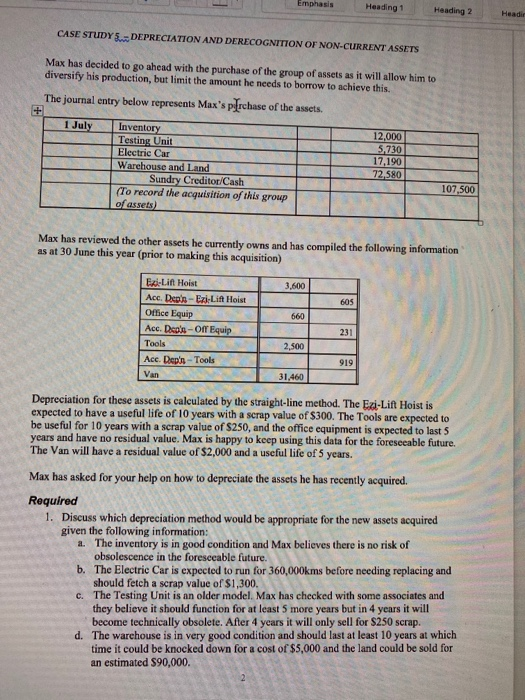

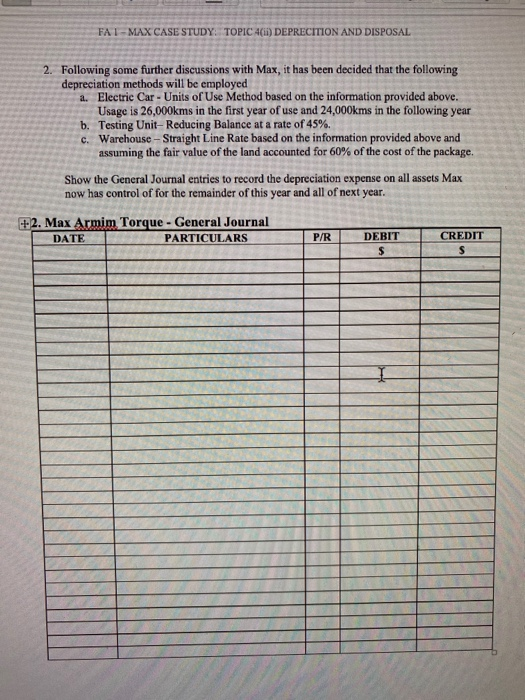

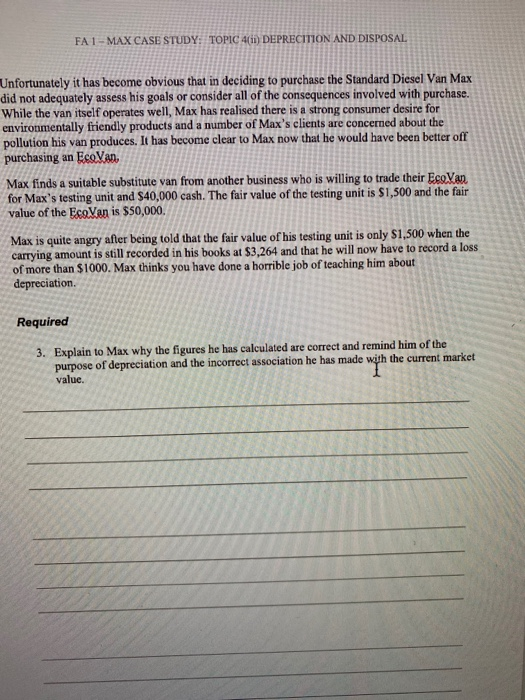

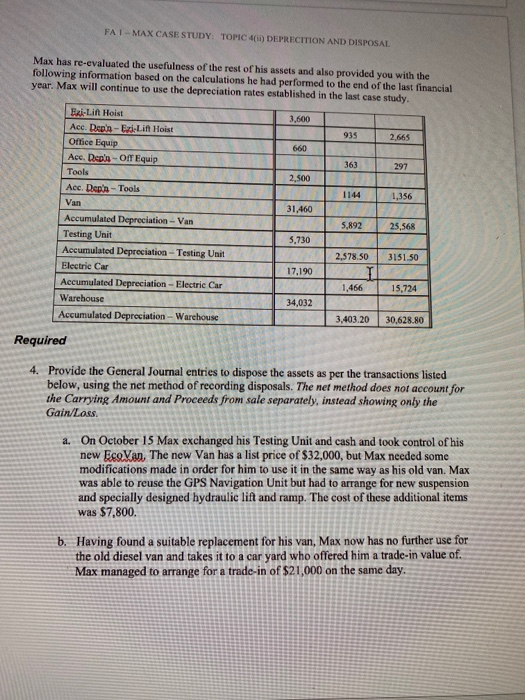

Emphasis Heading 1 Heading 2 Header CASE STUDY-DEPRECIATION AND DERECOGNITION OF NON-CURRENT ASSETS Max has decided to go ahead with the purchase of the group of assets as it will allow him to diversify his production, but limit the amount he needs to borrow to achieve this. The journal entry below represents Max's prchase of the assets. 1 July Inventory Testing Unit Electric Car Warehouse and Land Sundry Creditor/Cash (To record the acquisition of this group of assets) 12,000 5,730 17,190 72.580 107,500 Max has reviewed the other assets he currently owns and has compiled the following information as at 30 June this year (prior to making this acquisition) 3.600 605 660 Ex-Lin Hoist Ace. Dep's -Ezi Lift Hoist Office Equip Ace Deco's - Off Equip Tools Acc. Dep's - Tools Van 231 2,500 919 31,460 Depreciation for these assets is calculated by the straight-line method. The Exi-Lift Hoist is expected to have a useful life of 10 years with a scrap value of $300. The Tools are expected to be useful for 10 years with a scrap value of $250, and the office equipment is expected to last 5 years and have no residual value. Max is happy to keep using this data for the foreseeable future. The Van will have a residual value of $2,000 and a useful life of 5 years. Max has asked for your help on how to depreciate the assets he has recently acquired. Required 1. Discuss which depreciation method would be appropriate for the new assets acquired given the following information: 2. The inventory is in good condition and Max believes there is no risk of obsolescence in the foreseeable future. b. The Electric Car is expected to run for 360,000kms before needing replacing and should fetch a scrap value of $1,300. c. The Testing Unit is an older model. Max has checked with some associates and they believe it should function for at least 5 more years but in 4 years it will become technically obsolete. After 4 years it will only sell for $250 scrap. d. The warehouse is in very good condition and should last at least 10 years at which time it could be knocked down for a cost of $5,000 and the land could be sold for an estimated $90,000 FAI-MAX CASE STUDY: TOPIC 4) DEPRECTION AND DISPOSAL Make sure you include arguments for the methods you have chosen in your answer. I FAI-MAX CASE STUDY: TOPIC 4(1) DEPRECITION AND DISPOSAL 2. Following some further discussions with Max, it has been decided that the following depreciation methods will be employed a. Electric Car - Units of Use Method based on the information provided above. Usage is 26,000kms in the first year of use and 24,000kms in the following year b. Testing Unit- Reducing Balance at a rate of 45%. c. Warehouse - Straight Line Rate based on the information provided above and assuming the fair value of the land accounted for 60% of the cost of the package. Show the General Journal entries to record the depreciation expense on all assets Max now has control of for the remainder of this year and all of next year. +2. Max Armim Torque - General Journal DATE PARTICULARS P/R CREDIT DEBIT S FA 1 - MAX CASE STUDY: TOPIC 4(1) DEPRECITION AND DISPOSAL Unfortunately it has become obvious that in deciding to purchase the Standard Diesel Van Max did not adequately assess his goals or consider all of the consequences involved with purchase. While the van itself operates well, Max has realised there is a strong consumer desire for environmentally friendly products and a number of Max's clients are concerned about the pollution his van produces. It has become clear to Max now that he would have been better off purchasing an Eco Van Max finds a suitable substitute van from another business who is willing to trade their Eco Van for Max's testing unit and $40,000 cash. The fair value of the testing unit is $1,500 and the fair value of the Eco Van is $50,000. Max is quite angry after being told that the fair value of his testing unit is only $1,500 when the carrying amount is still recorded in his books at $3,264 and that he will now have to record a loss of more than $1000. Max thinks you have done a horrible job of teaching him about depreciation. Required 3. Explain to Max why the figures he has calculated are correct and remind him of the purpose of depreciation and the incorrect association he has made with the current market value. FAT-MAX CASE STUDY: TOPIC 4) DEPRECTION AND DISPOSAL Max has re-evaluated the usefulness of the rest of his assets and also provided you with the following information based on the calculations he had performed to the end of the last financial year. Max will continue to use the depreciation rates established in the last case study. 3.600 935 2.665 660 363 297 2,500 1144 1,356 Evi-Lin Hoist Ace. Depa-ExLift Hoist Office Equip Ace. Depin-Off Equip Tools Ace Depa-Tools Van Accumulated Depreciation - Van Testing Unit Accumulated Depreciation - Testing Unit Electric Car Accumulated Depreciation - Electric Car Warehouse Accumulated Depreciation - Warehouse 31,460 5,892 25,568 5,730 2,578.50 3151.50 17,190 1,466 15.724 34,032 3,403.20 30.628.80 Required 4. Provide the General Journal entries to dispose the assets as per the transactions listed below, using the net method of recording disposals. The net method does not account for the Carrying Amount and Proceeds from sale separately, instead showing only the Gain/Loss a. On October 15 Max exchanged his Testing Unit and cash and took control of his new Eco Van. The new Van has a list price of $32,000, but Max needed some modifications made in order for him to use it in the same way as his old van. Max was able to reuse the GPS Navigation Unit but had to arrange for new suspension and specially designed hydraulic lift and ramp. The cost of these additional items was $7,800. b. Having found a suitable replacement for his van, Max now has no further use for the old diesel van and takes it to a car yard who offered him a trade-in value of. Max managed to arrange for a trade-in of $21,000 on the same day. M N A E MI ABCDE INI Emphasis AaBbcc AaBb CcD Heading 1 Heading 2 He FAI-MAX CASE STUDY: TOPIC 4) DEPRECTION AND DISPOSAL 4. Max Armim Torque - General Journal DATE PARTICULARS P/R DEBIT CREDIT ACDE AaBbcc AaBb CcD AalbCcDd Emphasis Heading 1 Heading 2 Heading 3 FA 1 - MAX CASE STUDY: TOPIC 4(1) DEPRECTION AND DISPOSAL Max is feeling better about the entries now and thanks you for taking care of them for him. He now wants to know that since his business is doing much better with the better assets and products for clients to buy from him he believes he has managed to build quite a solid reputation which has improved the net worth of his business and wants this to be reflected in Max Aumim Torque's balance sheet and has asked you to work your magic to make it happen. Required 5. Explain to Max if this is possible and what the standards say about this. Discuss also what the standards say the correct treatment of goodwill is and contrast it to the previous standards