Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ENAPA Manufacturing Company Limited commenced business on 1st March, 2016 making accounts to 31st December each year. The following assets were acquired for use

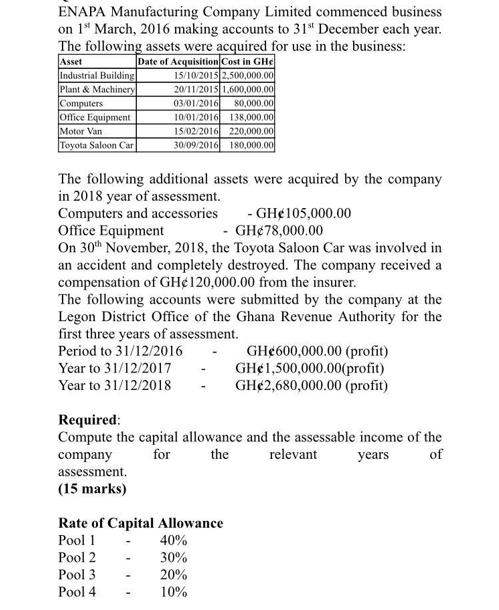

ENAPA Manufacturing Company Limited commenced business on 1st March, 2016 making accounts to 31st December each year. The following assets were acquired for use in the business: Asset Date of Acquisition Cost in GHe 15/10/2015 2,500,000.00 20/11/2015 1,600,000,00 03/01/2016 80,000,00 10/01/2016 138,000.00 15/02/2016 220,000.00 30/09/2016 180,000.00 Industrial Building Plant & Machinery Computers Office Equipment Motor Van Toyota Saloon Car The following additional assets were acquired by the company in 2018 year of assessment. Computers and accessories - GH105,000.00 - GH78,000.00 Office Equipment On 30th November, 2018, the Toyota Saloon Car was involved in an accident and completely destroyed. The company received a compensation of GH120,000.00 from the insurer. The following accounts were submitted by the company at the Legon District Office of the Ghana Revenue Authority for the first three years of assessment. Period to 31/12/2016 Year to 31/12/2017 Year to 31/12/2018 Required: Compute the capital allowance and the assessable income of the relevant company for the years of assessment. (15 marks) Rate of Capital Allowance Pool 1 Pool 2 Pool 3 Pool 4 GH600,000.00 (profit) GH1,500,000.00(profit) GH2,680,000.00 (profit) 40% 30% 20% 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ENAPA Manufacturing Company Limited Capital Allowance and Assessable Income Capital Allowance Calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started