Answered step by step

Verified Expert Solution

Question

1 Approved Answer

End September you have to pay $20,000,000. You plan to borrow the money at the money market for three months right at the time of

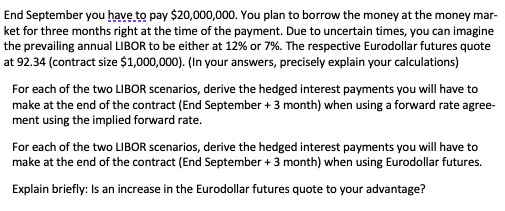

End September you have to pay $20,000,000. You plan to borrow the money at the money market for three months right at the time of the payment. Due to uncertain times, you can imagine the prevailing annual LIBOR to be either at 12% or 7%. The respective Eurodollar futures quote at 92.34 (contract size $1,000,000 ). (In your answers, precisely explain your calculations) For each of the two LIBOR scenarios, derive the hedged interest payments you will have to make at the end of the contract (End September +3 month) when using a forward rate agreement using the implied forward rate. For each of the two LIBOR scenarios, derive the hedged interest payments you will have to make at the end of the contract (End September +3 month) when using Eurodollar futures. Explain briefly: Is an increase in the Eurodollar futures quote to your advantage

End September you have to pay $20,000,000. You plan to borrow the money at the money market for three months right at the time of the payment. Due to uncertain times, you can imagine the prevailing annual LIBOR to be either at 12% or 7%. The respective Eurodollar futures quote at 92.34 (contract size $1,000,000 ). (In your answers, precisely explain your calculations) For each of the two LIBOR scenarios, derive the hedged interest payments you will have to make at the end of the contract (End September +3 month) when using a forward rate agreement using the implied forward rate. For each of the two LIBOR scenarios, derive the hedged interest payments you will have to make at the end of the contract (End September +3 month) when using Eurodollar futures. Explain briefly: Is an increase in the Eurodollar futures quote to your advantage Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started