Answered step by step

Verified Expert Solution

Question

1 Approved Answer

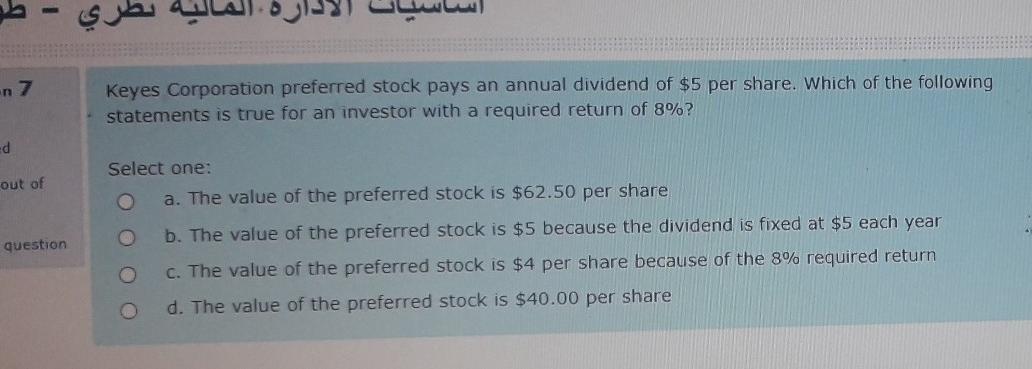

en 7 Keyes Corporation preferred stock pays an annual dividend of $5 per share. Which of the following statements is true for an investor with

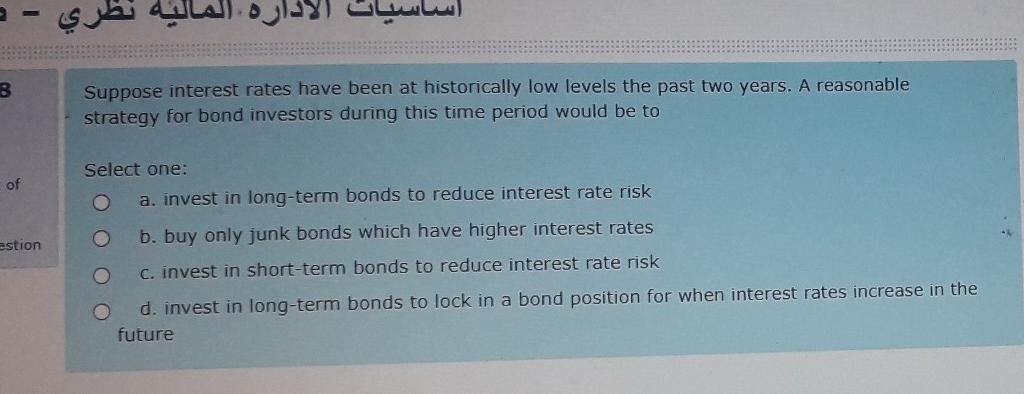

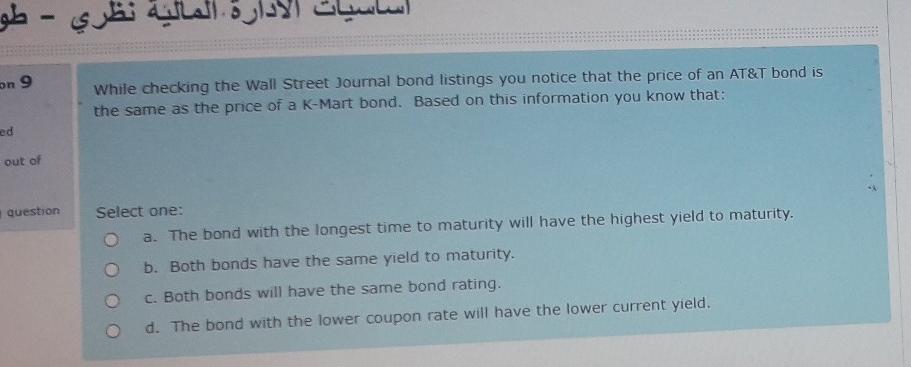

en 7 Keyes Corporation preferred stock pays an annual dividend of $5 per share. Which of the following statements is true for an investor with a required return of 8%? ed out of question Select one: a. The value of the preferred stock is $62.50 per share b. The value of the preferred stock is $5 because the dividend is fixed at $5 each year O C. The value of the preferred stock is $4 per share because of the 8% required return d. The value of the preferred stock is $40.00 per share 8 Suppose interest rates have been at historically low levels the past two years. A reasonable strategy for bond investors during this time period would be to of estion Select one: 0 a. invest in long-term bonds to reduce interest rate risk b. buy only junk bonds which have higher interest rates c. invest in short-term bonds to reduce interest rate risk d. invest in long-term bonds to lock in a bond position for when interest rates increase in the future - on 9 While checking the Wall Street Journal bond listings you notice that the price of an AT&T bond is the same as the price of a K-Mart bond. Based on this information you know that: ed out of question Select one: : a. The bond with the longest time to maturity will have the highest yield to maturity. b. Both bonds have the same yield to maturity. C. Both bonds will have the same bond rating. d. The bond with the lower coupon rate will have the lower current yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started