Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Empresas El Ciclista, a bicycle manufacturer, is preparing its financial statements for December 31, 2023. The company has identified the following legal situations that

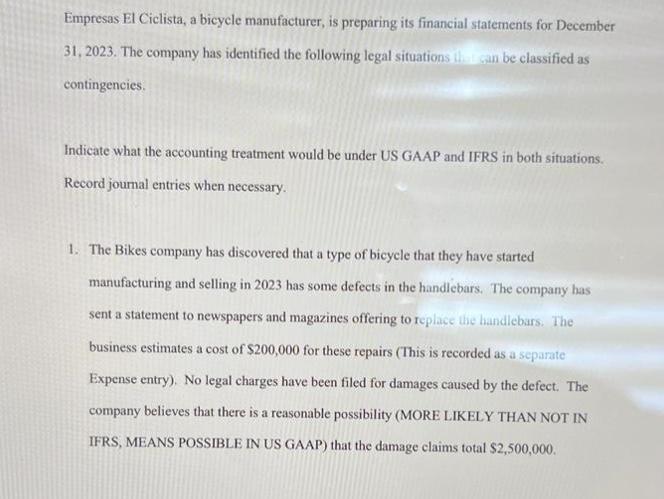

Empresas El Ciclista, a bicycle manufacturer, is preparing its financial statements for December 31, 2023. The company has identified the following legal situations that can be classified as contingencies. Indicate what the accounting treatment would be under US GAAP and IFRS in both situations. Record journal entries when necessary. 1. The Bikes company has discovered that a type of bicycle that they have started manufacturing and selling in 2023 has some defects in the handlebars. The company has sent a statement to newspapers and magazines offering to replace the handlebars. The business estimates a cost of $200,000 for these repairs (This is recorded as a separate Expense entry). No legal charges have been filed for damages caused by the defect. The company believes that there is a reasonable possibility (MORE LIKELY THAN NOT IN IFRS, MEANS POSSIBLE IN US GAAP) that the damage claims total $2,500,000. 2. The company has an incinerator in the back of one of its stores that is used to burn cardboard boxes received in inventory shipments. In August 2023, the state environmental protection agency files a lawsuit against the company for contamination. The company hopes to stop using the incinerator and start recycling. However, its lawyers consider it likely (MORE LIKELY THAN NOT IN IFRS, approximately 90% probability) that a fine between $70,000 and $80,000 will be awarded against the company. Lawyers cannot predict the exact amount.

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Situation 1 Defective Handlebars Under US GAAP The estimated cost of 200000 for replacing the handle...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started