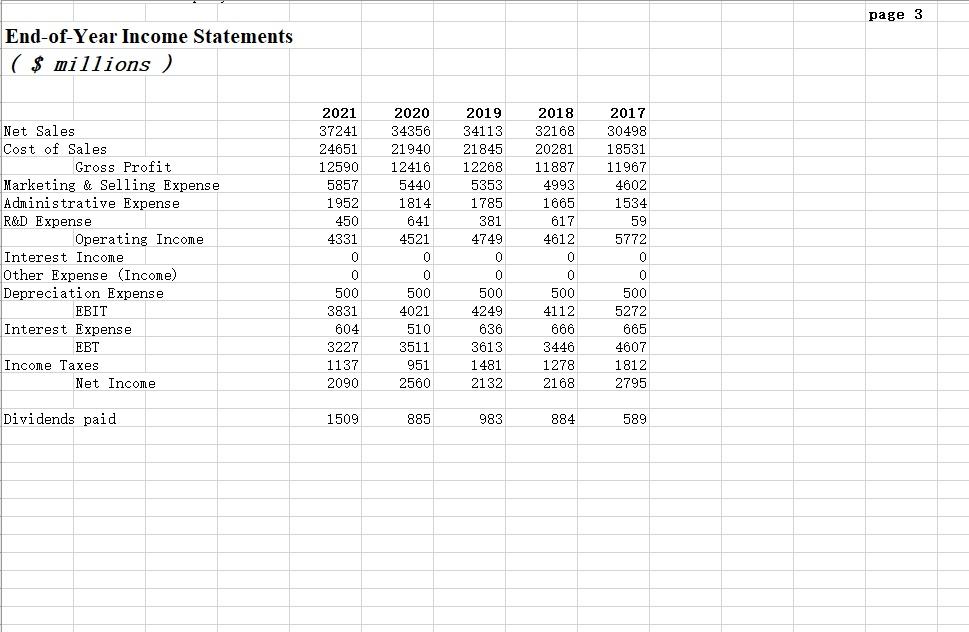

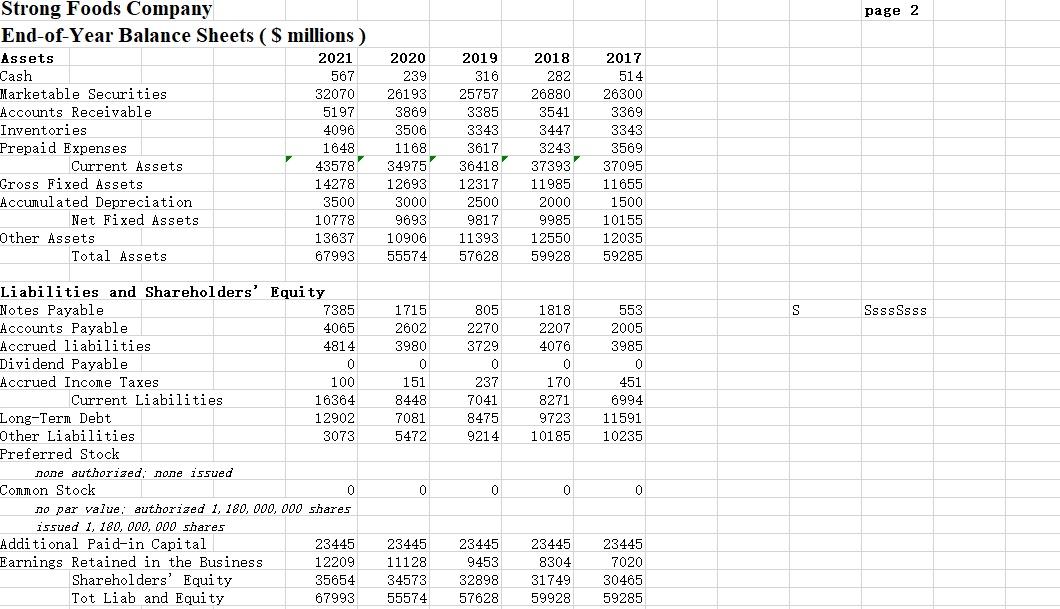

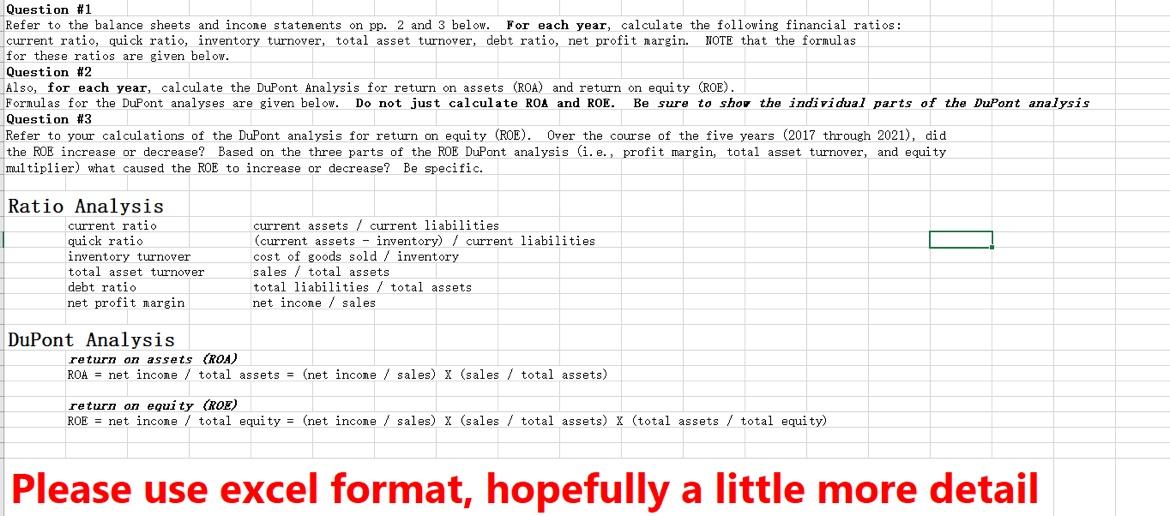

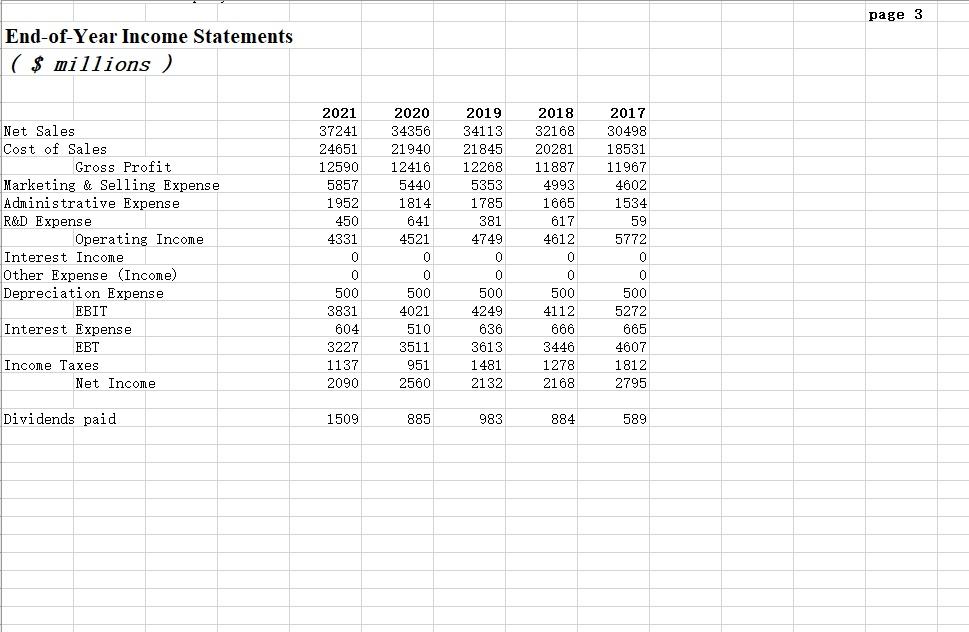

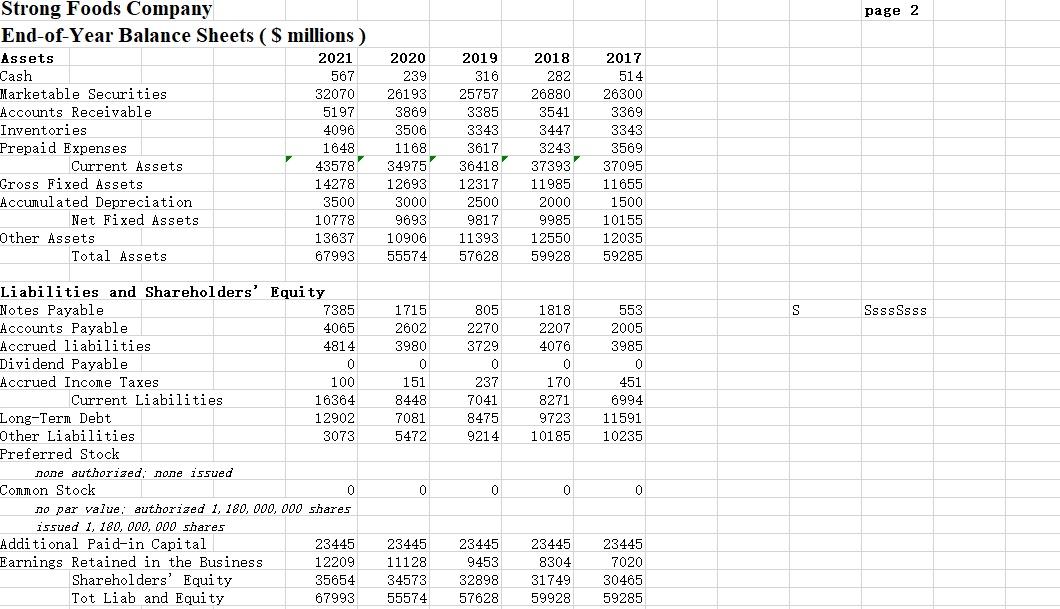

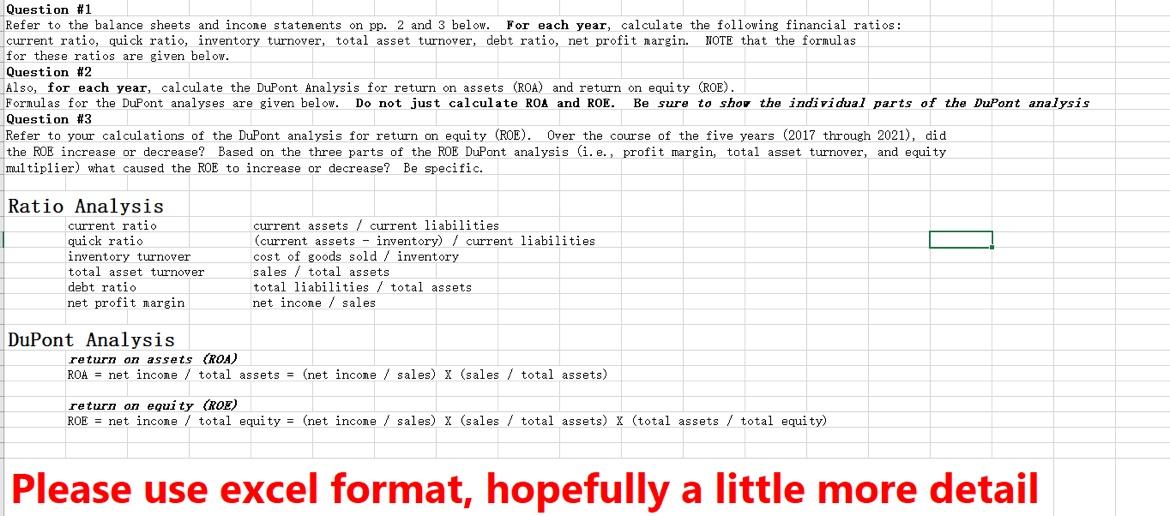

End-of-Year Income Statements ($millions) Strong Foods Company page 2 End-of-Year Balance Sheets ( \$ millions ) \begin{tabular}{|l|r|r|r|r|r|r|} \hline Assets & 2021 & 2020 & 2019 & 2018 & 2017 \\ \hline Cash & 567 & 239 & 316 & 282 & 514 \\ \hline Marketable Securities & 32070 & 26193 & 25757 & 26880 & 26300 \\ Accounts Receivable & 5197 & 3869 & 3385 & 3541 & 3369 \\ Inventories & 4096 & 3506 & 3343 & 3447 & 3343 \\ Prepaid Expenses & 1648 & 1168 & 3617 & 3243 & 3569 \\ \hline Current Assets & 43578 & 34975 & 36418 & 37393 & 37095 \\ \hline Gross Fixed Assets & 14278 & 12693 & 12317 & 11985 & 11655 \\ Accumulated Depreciation & 3500 & 3000 & 2500 & 2000 & 1500 \\ \hline Net Fixed Assets & 10778 & 9693 & 9817 & 9985 & 10155 \\ \hline Other Assets & 13637 & 10906 & 11393 & 12550 & 12035 \\ \hline Total Assets & 67993 & 55574 & 57628 & 59928 & 59285 \\ \hline \end{tabular} Liabilities and Shareholders' Equity Preferred Stock none authorized; none issued Common Stock no par value: authorized 1, 180, 000, 000 shares issued 1, 180,000, 000 shares \begin{tabular}{|l|r|r|r|r|r|} Additional Paid-in Capital & 23445 & 23445 & 23445 & 23445 & 23445 \\ \hline Earnings Retained in the Business & 12209 & 11128 & 9453 & 8304 & 7020 \\ \hline Shareholders' Equity & 35654 & 34573 & 32898 & 31749 & 30465 \\ \hline Tot Liab and Equity & 67993 & 55574 & 57628 & 59928 & 59285 \end{tabular} Question \#1 Refer to the balance sheets and incone statenents on pp. 2 and 3 below. For each year, calculate the following financial ratios: current ratio, quick ratio, inventory turnover, total asset turnover, debt ratio, net profit nargin. NOTE that the formulas for these ratios are given below. Question #2 Also, for each year, calculate the DuPont Analysis for return on assets (ROA) and return on equity (ROE). Formulas for the Dupont analyses are given below. Do not just calculate ROA and RoE. Be sure to shor the individual parts of the Dupont analysis Question \#3 Refer to your calculations of the DuPont analysis for return on equity (ROE). Over the course of the five years (2017 through 2021), did the ROE increase or decrease? Based on the three parts of the ROE DuPont analysis (i.e., profit margin, total asset turnover, and equity multiplier) what caused the ROE to increase or decrease? Be specific. Ratio Analysis current ratio current assets / current liabilities quick ratio (current assets - inventory) / current liabilities inventory turnover cost of goods sold/ inventory total asset turnover sales / total assets debt ratio total liabilities/total assets net profit margin net incone / sales DuPont Analysis return on assets (ROA) ROH= net incone / total assets = (net incone / sales) X (sales / total assets) return on equity (RoE) ROE = net incone / total equity = (net incone / sales) X (sales/total assets) X (total assets/total equity) Please use excel format, hopefully a little more detail