Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ending DTA and DTL balances are in the RED, but I am not sure how to get there. In 2021, Jones Company began operations. During

Ending DTA and DTL balances are in the RED, but I am not sure how to get there.

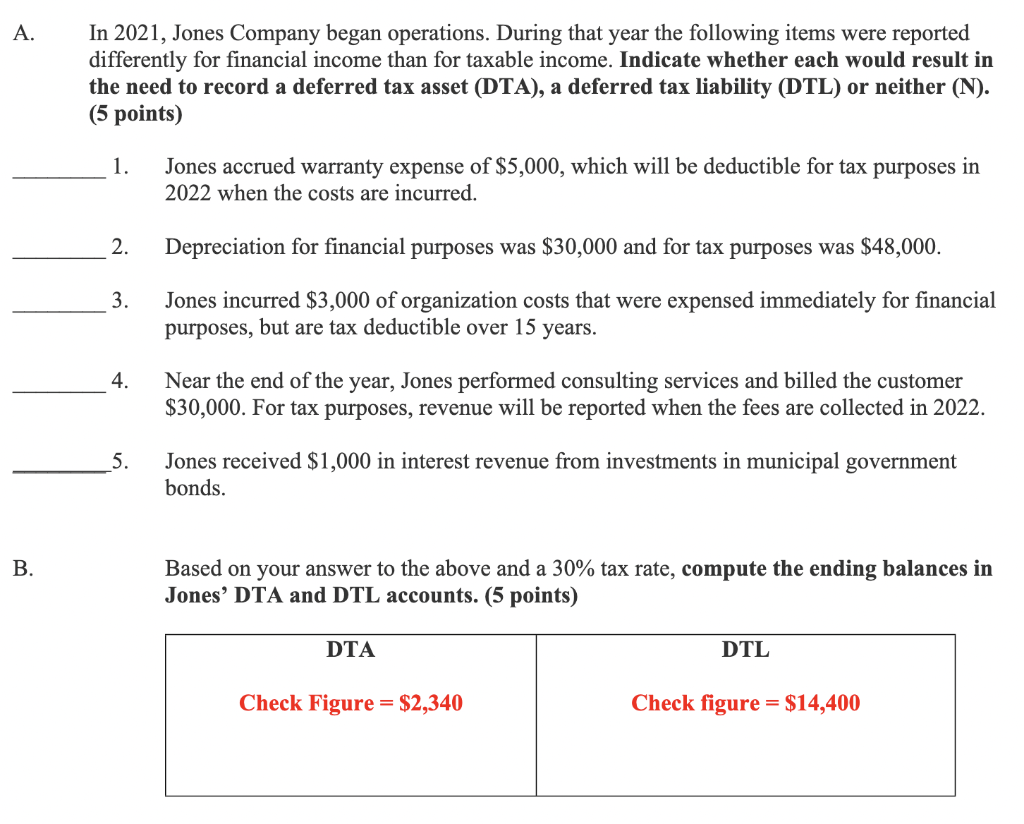

In 2021, Jones Company began operations. During that year the following items were reported differently for financial income than for taxable income. Indicate whether each would result in the need to record a deferred tax asset (DTA), a deferred tax liability (DTL) or neither (N). (5 points) 1. Jones accrued warranty expense of $5,000, which will be deductible for tax purposes in 2022 when the costs are incurred. 2. Depreciation for financial purposes was $30,000 and for tax purposes was $48,000. 3. Jones incurred $3,000 of organization costs that were expensed immediately for financial purposes, but are tax deductible over 15 years. 4. Near the end of the year, Jones performed consulting services and billed the customer $30,000. For tax purposes, revenue will be reported when the fees are collected in 2022. 5. Jones received $1,000 in interest revenue from investments in municipal government bonds. Based on your answer to the above and a 30% tax rate, compute the ending balances in Jones' DTA and DTL accounts. (5 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started