Answered step by step

Verified Expert Solution

Question

1 Approved Answer

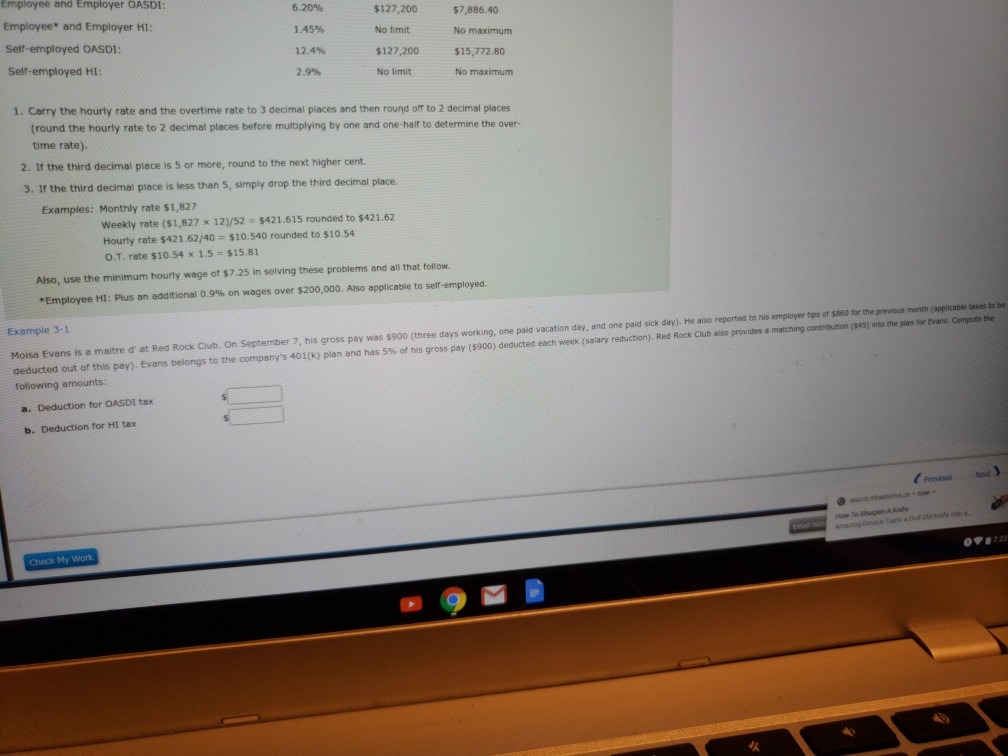

Employee and Employer OASDI Employee* and Employer HI: Self-employed OASDI Self-employed Hl 6.20% 1.45% 12.4% 2.9% $127,200 $7,886.40 No limit 127,200$15,772.80 No maximum No limit

Employee and Employer OASDI Employee* and Employer HI: Self-employed OASDI Self-employed Hl 6.20% 1.45% 12.4% 2.9% $127,200 $7,886.40 No limit 127,200$15,772.80 No maximum No limit No maximum 1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimal places (round the hourly rate to 2 decimal places before multiplying by one and one-hair to determine the over- time rate). 2. If the third decimal place is 5 or more, round to the next higher cent. 3. If the third decimal place is less than S, simply drop the third decimal place. Examples: Monthly rate $1,827 Weekly rate ($1,827 x 12)/52 - $421.615 rounded to $421.62 Hourly rate $42 1.62/40 S 10,540 rounded to $10.54 .T. rate $10.54 x 1.5 $15.81 Also, use the minimum hourly wage of $7.25 in solving these problems and all that follow Employee HI : plus an additional 0.9% on wages over S200,000. Also applicable to self-employed. Moisa Evans is a maitre d' at Red Rock Club. On September 7, his gross pey was s900 (three days working, one paid vacation day, and one paid sick day). He also reported to his employer tps or $860 for the previous month (applicable taves to be deducted out of this pay Evans belongs to the company's 401(k) plan and has 5% of his gross pay $900 deducted each week (salary reduction Red Rock Clu a pro des a matting following amounts: Example 3-1 contribution-(545) into the pian for Evans. Compute a. Deduction for OASDI tax b. Deduction for HI tax Net Previous Check My Work 09872

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started