Answered step by step

Verified Expert Solution

Question

1 Approved Answer

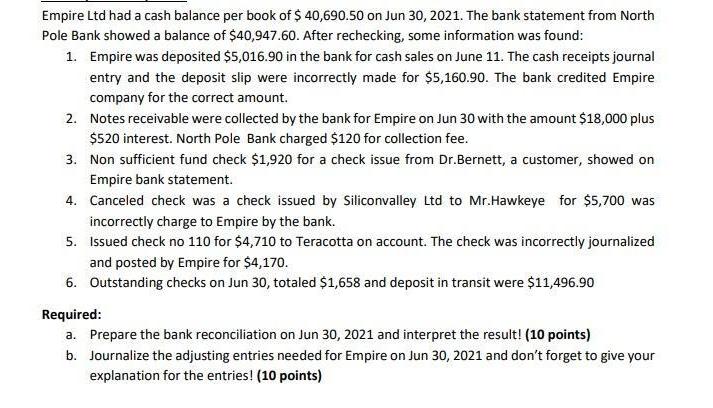

Empire Ltd had a cash balance per book of $ 40,690.50 on Jun 30, 2021. The bank statement from North Pole Bank showed a

Empire Ltd had a cash balance per book of $ 40,690.50 on Jun 30, 2021. The bank statement from North Pole Bank showed a balance of $40,947.60. After rechecking, some information was found: 1. Empire was deposited $5,016.90 in the bank for cash sales on June 11. The cash receipts journal entry and the deposit slip were incorrectly made for $5,160.90. The bank credited Empire company for the correct amount. 2. Notes receivable were collected by the bank for Empire on Jun 30 with the amount $18,000 plus $520 interest. North Pole Bank charged $120 for collection fee. 3. Non sufficient fund check $1,920 for a check issue from Dr.Bernett, a customer, showed on Empire bank statement. 4. Canceled check was a check issued by Siliconvalley Ltd to Mr.Hawkeye for $5,700 was incorrectly charge to Empire by the bank. 5. Issued check no 110 for $4,710 to Teracotta on account. The check was incorrectly journalized and posted by Empire for $4,170. 6. Outstanding checks on Jun 30, totaled $1,658 and deposit in transit were $11,496.90 Required: a. Prepare the bank reconciliation on Jun 30, 2021 and interpret the result! (10 points) b. Journalize the adjusting entries needed for Empire on Jun 30, 2021 and don't forget to give your explanation for the entries! (10 points)

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

A The requirement is to prepare the bank reconciliation statement For this we need to adjust the giv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started