Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Encik Ali and Puan Alia are Malaysian residents living together as husband and wife throughout the basis year 2022. Their income for the year

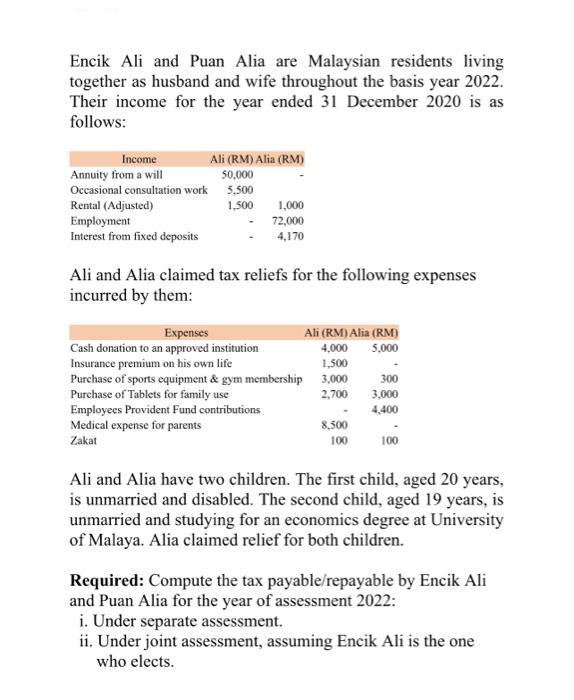

Encik Ali and Puan Alia are Malaysian residents living together as husband and wife throughout the basis year 2022. Their income for the year ended 31 December 2020 is as follows: Income Annuity from a will Occasional consultation work Rental (Adjusted) Employment Interest from fixed deposits Ali (RM) Alia (RM) 50,000 5,500 1,500 Ali and Alia claimed tax reliefs for the following expenses incurred by them: Expenses Cash donation to an approved institution 1,000 72,000 4,170 Insurance premium on his own life Purchase of sports equipment & gym membership Purchase of Tablets for family use Employees Provident Fund contributions Medical expense for parents Zakat Ali (RM) Alia (RM) 4,000 5,000 1,500 3,000 2,700 8,500 100 300 3,000 4,400 100 Ali and Alia have two children. The first child, aged 20 years, is unmarried and disabled. The second child, aged 19 years, is unmarried and studying for an economics degree at University of Malaya. Alia claimed relief for both children. Required: Compute the tax payable/repayable by Encik Ali and Puan Alia for the year of assessment 2022: i. Under separate assessment. ii. Under joint assessment, assuming Encik Ali is the one who elects.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started