Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Empire skin solutions Pty (Ltd) has initiated a new line of CBD skin products. Empire must acquire a new high-tech machine for this new product

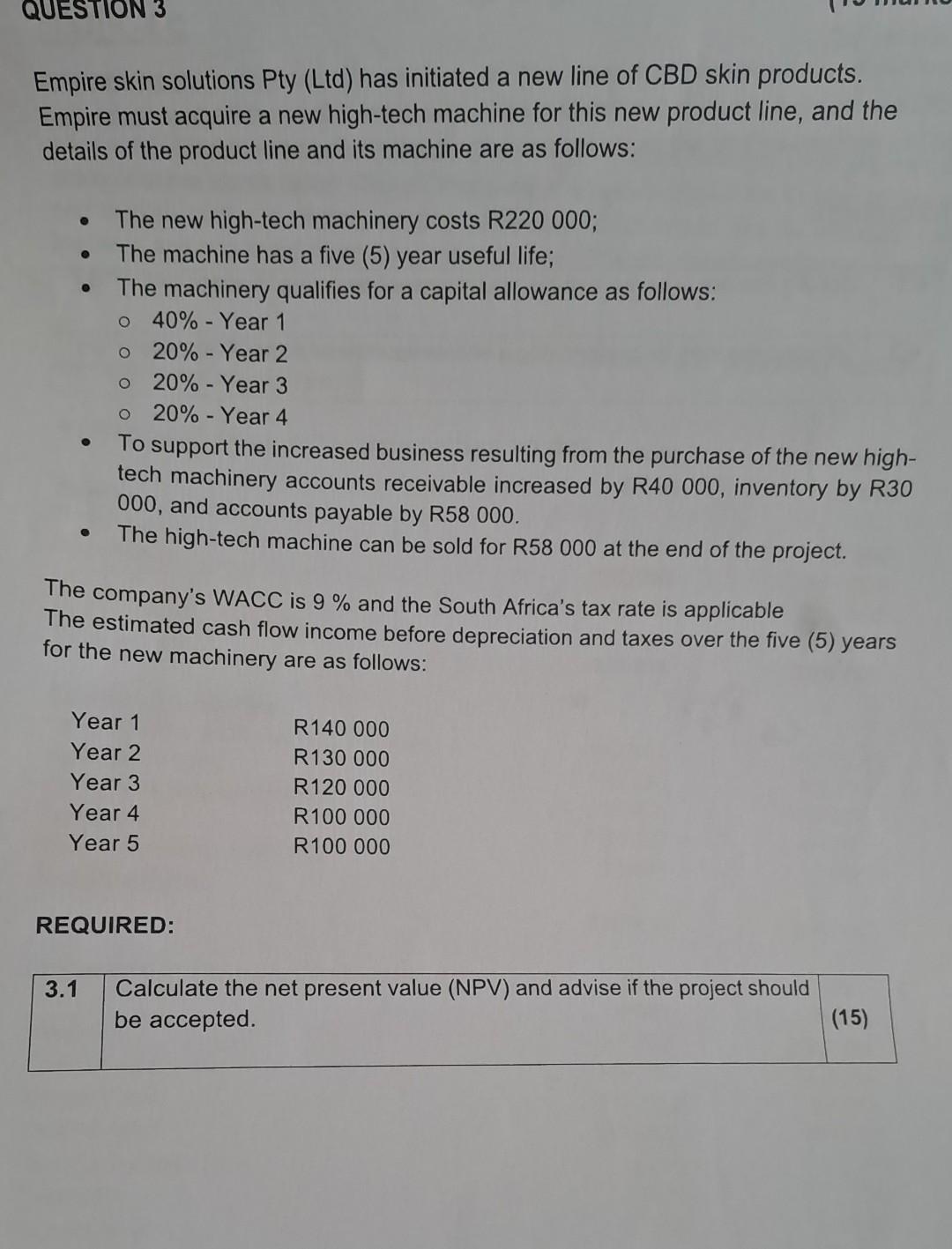

Empire skin solutions Pty (Ltd) has initiated a new line of CBD skin products. Empire must acquire a new high-tech machine for this new product line, and the details of the product line and its machine are as follows: - The new high-tech machinery costs R220 000; - The machine has a five (5) year useful life; - The machinery qualifies for a capital allowance as follows: - 40% - Year 1 - 20% - Year 2 - 20% - Year 3 - 20\% - Year 4 - To support the increased business resulting from the purchase of the new hightech machinery accounts receivable increased by R40000, inventory by R30 000 , and accounts payable by R58 000 . - The high-tech machine can be sold for R58 000 at the end of the project. The company's WACC is 9% and the South Africa's tax rate is applicable The estimated cash flow income before depreciation and taxes over the five (5) years for the new machinery are as follows: REQUIRED: \begin{tabular}{|l|l|l|} \hline 3.1 & Calculate the net present value (NPV) and advise if the project should \end{tabular} be accepted. (15)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started