Answered step by step

Verified Expert Solution

Question

1 Approved Answer

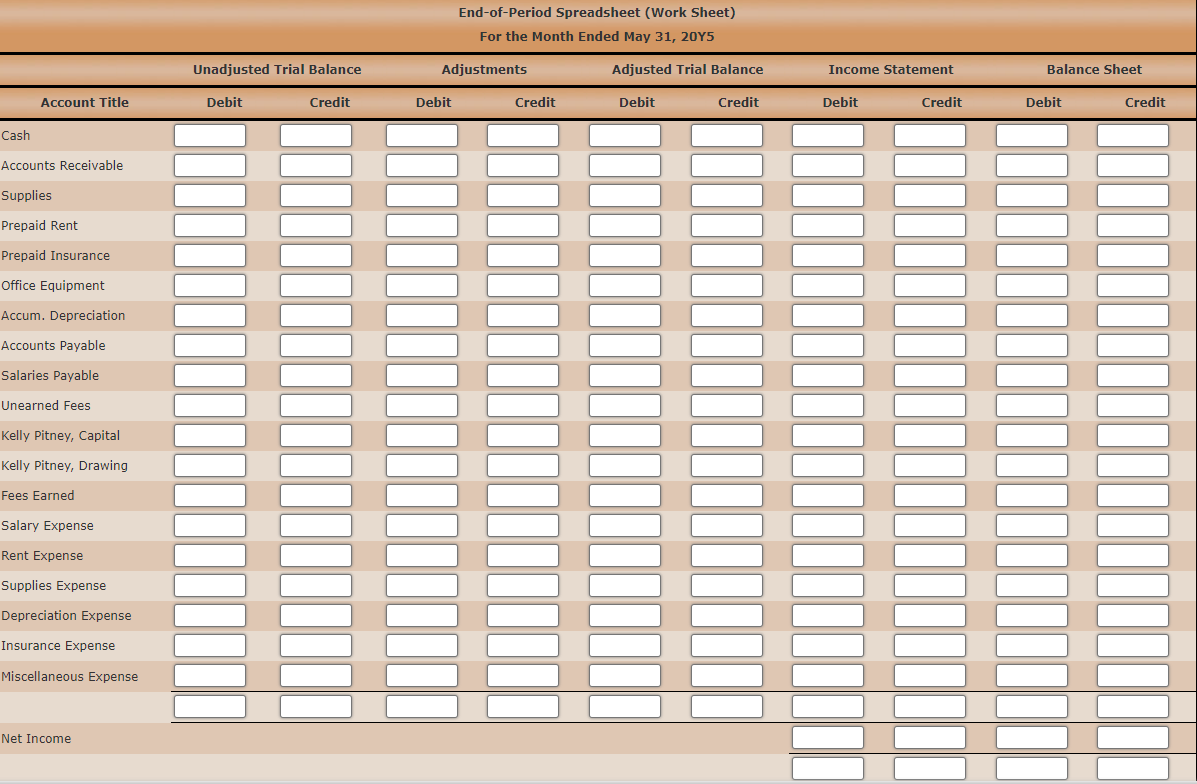

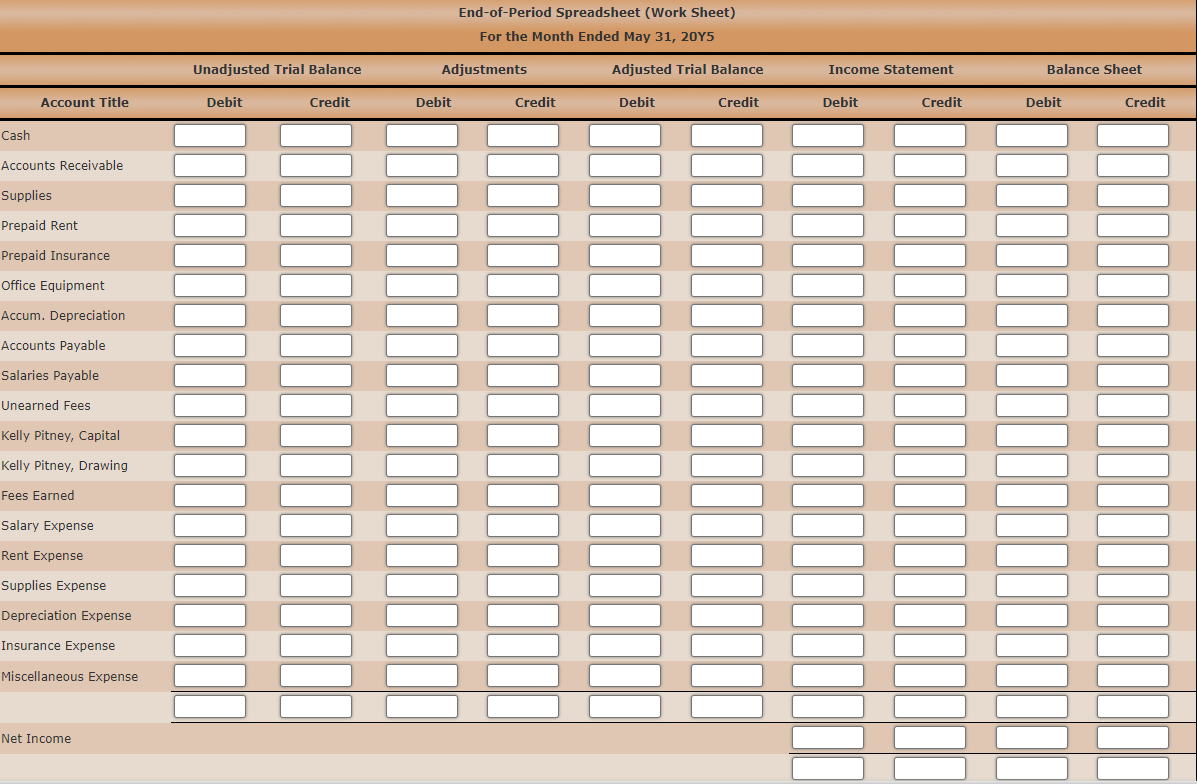

End - of - Period Spreadsheet ( Work Sheet ) For the Month Ended May 3 1 , 2 0 Y 5 Comprehensive Problem 1

EndofPeriod Spreadsheet Work Sheet

For the Month Ended May Y Comprehensive Problem

Part : Work Sheet

The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts. Note: You must complete parts before completing part

Part : Enter the unadjusted trial balance on an endofperiod spreadsheet work sheet and complete the spreadsheet using the following adjustment data.

Insurance expired during May is $

Supplies on hand on May are $

Depreciation of office equipment for May is $

Accrued receptionist salary on May is $

Rent expired during May is $

Unearned fees on May are $

If an amount box does not require an entry, leave it blank.

Kelly Consulting

EndofPeriod Spreadsheet Work Sheet

For the Month Ended May Y

Unadjusted Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet

Account Title Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

Cash fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Accounts Receivable fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Supplies fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Prepaid Rent fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Prepaid Insurance fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Office Equipment fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Accum. Depreciation fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Accounts Payable fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Salaries Payable fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Unearned Fees fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Kelly Pitney, Capital fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Kelly Pitney, Drawing fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Fees Earned fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Salary Expense fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Rent Expense fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Supplies Expense fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the blank

Depreciation Expense fill in the blank

fill in the blank

fill in the blank

fill in the blank

fill in the bla

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started