Question

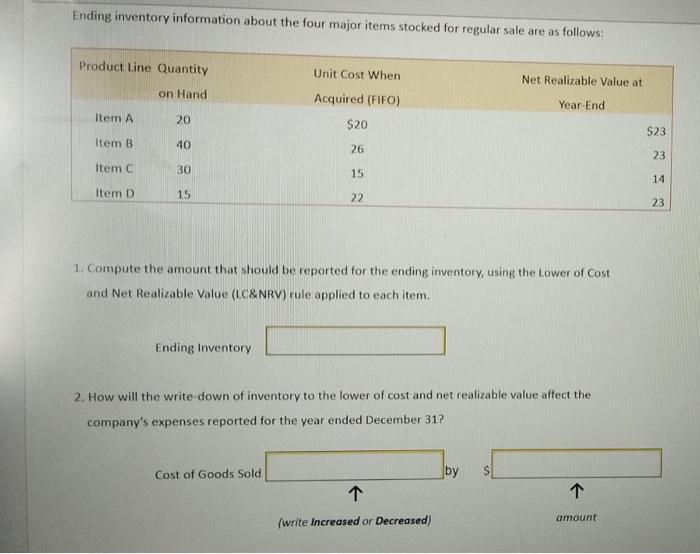

Ending inventory information about the four major items stocked for regular sale are as follows: Product Line Quantity Unit Cost When Net Realizable Value

Ending inventory information about the four major items stocked for regular sale are as follows: Product Line Quantity Unit Cost When Net Realizable Value at on Hand Acquired (FIFO) Year-End Item A 20 $20 $23 Item B 40 26 23 Item C 30 15 14 Item D 15 22 23 1. Compute the amount that should be reported for the ending inventory, using the Lower of Cost and Net Realizable Value (LC&NRV) rule applied to each item. Ending Inventory 2. How will the write-down of inventory to the lower of cost and net realizable value affect the company's expenses reported for the year ended December 31? Cost of Goods Sold by amount (write Increased or Decreased)

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 We must determine the lower of the cost and market value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting concepts and applications

Authors: Albrecht Stice, Stice Swain

11th Edition

978-0538750196, 538745487, 538750197, 978-0538745482

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App