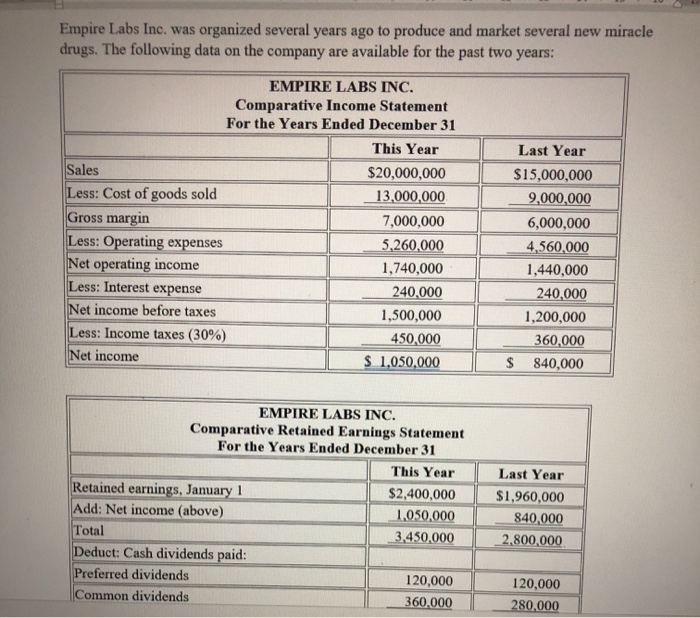

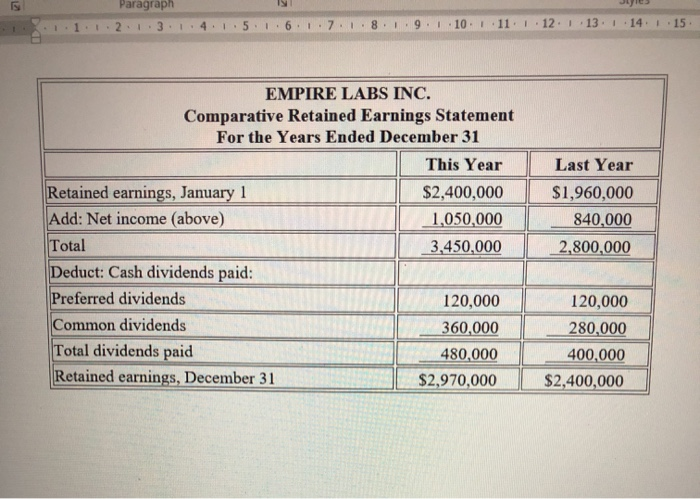

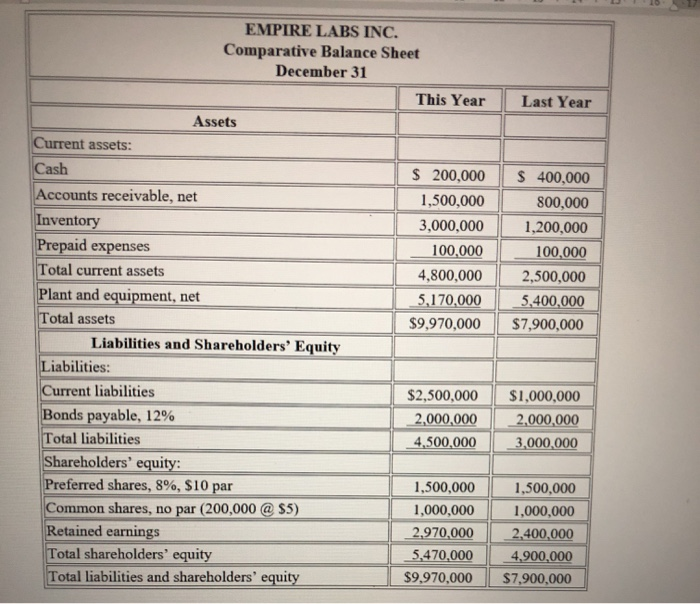

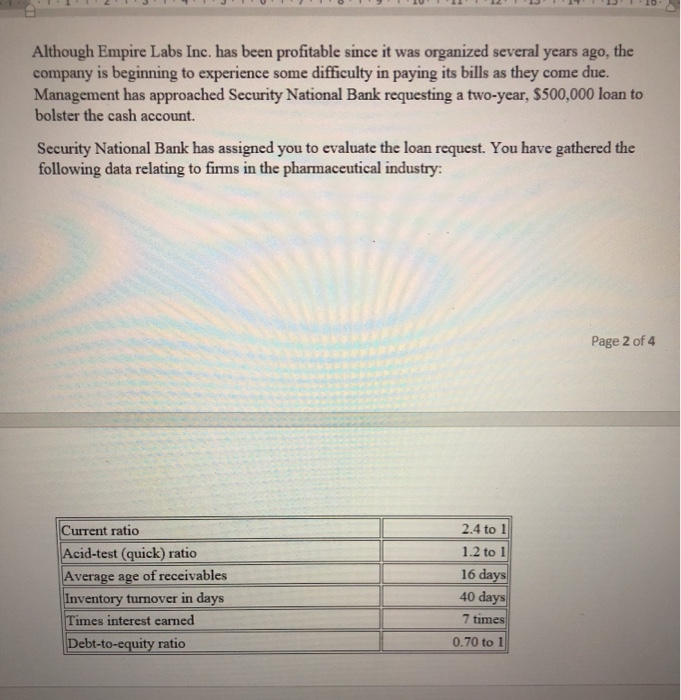

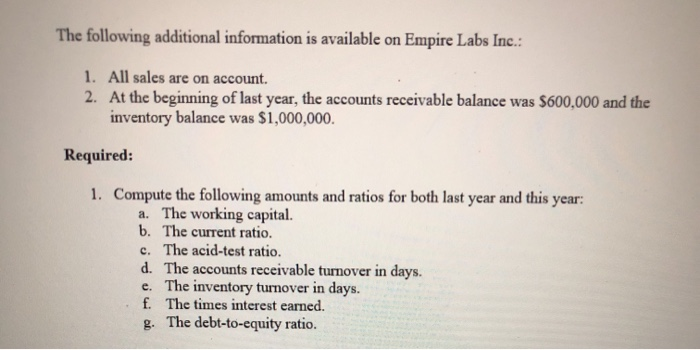

Empire Labs Inc. was organized several years ago to produce and market several new miracle drugs. The following data on the company are available for the past two years: EMPIRE LABS INC. Comparative Income Statement For the Years Ended December 31 This Year Sales $20,000,000 Less: Cost of goods sold 13,000,000 Gross margin 7,000,000 Less: Operating expenses 5,260,000 Net operating income 1,740,000 Less: Interest expense 240,000 Net income before taxes 1,500,000 Less: Income taxes (30%) 450,000 Net income $ 1,050,000 Last Year $15,000,000 9,000,000 6,000,000 4,560,000 1,440,000 240,000 1,200,000 360,000 $ 840,000 EMPIRE LABS INC. Comparative Retained Earnings Statement For the Years Ended December 31 This Year Retained earnings, January 1 $2,400,000 Add: Net income (above) 1,050,000 Total 3,450,000 Deduct: Cash dividends paid: Preferred dividends 120,000 Common dividends 360,000 Last Year $1,960,000 840,000 2,800,000 120,000 280,000 Paragraph 1.2.3.4.1.5. 6. . 7. ! 1 9.1.10 111 112 113.1.14.1 15. EMPIRE LABS INC. Comparative Retained Earnings Statement For the Years Ended December 31 This Year Retained earnings, January 1 $2,400,000 Add: Net income (above) 1,050,000 Total 3,450,000 Deduct: Cash dividends paid: Preferred dividends 120,000 Common dividends 360,000 Total dividends paid 480,000 Retained earnings, December 31 $2,970,000 Last Year $1,960,000 840,000 2,800,000 120,000 280,000 400,000 $2,400,000 Last Year EMPIRE LABS INC. Comparative Balance Sheet December 31 This Year Assets Current assets: Cash $ 200,000 Accounts receivable, net 1,500,000 Inventory 3,000,000 Prepaid expenses 100,000 Total current assets 4.800,000 Plant and equipment, net 5,170,000 Total assets $9,970,000 Liabilities and Shareholders' Equity Liabilities: Current liabilities $2,500,000 Bonds payable, 12% 2,000,000 Total liabilities 4,500,000 Shareholders' equity: Preferred shares, 8%, $10 par 1,500,000 Common shares, no par (200,000 @ $5) 1,000,000 Retained earnings 2.970,000 Total shareholders' equity 5,470,000 Total liabilities and shareholders' equity $9.970,000 $ 400,000 800,000 1,200,000 100,000 2,500,000 5,400,000 $7,900,000 $1,000,000 2,000,000 3,000,000 1,500,000 1,000,000 2,400,000 4,900,000 $7,900,000 Although Empire Labs Inc. has been profitable since it was organized several years ago, the company is beginning to experience some difficulty in paying its bills as they come due. Management has approached Security National Bank requesting a two-year, $500,000 loan to bolster the cash account. Security National Bank has assigned you to evaluate the loan request. You have gathered the following data relating to firms in the pharmaceutical industry: Page 2 of 4 Current ratio Acid-test (quick) ratio Average age of receivables Inventory turnover in days Times interest earned Debt-to-equity ratio 2.4 to 1 1.2 to 1 16 days 40 days 7 times 0.70 to 1 The following additional information is available on Empire Labs Inc.: 1. All sales are on account. 2. At the beginning of last year, the accounts receivable balance was $600,000 and the inventory balance was $1,000,000. Required: 1. Compute the following amounts and ratios for both last year and this year: a. The working capital. b. The current ratio. c. The acid-test ratio. d. The accounts receivable turnover in days. e. The inventory turnover in days. f. The times interest earned. g. The debt-to-equity ratio