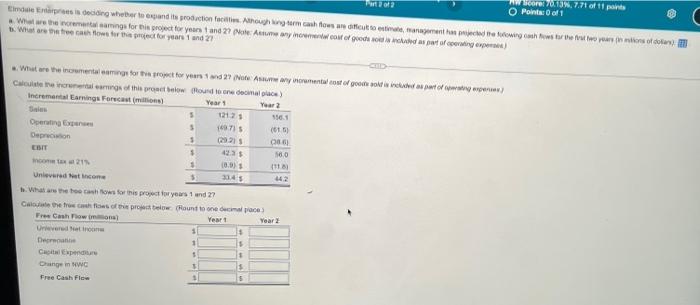

Endale Enterprises is deciding whether to expand its production facilities Athough king term cash flows are difficut to estimate, management has projected the following cash flows for the first two years nations of dollars) What are the incremental samings for this project for years 1 and 27 pote: Assume any incremental cost of goods sold is included as part of operating expenses) b. What are the tree cash flows for this project for years 1 and 27 What are the incremental eamings for this project for years 1 and 27 (Note: Assume any incremental cost of goods sold is included as part of operating experes) Calculate the incremental earnings of this project below Incremental Earnings Forecast (millions) Round to one decimal place) Year 1 Year 2 Sales Operating Expenses Depreciation EBIT income tax at 21% Unlevered Net Income b. What are the too cash flows for this project for years 1 and 27 Calculate the from cash flows of this project below (Round to one decimal place) Free Cash Flow (millions) Year 1 Unlevered Net tron Deprecate Capital Expenditure Change in NWC Free Cash Flow S $ S $ $ $ 1 S $ S 121.2 S (497) S (292) S 42.3 $ (89) 31.4 5 $ $ 116.1 (61.5) (86) 56.0 Part 2 of 2 (118) 44.2 Year 2 AW Score: 70.13%, 7.71 of 11 points Points: 0 of 1 Endale Enterprises is deciding whether to expand its production facilities Athough king term cash flows are difficut to estimate, management has projected the following cash flows for the first two years nations of dollars) What are the incremental samings for this project for years 1 and 27 pote: Assume any incremental cost of goods sold is included as part of operating expenses) b. What are the tree cash flows for this project for years 1 and 27 What are the incremental eamings for this project for years 1 and 27 (Note: Assume any incremental cost of goods sold is included as part of operating experes) Calculate the incremental earnings of this project below Incremental Earnings Forecast (millions) Round to one decimal place) Year 1 Year 2 Sales Operating Expenses Depreciation EBIT income tax at 21% Unlevered Net Income b. What are the too cash flows for this project for years 1 and 27 Calculate the from cash flows of this project below (Round to one decimal place) Free Cash Flow (millions) Year 1 Unlevered Net tron Deprecate Capital Expenditure Change in NWC Free Cash Flow S $ S $ $ $ 1 S $ S 121.2 S (497) S (292) S 42.3 $ (89) 31.4 5 $ $ 116.1 (61.5) (86) 56.0 Part 2 of 2 (118) 44.2 Year 2 AW Score: 70.13%, 7.71 of 11 points Points: 0 of 1