Question

Employee Benefit Plan Audits: AICPA Implements New Standards by | Aaron Slaughter When a certified public accountant (CPA) con- ducts the annual audit of an

Employee Benefit Plan Audits: AICPA Implements New Standards by | Aaron Slaughter

When a certified public accountant (CPA) con- ducts the annual audit of an employee benefit plan's financial statements, the CPA is required by the American Institute of Certified Public Accountants (AICPA) to follow ten generally accepted auditing standards.

CPAs rely on two key sources of information when con- ducting these audits.

1. Statements on Auditing Standards (SASs) issued by the Auditing Standards Board (ASB) of the AICPA. Each of these statements is referred to as an SAS and reflects AICPA's interpretations of accepted auditing standards.

2. AICPA auditing guides for independent auditors. For example, AICPA has published an extensive audit and accounting guide entitled Audit and Accounting Guide for Employee Benefit Plans.

In 2019 and 2020, ASB updated its interpretation of audit standards with the issuance of SAS No. 134-140. Some of the more significant updates contained in these statements include:

- Clarification of responsibilities between auditors and their clients

- Required disclosures on the most significant issues in performing the audit

- Refreshing the concept of materiality

- Additional guidance to auditors.

Due in part to the COVID-19 pandemic, AICPA delayed implementation of these new audit standards until plan years ending on or after December 15, 2021, although CPA firms are allowed to adopt these changes earlier.

These new auditing standards will have a significant im- pact on the audit of employee benefit plans, including financial statements and auditor reports. SAS No. 136, which is titled "Forming an Opinion and Reporting on Financial Statements of Employee Benefit Plans Subject to the Employee Retirement Income Security Act (ERISA)" will likely have the biggest impact.

Opinion on Employee Benefit Plan Financial Statements:

The new statements on auditing standards change the form and content of the independent auditor's report of employee benefit plan financial statements. Changes include the following.

- The auditor's opinion and the basis for the opinion have been moved to the first three paragraphs of the auditor's report. Previously the opinion was the last paragraph of the report.

- The paragraph of the auditor's report stating the basis of opinion now includes a statement that the auditor is required to be independent of the entity and to meet the other ethical responsibilities relating to the audit. Although the rules concerning auditor independence have been around for years, their inclusion in the auditor's report is new.

- The report expands the trustees' responsibility for the financial statements, including a paragraph about the plan's ability to continue operations as a going concern. Plan trustees will be asked to acknowledge in writing that they are:

- Maintaining current plan documents

- Administering and disclosing plan transactions in the financial statements in a manner consistent with plan provisions

- Maintaining sufficient records for plan participants.

A paragraph detailing these responsibilities has also been added to the auditor's report. The auditor's report also must now contain a paragraph explaining the auditor's expanded responsibility for the audit. The paragraph must state that the auditor:

- Exercised professional judgment and skepticism

- Identified and assessed the risks of material misstatements and designed and performed appropriate audit procedures

- Evaluated accounting procedures and accounting estimates made by the trustees of the plan

- Concluded that the plan had the ability to continue as a going concern for a reasonable period of time.

The changes made by the revised auditing standards will result in a significantly expanded auditor's report. An example of an auditor's report for a defined benefit pension plan is shown in the sidebar.

Materiality in Financial Statements

The auditor's report, in the opinion paragraph, states that in the auditor's opinion, "the accompanying financial statements present fairly, in all material respects . . ."

The greater the materiality level of an element of the financial statements, the greater attention the auditor must devote to that element. The revised audit standards set forth an updated description of materiality:

Misstatements, including omissions, are considered to be material if there is substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In other words, the reader of the financial statements would consider a misstatement or omission as significant if that matter should be corrected in the financial statements or if the matter must be brought to the attention of the reader of the financial statements by the plan auditor.

Multiemployer Plan High-Risk Areas

In multiemployer plan audits, the five high-risk areas that could lead to material misstatement in the financial statements are investments, contributions, benefits paid and denied, participant data and plan expenses. Investments and benefits paid and denied tend to be common to all employee benefit plan audits, whether corporate, multiemployer or public. Because of the unique nature of multiemployer plans, there is a greater risk of material misstatements in contributions, participant data and plan expenses.

Employee Benefit Plan Financial Statements

SAS No. 136 "Forming an Opinion and Reporting Financial Statements of Employee Benefit Plans Subject to ERISA" prescribes new performance requirements for audits of employee benefit plan financial statements. The SAS specifically addresses requirements applicable to multiemployer plans, which include the following.

- The auditor should receive a written agreement of engagement acceptance from the trustees. In this agreement, the trustees should acknowledge and understand their responsibility to maintain plan documents and administer the plan and transactions for the benefit of plan participants and their beneficiaries. The auditor should also ensure that the trustees will pro- vide to the auditor a draft of the Form 5500 that is substantially complete prior to dating the auditor's report.

- The auditor's responsibility to identify and assess the risks of material misstatement in the financial statements through understanding the plan, including the plans internal control systems, should be addressed.

- The auditor should evaluate whether prohibited trans- actions have been appropriately reported and, if they have not been reported, consider modification of their opinion on the auditor's report.

- In the course of performing audit procedures, the auditor should determine whether any matters discovered are reportable findings that should be communicated to management as part of the audit. Reportable findings include the following.

- Identified instances of noncompliance or suspected noncompliance with laws or regulations

- A finding that, in the auditor's professional judgment, would be significant and relevant to the trustees of the plan

- Deficiencies in internal control that should be communicated to plan trustees

- The auditor should produce a audit documentation, including procedures performed in accordance with audit standards and an explanation of why it was necessary to test certain plan provisions.

SAS No. 136 revises the format and reporting of what were previously referred to as "limited scope" audits. These are now titled "ERISA Section 103(a)(3)(c) Audits." No further description of these audits is provided here since they are rarely employed on multiemployer plans.

Conclusions

This article describes the major features of the new statements on accounting standards that affect employee benefit plan audits. In no way does this article reflect all of the requirements of the new statements which, as illustrated by their overall length, are very comprehensive.

Employee benefit plan trustees and the plan administrator should meet with the independent auditor to review the new standards and review how each SAS will affect the responsibilities of all parties in future audits.

AICPA is also in the process of revising the Audit Guide

for Employee Benefit Plans to include a new chapter devoted specifically to multiemployer plans, which will be discussed in a future article after it is publicly released.

Required:

Produce a summary of the article in 700 worrdz.

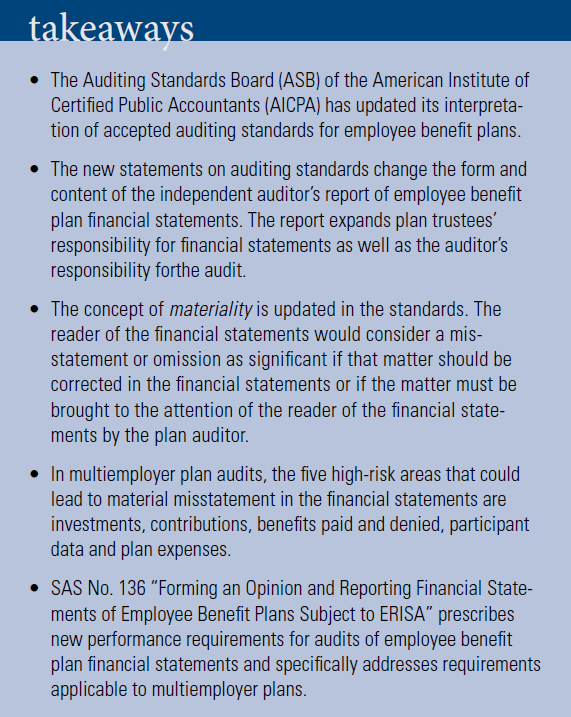

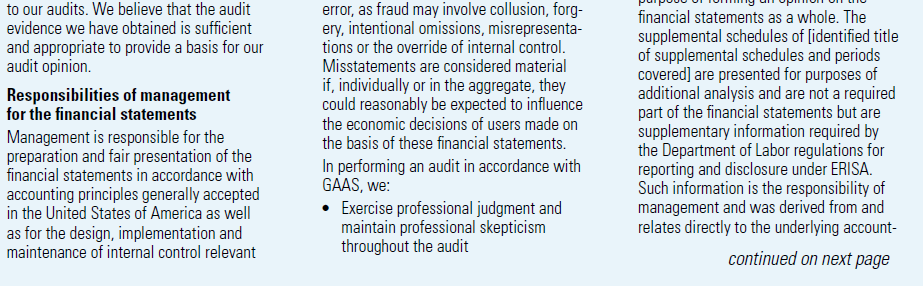

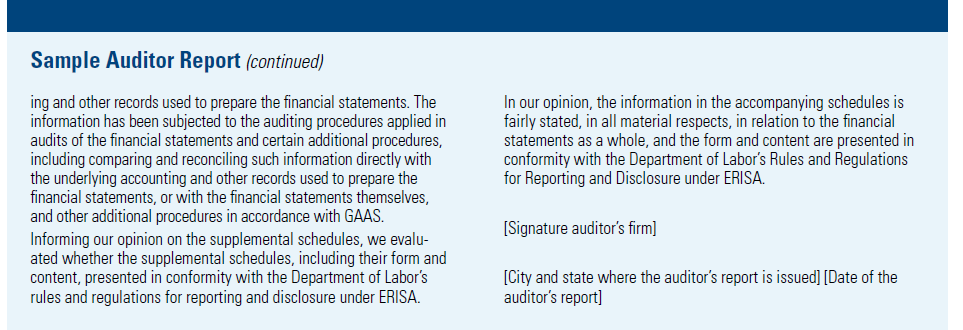

takeaways The Auditing Standards Board (ASB) of the American Institute of Certified Public Accountants (AICPA) has updated its interpreta- tion of accepted auditing standards for employee benefit plans. The new statements on auditing standards change the form and content of the independent auditor's report of employee benefit plan financial statements. The report expands plan trustees' responsibility for financial statements as well as the auditor's responsibility forthe audit. The concept of materiality is updated in the standards. The reader of the financial statements would consider a mis- statement or omission as significant if that matter should be corrected in the financial statements or if the matter must be brought to the attention of the reader of the financial state- ments by the plan auditor. In multiemployer plan audits, the five high-risk areas that could lead to material misstatement in the financial statements are investments, contributions, benefits paid and denied, participant data and plan expenses. SAS No. 136 "Forming an Opinion and Reporting Financial State- ments of Employee Benefit Plans Subject to ERISA" prescribes new performance requirements for audits of employee benefit plan financial statements and specifically addresses requirements applicable to multiemployer plans. Sample Auditor Report Below is a sample of an auditor's report for a defined benefit pension plan that reflects the new standards implemented by the American Audit- ing Standards Board of the American Institute of CPAs. to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. Identify and assess the risks of material misstatement of the financial state- ments, whether due to fraud or error, and design and perform audit proce- dures responsive to those risks. Such procedures include examining, on the test basis, evidence regarding the amounts and disclosures in the financial statements. Independent auditor's report [Appropriate addressee] Opinion We have audited the financial statements of XYZ Pension Plan, an employee benefit plan subject to the Employee Retirement Income Security Act of 1974 (ERISA), which comprise the statements of net assets available for benefits and of ac- cumulated plan benefits as of December 31, 20X2 and 20X1 and of the related statements of changes in net assets available for benefits and of changes in accumulated plan benefits for the year ended December 31, 20X2 as well as the related notes to the financial statements. In our opinion, the accompanying financial statements present fairly, in all material respects, the net assets available for benefits and accumulated plan benefits of XYZ Pension Plan as of December 31, 20X2 and 20X1 and the changes in its net assets available for benefits and changes in its accumulated plan benefits for the year ended December 31, 20X2 in accordance with accounting principles generally accepted in the United States of America. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about XYZ Pension Plan's ability to continue as a going con- cern for [insert the time period set by the applicable financial reporting framework]. Management is also responsible for maintaining a current plan instrument, including all plan amendments; adminis- tering the plan; and determining that the plans transactions that are presented and disclosed in the financial statements are in conformity with the plan's provisions, including maintaining sufficient records with respect to each of the participants to determine the benefits due or which may become due to such participants. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appro- priate in the circumstances but not for the purpose of expressing an opinion on the effectiveness of XYZ Pension Plan's internal control. Accordingly, no such opinion is expressed. Evaluate the appropriateness of ac- counting policies used, the reasonable- ness of significant accounting estimates made by management and the overall presentation of the financial statements. . Conclude whether, in our judgment, there are conditions or events, consid- ered in the aggregate, that raise sub- stantial doubt about XYZ Pension Plan's ability to continue as a going concern for a reasonable period of time. Basis for opinion We conducted our audits in accordance with auditing standards generally ac- cepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the auditor's responsibilities for the audit of the financial statements section of our report. We are required to be independent of XYZ Pension Plan and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating Auditor's responsibilities for the audit of the financial statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from ma- terial misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that the audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for the one resulting from We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings and certain internal control- related matters that we identified during the audit. Other matter-supplemental schedules required by ERISA Our audits were conducted for the purpose of forming an opinion on the to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of management for the financial statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America as well as for the design, implementation and maintenance of internal control relevant error, as fraud may involve collusion, forg- ery, intentional omissions, misrepresenta- tions or the override of internal control. Misstatements are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users made on the basis of these financial statements. In performing an audit in accordance with GAAS, we: Exercise professional judgment and maintain professional skepticism throughout the audit financial statements as a whole. The supplemental schedules of [identified title of supplemental schedules and periods covered] are presented for purposes of additional analysis and are not a required part of the financial statements but are supplementary information required by the Department of Labor regulations for reporting and disclosure under ERISA. Such information is the responsibility of management and was derived from and relates directly to the underlying account- continued on next page Sample Auditor Report (continued) ing and other records used to prepare the financial statements. The information has been subjected to the auditing procedures applied in audits of the financial statements and certain additional procedures, including comparing and reconciling such information directly with the underlying accounting and other records used to prepare the financial statements, or with the financial statements themselves, and other additional procedures in accordance with GAAS. Informing our opinion on the supplemental schedules, we evalu- ated whether the supplemental schedules, including their form and content, presented in conformity with the Department of Labor's rules and regulations for reporting and disclosure under ERISA. In our opinion, the information in the accompanying schedules is fairly stated, in all material respects, in relation to the financial statements as a whole, and the form and content are presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under ERISA. [Signature auditor's firm] [City and state where the auditor's report is issued] [Date of the auditor's report]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started