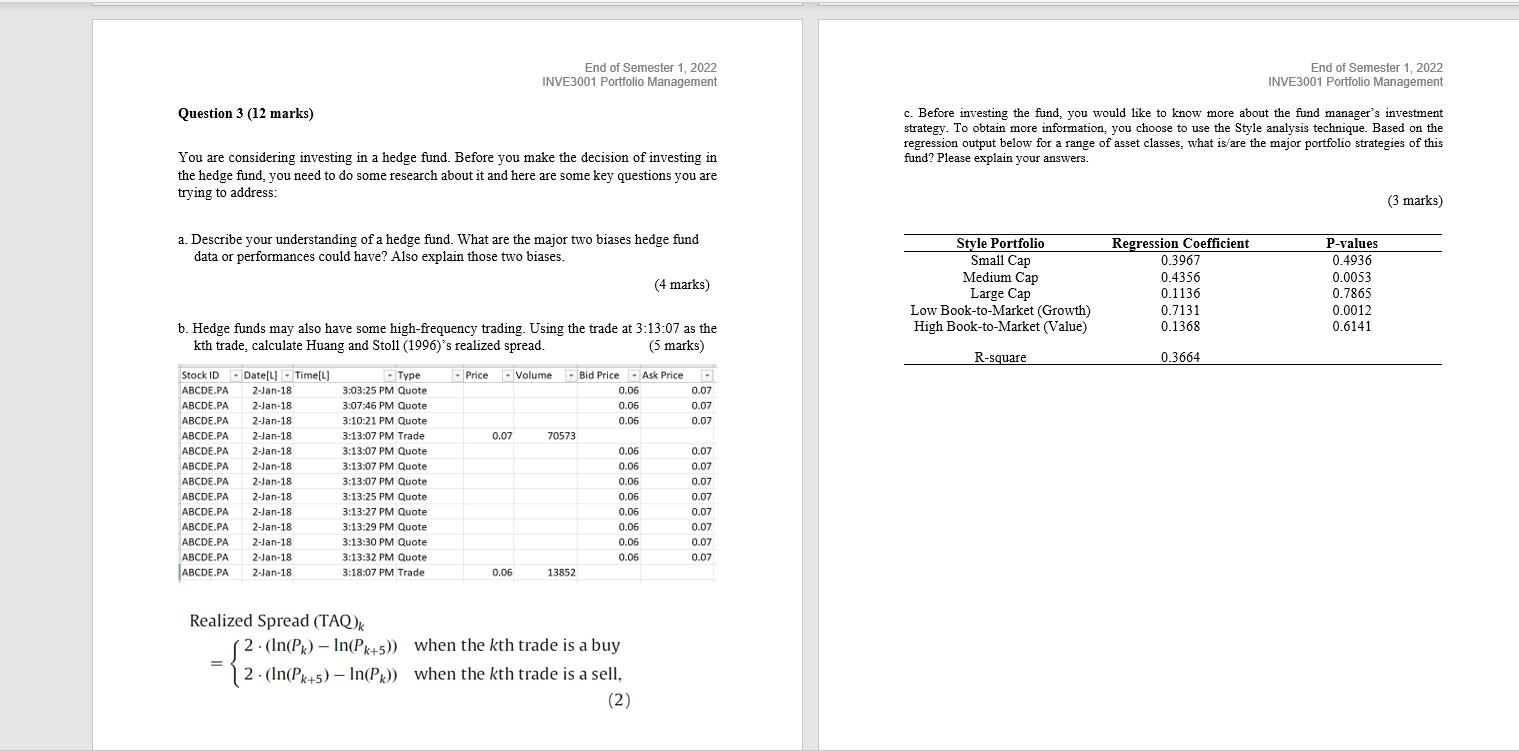

End of Semester 1, 2022 INVE3001 Portfolio Management Question 3 (12 marks) You are considering investing in a hedge fund. Before you make the decision of investing in the hedge fund, you need to do some research about it and here are some key questions you are trying to address: a. Describe your understanding of a hedge fund. What are the major two biases hedge fund data or performances could have? Also explain those two biases. (4 marks) b. Hedge funds may also have some high-frequency trading. Using the trade at 3:13:07 as the kth trade, calculate Huang and Stoll (1996)'s realized spread. (5 marks) Stock ID Date[L] Time[L] -Price Volume -Bid Price - Ask Price 0.06 0.06 0.06 0.07 70573 0.06 Coole 0.06 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 -Type 3:03:25 PM Quote 3:07:46 PM Quote 3:10:21 PM Quote 3:13:07 PM Trade 3:13:07 PM Quote 3:13:07 PM Quote 3:13:07 PM Quote 3:13:25 PM Quote 3:13:27 PM Quote 3:13:29 PM Quote 3:13:30 PM Quote 3:13:32 PM Quote 3:18:07 PM Trade 0.06 0.06 0.06 0.06 0.06 0.06 0.06 13852 Realized Spread (TAQ)k 2. (In(Pk) - In(Pk+5)) when the kth trade is a buy = {:(( 2 (In(Pk+5)- In(P) when the kth trade is a sell, . (2) - 0.07 0.07 0.07 0.07 0.07 0.07 0.07 0.07 0.07 0.07 0.07 End of Semester 1, 2022 INVE3001 Portfolio Management c. Before investing the fund, you would like to know more about the fund manager's investment strategy. To obtain more information, you choose to use the Style analysis technique. Based on the regression output below for a range of asset classes, what is/are the major portfolio strategies of this fund? Please explain your answers. (3 marks) Style Portfolio Small Cap Medium Cap Regression Coefficient 0.3967 P-values 0.4936 0.4356 0.0053 Large Cap 0.1136 0.7865 0.7131 0.0012 Low Book-to-Market (Growth) High Book-to-Market (Value) 0.1368 0.6141 R-square 0.3664 End of Semester 1, 2022 INVE3001 Portfolio Management Question 3 (12 marks) You are considering investing in a hedge fund. Before you make the decision of investing in the hedge fund, you need to do some research about it and here are some key questions you are trying to address: a. Describe your understanding of a hedge fund. What are the major two biases hedge fund data or performances could have? Also explain those two biases. (4 marks) b. Hedge funds may also have some high-frequency trading. Using the trade at 3:13:07 as the kth trade, calculate Huang and Stoll (1996)'s realized spread. (5 marks) Stock ID Date[L] Time[L] -Price Volume -Bid Price - Ask Price 0.06 0.06 0.06 0.07 70573 0.06 Coole 0.06 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 ABCDE.PA 2-Jan-18 -Type 3:03:25 PM Quote 3:07:46 PM Quote 3:10:21 PM Quote 3:13:07 PM Trade 3:13:07 PM Quote 3:13:07 PM Quote 3:13:07 PM Quote 3:13:25 PM Quote 3:13:27 PM Quote 3:13:29 PM Quote 3:13:30 PM Quote 3:13:32 PM Quote 3:18:07 PM Trade 0.06 0.06 0.06 0.06 0.06 0.06 0.06 13852 Realized Spread (TAQ)k 2. (In(Pk) - In(Pk+5)) when the kth trade is a buy = {:(( 2 (In(Pk+5)- In(P) when the kth trade is a sell, . (2) - 0.07 0.07 0.07 0.07 0.07 0.07 0.07 0.07 0.07 0.07 0.07 End of Semester 1, 2022 INVE3001 Portfolio Management c. Before investing the fund, you would like to know more about the fund manager's investment strategy. To obtain more information, you choose to use the Style analysis technique. Based on the regression output below for a range of asset classes, what is/are the major portfolio strategies of this fund? Please explain your answers. (3 marks) Style Portfolio Small Cap Medium Cap Regression Coefficient 0.3967 P-values 0.4936 0.4356 0.0053 Large Cap 0.1136 0.7865 0.7131 0.0012 Low Book-to-Market (Growth) High Book-to-Market (Value) 0.1368 0.6141 R-square 0.3664