Answered step by step

Verified Expert Solution

Question

1 Approved Answer

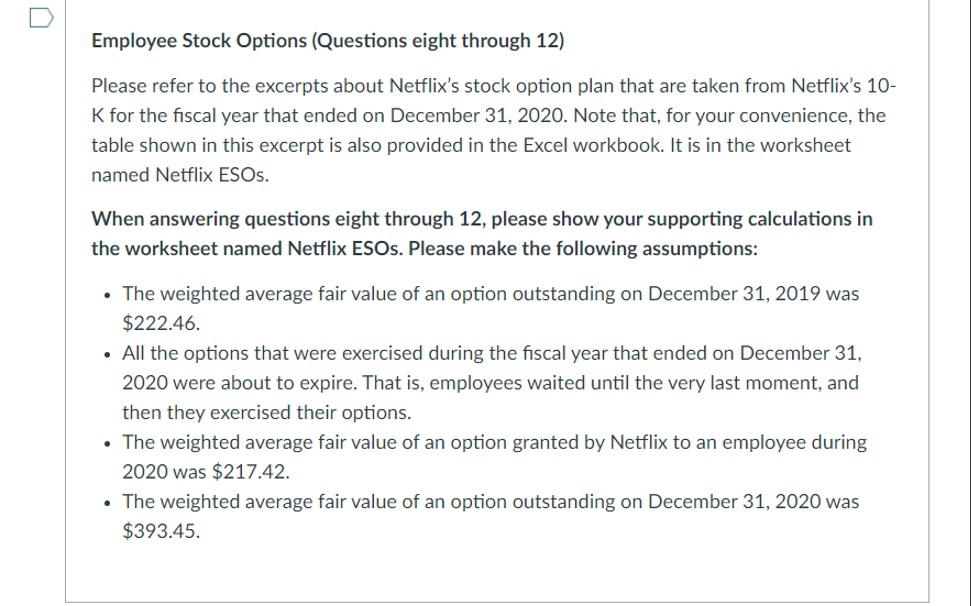

Employee Stock Options ( Questions eight through 1 2 ) Please refer to the excerpts about Netflix's stock option plan that are taken from Netflix's

Employee Stock Options Questions eight through

Please refer to the excerpts about Netflix's stock option plan that are taken from Netflix's

for the fiscal year that ended on December Note that, for your convenience, the

table shown in this excerpt is also provided in the Excel workbook. It is in the worksheet

named Netflix ESOs.

When answering questions eight through please show your supporting calculations in

the worksheet named Netflix ESOs. Please make the following assumptions:

The weighted average fair value of an option outstanding on December was

$

All the options that were exercised during the fiscal year that ended on December

were about to expire. That is employees waited until the very last moment, and

then they exercised their options.

The weighted average fair value of an option granted by Netflix to an employee during

was $

The weighted average fair value of an option outstanding on December

What was Netflixs pro forma ie unrecognized employee stock option ie ESO obligation on December Your answer should be in millions of dollars.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started