Answered step by step

Verified Expert Solution

Question

1 Approved Answer

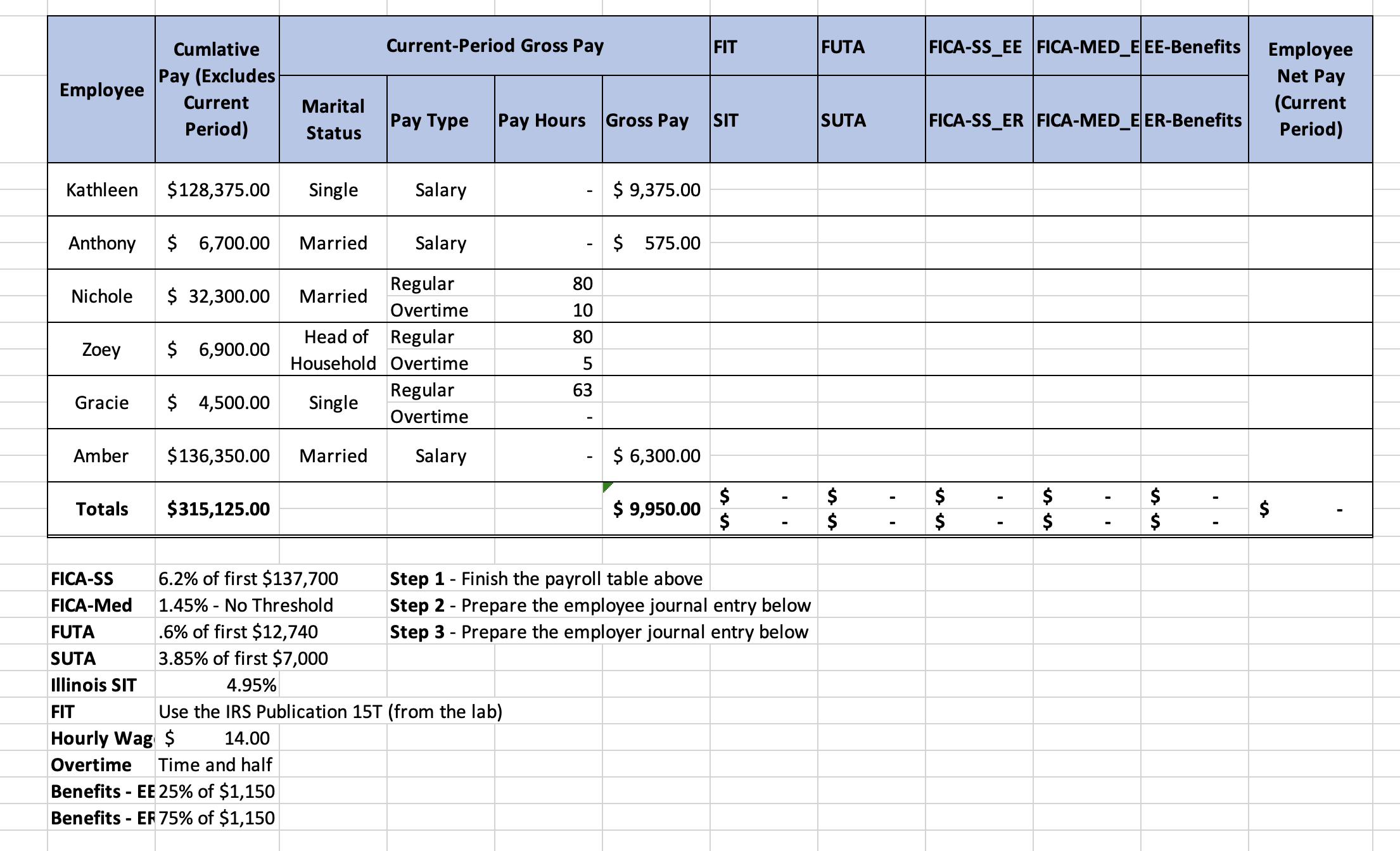

Employee Anthony Kathleen $128,375.00 Single Nichole Zoey Cumlative Pay (Excludes Current Period) Gracie $ 6,700.00 $ 32,300.00 $ 6,900.00 Marital Status Married Totals $315,125.00

Employee Anthony Kathleen $128,375.00 Single Nichole Zoey Cumlative Pay (Excludes Current Period) Gracie $ 6,700.00 $ 32,300.00 $ 6,900.00 Marital Status Married Totals $315,125.00 $ 4,500.00 Single Amber $136,350.00 Married Current-Period Gross Pay FICA-SS 6.2% of first $137,700 FICA-Med 1.45% - No Threshold FUTA .6% of first $12,740 3.85% of first $7,000 SUTA Illinois SIT 4.95% FIT Hourly Wag $ Overtime Time and half Benefits - EE 25% of $1,150 Benefits EF 75% of $1,150 Pay Type Regular Married Overtime Head of Regular Household Overtime Salary Salary Regular Overtime Salary Pay Hours Gross Pay 80 10 80 5 63 Use the IRS Publication 15T (from the lab) 14.00 $ 9,375.00 $ 575.00 $ 6,300.00 $ 9,950.00 FIT SIT $ $ Step 1 - Finish the payroll table above Step 2 - Prepare the employee journal entry below Step 3 - Prepare the employer journal entry below FUTA SUTA $ $ FICA-SS_EE FICA-MED_EEE-Benefits FICA-SS_ER FICA-MED_EER-Benefits $ $ $ $ $ $ Employee Net Pay $ (Current Period)

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Finish the payroll table above Kathleen Cumulative Pay Excludes Current Period 12837500 Curre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started