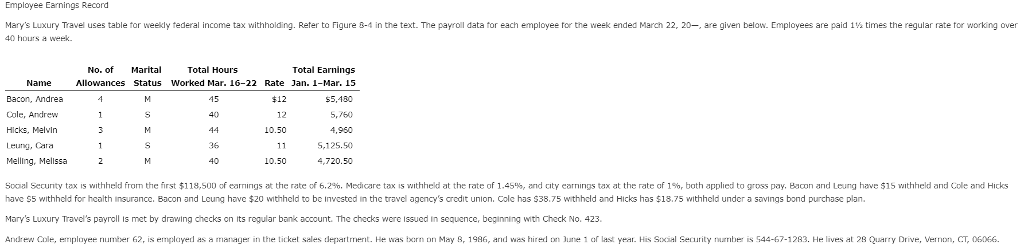

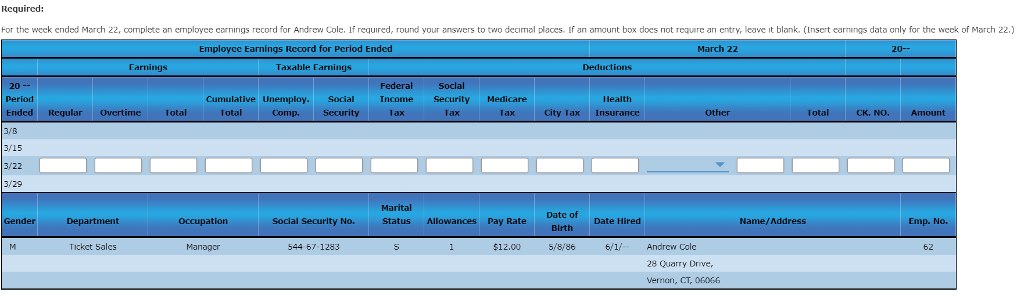

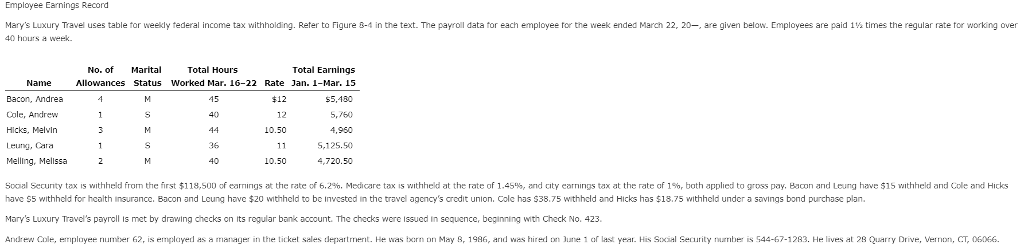

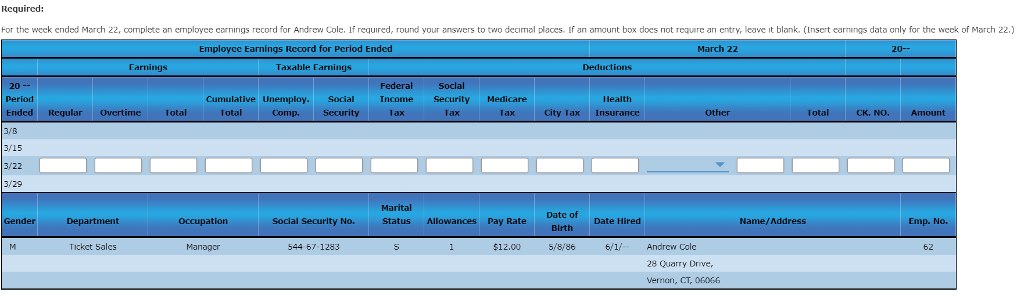

Employee Earnings Record Mary's Luxury Travel uses table for weekly tederal income tax withholdi 40 hours a week Rete to Figure & 4 in the text. T e payroll data tor each employee tor the week ended March 22, 20-, are given below. Employees are paid 1% times the regular rate tor workin over Total Earnings Allowances Status Worked Mar. 16-22 Rate Jan. 1-Mar. 15 $5,180 5,760 4,950 S,125.50 4,720.50 No. of Marital Total Hours Name Bacon, Andrea Cole, Andrew Hicks, Melvin Leun, Cata Mallling, Mellssa $12 12 10.50 15 40 36 40 10.50 so 1 secur ty tax s thheld from the first 118,500 o ear "ngs at the rate of 6.2 Mec care tax s withheld at the rate of 1.45% and city earnings tax at the rate of 1% both applied to gross pay. Baoon and Le g have $15 withheld and Cole and Hicks have S5 withheld for hcalth insurance. Bacon and Lcung have $20 withheld to be invested in the travel agcncy's crodit union. Cole has $38.75 withheld and Hicks has $18.75 withheld under a savings bond purchasc plan Mary's Luxury Travel's payroll is met by drewing checks on its regular bank account. The checks were issued in sequence, beginning with Check No. 423. Andrt w ule, Hriplu et riumiter 62 ls emplayetl is managter in the lilket sales t t 2 tt rriert. H was barn Dn Ma S 1986 and wishire l tri latie CJ ast year. Hts Stx al Security nurrtier 44-67-1283. He lives at 28 larry Drive, Vernor, 60 . Employee Earnings Record Mary's Luxury Travel uses table for weekly tederal income tax withholdi 40 hours a week Rete to Figure & 4 in the text. T e payroll data tor each employee tor the week ended March 22, 20-, are given below. Employees are paid 1% times the regular rate tor workin over Total Earnings Allowances Status Worked Mar. 16-22 Rate Jan. 1-Mar. 15 $5,180 5,760 4,950 S,125.50 4,720.50 No. of Marital Total Hours Name Bacon, Andrea Cole, Andrew Hicks, Melvin Leun, Cata Mallling, Mellssa $12 12 10.50 15 40 36 40 10.50 so 1 secur ty tax s thheld from the first 118,500 o ear "ngs at the rate of 6.2 Mec care tax s withheld at the rate of 1.45% and city earnings tax at the rate of 1% both applied to gross pay. Baoon and Le g have $15 withheld and Cole and Hicks have S5 withheld for hcalth insurance. Bacon and Lcung have $20 withheld to be invested in the travel agcncy's crodit union. Cole has $38.75 withheld and Hicks has $18.75 withheld under a savings bond purchasc plan Mary's Luxury Travel's payroll is met by drewing checks on its regular bank account. The checks were issued in sequence, beginning with Check No. 423. Andrt w ule, Hriplu et riumiter 62 ls emplayetl is managter in the lilket sales t t 2 tt rriert. H was barn Dn Ma S 1986 and wishire l tri latie CJ ast year. Hts Stx al Security nurrtier 44-67-1283. He lives at 28 larry Drive, Vernor, 60