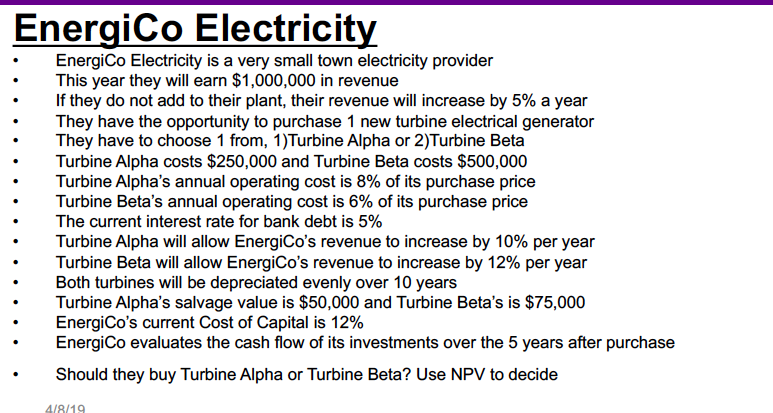

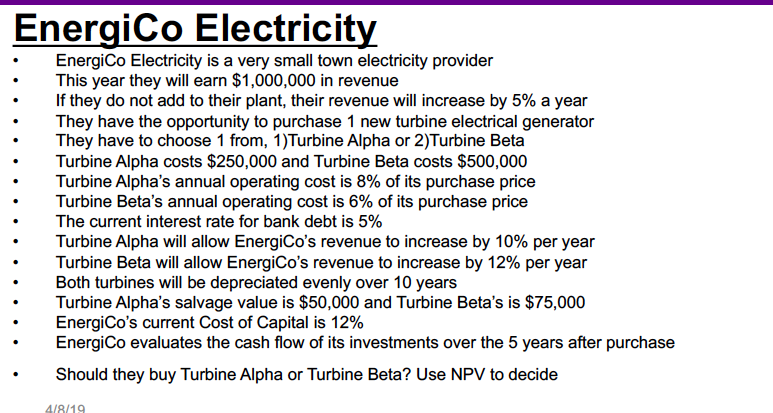

EnergiCo Electricit EnergiCo Electricity is a very small town electricity provider This year they will earn $1,000,000 in revenue If they do not add to their plant, their revenue will increase by 5% a year They have the opportunity to purchase 1 new turbine electrical generator They have to choose 1 from, 1)Turbine Alpha or 2)Turbine Beta Turbine Alpha costs $250,000 and Turbine Beta costs $500,000 Turbine Alpha's annual operating cost is 8% of its purchase price Turbine Beta's annual operating cost is 6% of its purchase price The current interest rate for bank debt is 5% Turbine Alpha will allow EnergiCo's revenue to increase by 10% per year Turbine Beta will allow EnergiCo's revenue to increase by 12% per year Both turbines will be depreciated evenly over 10 years Turbine Alpha's salvage value is $50,000 and Turbine Beta's is $75,000 Energico's current Cost of Capital is 12% EnergiCo evaluates the cash flow of its investments over the 5 years after purchase Should they buy Turbine Alpha or Turbine Beta? Use NPV to decide 418/19 EnergiCo Electricit EnergiCo Electricity is a very small town electricity provider This year they will earn $1,000,000 in revenue If they do not add to their plant, their revenue will increase by 5% a year They have the opportunity to purchase 1 new turbine electrical generator They have to choose 1 from, 1)Turbine Alpha or 2)Turbine Beta Turbine Alpha costs $250,000 and Turbine Beta costs $500,000 Turbine Alpha's annual operating cost is 8% of its purchase price Turbine Beta's annual operating cost is 6% of its purchase price The current interest rate for bank debt is 5% Turbine Alpha will allow EnergiCo's revenue to increase by 10% per year Turbine Beta will allow EnergiCo's revenue to increase by 12% per year Both turbines will be depreciated evenly over 10 years Turbine Alpha's salvage value is $50,000 and Turbine Beta's is $75,000 Energico's current Cost of Capital is 12% EnergiCo evaluates the cash flow of its investments over the 5 years after purchase Should they buy Turbine Alpha or Turbine Beta? Use NPV to decide 418/19