Question

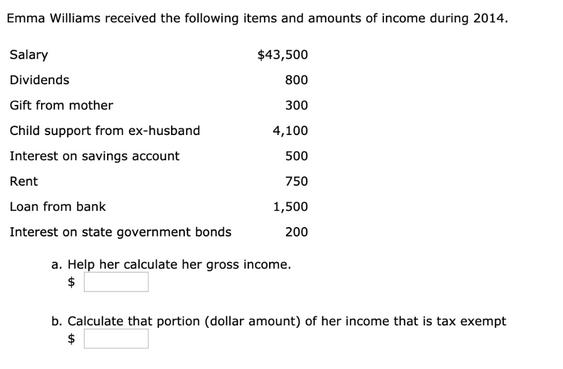

Emma Williams received the following items and amounts of income during 2014. Salary Dividends Gift from mother $43,500 800 300 Child support from ex-husband

Emma Williams received the following items and amounts of income during 2014. Salary Dividends Gift from mother $43,500 800 300 Child support from ex-husband 4,100 Interest on savings account 500 Rent 750 Loan from bank 1,500 200 Interest on state government bonds a. Help her calculate her gross income. $ b. Calculate that portion (dollar amount) of her income that is tax exempt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Financial Planning

Authors: Lawrence J. Gitman, Michael D. Joehnk, Randy Billingsley

12th Edition

1439044473, 978-1439044476

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App