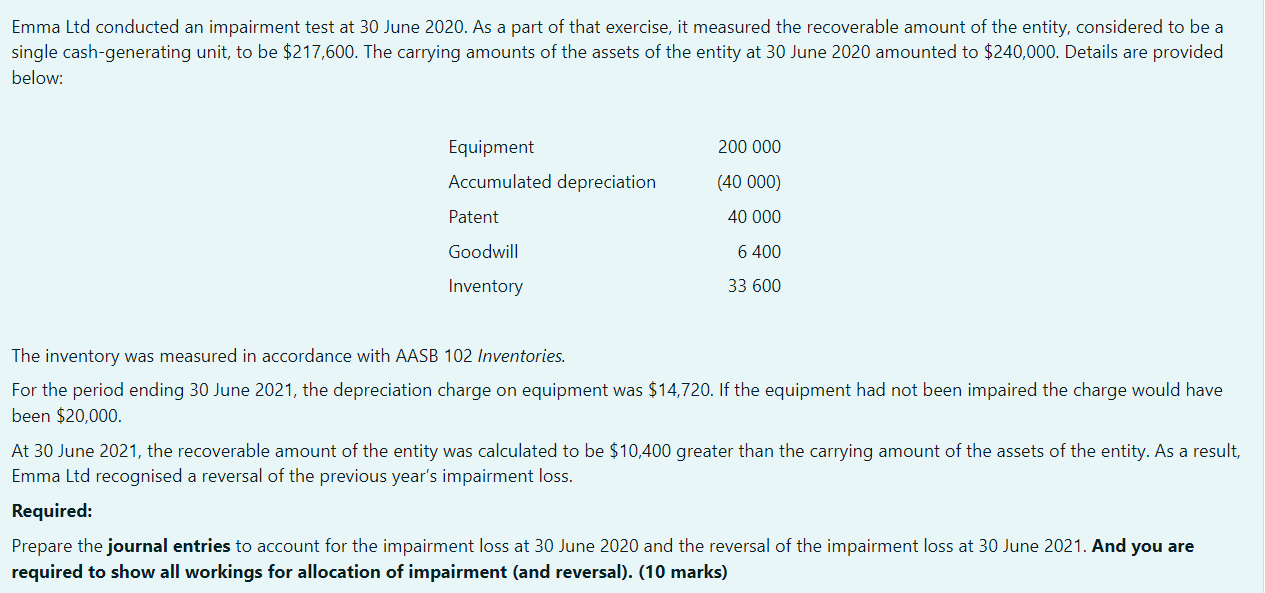

Emma Ltd conducted an impairment test at 30 June 2020. As a part of that exercise, it measured the recoverable amount of the entity, considered to be a single cash-generating unit, to be $217,600. The carrying amounts of the assets of the entity at 30 June 2020 amounted to $240,000. Details are provided below: Equipment 200 000 Accumulated depreciation (40 000) Patent 40 000 Goodwill 6 400 Inventory 33 600 The inventory was measured in accordance with AASB 102 Inventories. For the period ending 30 June 2021, the depreciation charge on equipment was $14,720. If the equipment had not been impaired the charge would have been $20,000. At 30 June 2021, the recoverable amount of the entity was calculated to be $10,400 greater than the carrying amount of the assets of the entity. As a result, Emma Ltd recognised a reversal of the previous year's impairment loss. Required: Prepare the journal entries to account for the impairment loss at 30 June 2020 and the reversal of the impairment loss at 30 June 2021. And you are required to show all workings for allocation of impairment (and reversal). (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

DATE Working Notes 2 Impaiement Loss is 24000021760...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started