Engineering cost analysis

please answer as soon as possible clear steps

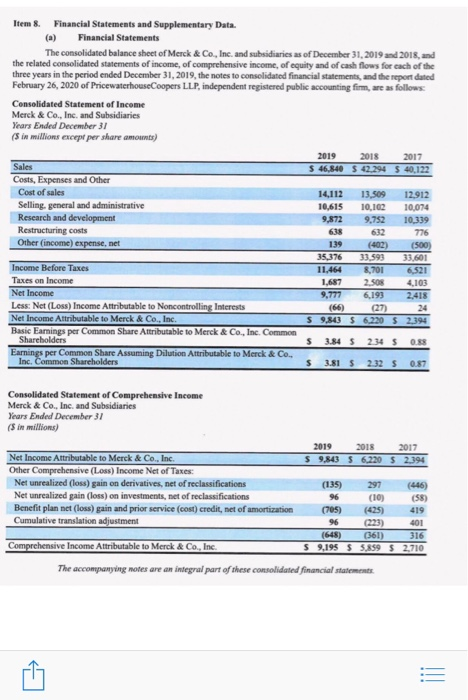

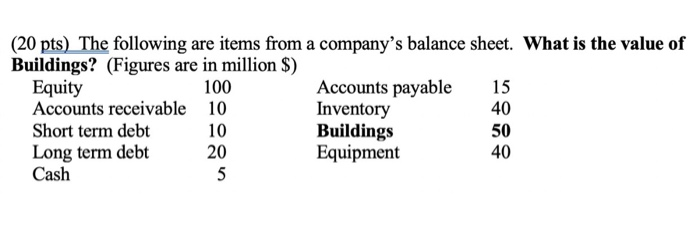

2019 Item 8. Financial Statements and Supplementary Data. (a) Financial Statements The consolidated balance sheet of Merck & Co., Inc. and subsidiaries as of December 31, 2019 and 2018, and the related consolidated statements of income, of comprehensive income, of equity and of cash flows for each of the three years in the period ended December 31, 2019, the notes to consolidated financial statements, and the report dated February 26, 2020 of PricewaterhouseCoopers LLP, independent registered public accounting firm, are as follows Consolidated Statement of Income Merck & Co., Inc. and Subsidiaries Years Ended December 31 (sin millions except per share amounts) 2018 2017 Sales $ 46,840 $ 42,294 $ 40,122 Costs, Expenses and Other Cost of sales 14,112 13,509 12,912 Selling general and administrative 10,615 10.102 10,074 Research and development 9,872 9,752 10,339 Restructuring costs 632 776 Other (income) expense, net 139 (402) (500) 35,376 33.593 33,601 Income Before Taxes 11.464 8,701 6,521 Taxes on Income 1,687 2.500 4,103 Net Income 9,777 6,193 2,418 Less: Net (Loss) Income Attributable to Noncontrolling Interests (66) (27) Net Income Attributable to Merck & Co., Inc. $ 9,843 $ 6,220 $2,394 Basic Earnings per Common Share Attributable to Merck & Co., Inc. Common Shareholders 3.84 S 2.34 $ 0.88 Earnings per Common Share Assuming Dilution Attributable to Merck & Co., Inc. Common Shareholders $ 3.81 $2.32 $ 0.87 Consolidated Statement of Comprehensive Income Merck & Co. Inc. and Subsidiaries Years Ended December 31 (sin millions) 2019 2018 2017 Net Income Attributable to Merck & Co., Inc. $9.843 5 6.220 $ 2.394 Other Comprehensive (Loss) Income Net of Taxes: Net unrealized (loss) gain on derivatives, net of reclassifications (135) 297 (446) Net unrealized gain (loss) on investments, net of reclassifications 96 (10) (58) Benefit plan net (loss) gain and prior service (cost) credit, net of amortization (705) (425) 419 Cumulative translation adjustment 96 (223) 401 (648) (361) 316 Comprehensive Income Attributable to Merck & Co., Inc. S 9,195 $5.859 $ 2.710 The accompanying notes are an integral part of these consolidated financial statements = (20 pts) The following are items from a company's balance sheet. What is the value of Buildings? (Figures are in million $) Equity 100 Accounts payable 15 Accounts receivable 10 Inventory Short term debt 10 Buildings 50 Long term debt Equipment 40 Cash 5 40 20 2019 Item 8. Financial Statements and Supplementary Data. (a) Financial Statements The consolidated balance sheet of Merck & Co., Inc. and subsidiaries as of December 31, 2019 and 2018, and the related consolidated statements of income, of comprehensive income, of equity and of cash flows for each of the three years in the period ended December 31, 2019, the notes to consolidated financial statements, and the report dated February 26, 2020 of PricewaterhouseCoopers LLP, independent registered public accounting firm, are as follows Consolidated Statement of Income Merck & Co., Inc. and Subsidiaries Years Ended December 31 (sin millions except per share amounts) 2018 2017 Sales $ 46,840 $ 42,294 $ 40,122 Costs, Expenses and Other Cost of sales 14,112 13,509 12,912 Selling general and administrative 10,615 10.102 10,074 Research and development 9,872 9,752 10,339 Restructuring costs 632 776 Other (income) expense, net 139 (402) (500) 35,376 33.593 33,601 Income Before Taxes 11.464 8,701 6,521 Taxes on Income 1,687 2.500 4,103 Net Income 9,777 6,193 2,418 Less: Net (Loss) Income Attributable to Noncontrolling Interests (66) (27) Net Income Attributable to Merck & Co., Inc. $ 9,843 $ 6,220 $2,394 Basic Earnings per Common Share Attributable to Merck & Co., Inc. Common Shareholders 3.84 S 2.34 $ 0.88 Earnings per Common Share Assuming Dilution Attributable to Merck & Co., Inc. Common Shareholders $ 3.81 $2.32 $ 0.87 Consolidated Statement of Comprehensive Income Merck & Co. Inc. and Subsidiaries Years Ended December 31 (sin millions) 2019 2018 2017 Net Income Attributable to Merck & Co., Inc. $9.843 5 6.220 $ 2.394 Other Comprehensive (Loss) Income Net of Taxes: Net unrealized (loss) gain on derivatives, net of reclassifications (135) 297 (446) Net unrealized gain (loss) on investments, net of reclassifications 96 (10) (58) Benefit plan net (loss) gain and prior service (cost) credit, net of amortization (705) (425) 419 Cumulative translation adjustment 96 (223) 401 (648) (361) 316 Comprehensive Income Attributable to Merck & Co., Inc. S 9,195 $5.859 $ 2.710 The accompanying notes are an integral part of these consolidated financial statements = (20 pts) The following are items from a company's balance sheet. What is the value of Buildings? (Figures are in million $) Equity 100 Accounts payable 15 Accounts receivable 10 Inventory Short term debt 10 Buildings 50 Long term debt Equipment 40 Cash 5 40 20