Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Empirical evidence indicates that the Forward market for foreign currencies is Efficient. You conduct business regularly with a company in Florence Italy and have

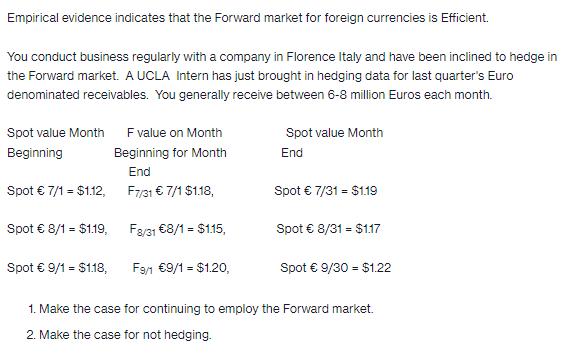

Empirical evidence indicates that the Forward market for foreign currencies is Efficient. You conduct business regularly with a company in Florence Italy and have been inclined to hedge in the Forward market. A UCLA Intern has just brought in hedging data for last quarter's Euro denominated receivables. You generally receive between 6-8 million Euros each month. Spot value Month Beginning Spot 7/1 = $1.12, Spot 8/1 = $1.19, Spot 9/1 = $1.18, F value on Month Beginning for Month End F7/31 7/1 $1.18, F8/31 8/1 = $1.15, F9/1 9/1 = $1.20, Spot value Month End Spot 7/31 = $1.19 Spot 8/31 - $1.17 Spot 9/30 = $1.22 1. Make the case for continuing to employ the Forward market. 2. Make the case for not hedging.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Case for continuing to employ the Forward market The Forward market allows you to lock in a specific exchange rate for future transactions providing certainty and protection against adverse currency ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started