Question: Engineering Economy Please solve it right and Correct. Storage tanks to hold a highly corrosive chemical are currently made of material Z26. The capital investment

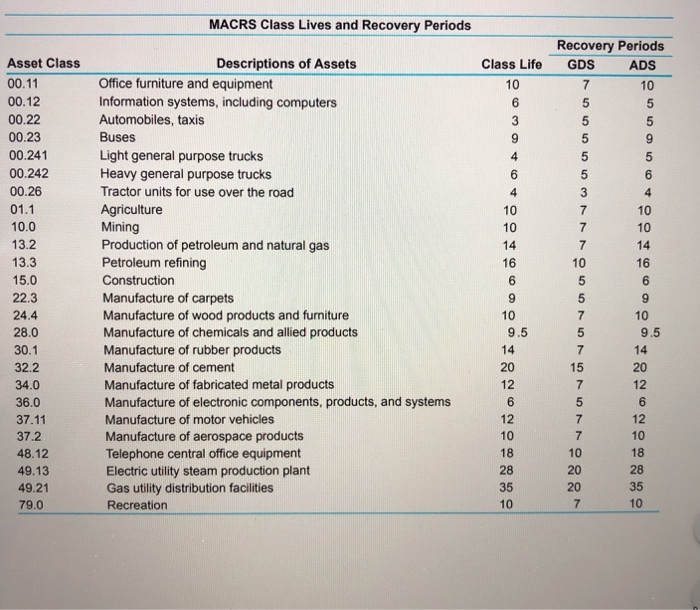

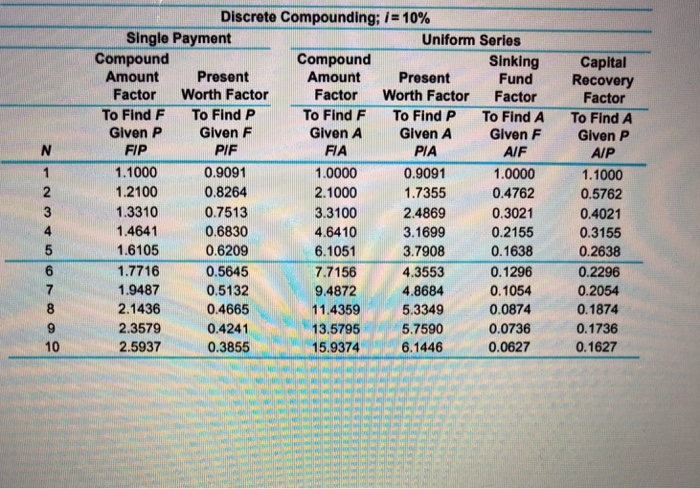

Storage tanks to hold a highly corrosive chemical are currently made of material Z26. The capital investment in a tank is $33,000, and its useful life is eight years.. Your company manufactures electronic components and uses the ADS for Asset Class 36.0 under MACRS to calculate depreciation deductions for these tanks. The net MV of the tanks at the end of their useful life is zero. When a tank is four years old, it must be relined at a cost of $11,000. This cost is not depreciated and can be claimed as an expense during year four. Instead of purchasing the tanks, they can be leased. A contract for up to 20 years of storage tank service can be written with the Rent-All Company. If your firm's after-tax MARR is 10% per year, what is the greatest annual amount that you can afford to pay for tank leasing without causing purchasing to be the more economical alternative? Your firm's effective income tax rate is 35%. Click the icon to view the partial listing of depreciable assets used in business. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10 % per year. The greatest annual amount that you can afford to pay is $ (Round to the nearest dollar.) MACRS Class Lives and Recovery Periods Recovery Periods Asset Class Descriptions of Assets Class Life GDS ADS Office furniture and equipment Information systems, including computers Automobiles, taxis 00.11 10 7 10 00.12 5 5 00.22 3 00.23 Buses 00.241 Light general purpose trucks Heavy general purpose trucks 4 5 00.242 6 6 00.26 Tractor units for use over the road 4 3 4 01.1 Agriculture Mining Production of petroleum and natural gas Petroleum refining 10 10 10.0 10 10 13.2 14 14 13.3 10 16 16 15.0 Construction 6 6 Manufacture of carpets Manufacture of wood products and furniture Manufacture of chemicals and allied products Manufacture of rubber products Manufacture of cement 22.3 24.4 10 10 28.0 9.5 9.5 30.1 14 14 32.2 20 20 Manufacture of fabricated metal products Manufacture of electronic components, products, and systems Manufacture of motor vehicles 34.0 12 12 6 36.0 6 12 12 37.11 37.2 Manufacture of aerospace products Telephone central office equipment Electric utility steam production plant Gas utility distribution facilities 10 10 18 10 18 48.12 28 20 28 49.13 35 20 35 49.21 10 10 79.0 Recreation 55 977 7O5 757 7 7O 7 Discrete Compounding; i 10 % Single Payment Compound Uniform Series Compound Amount Sinking Fund Capital Recovery Factor Present Worth Factor Amount Present Worth Factor Factor Factor Factor To Find P Given F PIF To Find F Given P To Find F Given A To Find P To Find A To Find A Given A PIA Given F Given P FIP FIA AIF AIP 1.1000 0.9091 1 1.0000 0.9091 1.0000 1.1000 1.2100 0.8264 2 2.1000 1.7355 0.4762 0.5762 1.3310 0.7513 3.3100 2.4869 0.3021 0.4021 1.4641 0.6830 4.6410 3.1699 0.2155 0.3155 1.6105 0.6209 6.1051 3.7908 0.1638 0.2638 0.5645 6 1.7716 7.7156 4.3553 0.1296 0.2296 1.9487 0.5132 9.4872 11.4359 4.8684 0.1054 0.2054 8 2.1436 0.4665 5.3349 0.0874 0.1874 2.3579 13.5795 0.0736 0.4241 5.7590 0.1736 10 2.5937 0.3855 0.0627 0.1627 15.9374 6.1446 45 O7 C0 Storage tanks to hold a highly corrosive chemical are currently made of material Z26. The capital investment in a tank is $33,000, and its useful life is eight years.. Your company manufactures electronic components and uses the ADS for Asset Class 36.0 under MACRS to calculate depreciation deductions for these tanks. The net MV of the tanks at the end of their useful life is zero. When a tank is four years old, it must be relined at a cost of $11,000. This cost is not depreciated and can be claimed as an expense during year four. Instead of purchasing the tanks, they can be leased. A contract for up to 20 years of storage tank service can be written with the Rent-All Company. If your firm's after-tax MARR is 10% per year, what is the greatest annual amount that you can afford to pay for tank leasing without causing purchasing to be the more economical alternative? Your firm's effective income tax rate is 35%. Click the icon to view the partial listing of depreciable assets used in business. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10 % per year. The greatest annual amount that you can afford to pay is $ (Round to the nearest dollar.) MACRS Class Lives and Recovery Periods Recovery Periods Asset Class Descriptions of Assets Class Life GDS ADS Office furniture and equipment Information systems, including computers Automobiles, taxis 00.11 10 7 10 00.12 5 5 00.22 3 00.23 Buses 00.241 Light general purpose trucks Heavy general purpose trucks 4 5 00.242 6 6 00.26 Tractor units for use over the road 4 3 4 01.1 Agriculture Mining Production of petroleum and natural gas Petroleum refining 10 10 10.0 10 10 13.2 14 14 13.3 10 16 16 15.0 Construction 6 6 Manufacture of carpets Manufacture of wood products and furniture Manufacture of chemicals and allied products Manufacture of rubber products Manufacture of cement 22.3 24.4 10 10 28.0 9.5 9.5 30.1 14 14 32.2 20 20 Manufacture of fabricated metal products Manufacture of electronic components, products, and systems Manufacture of motor vehicles 34.0 12 12 6 36.0 6 12 12 37.11 37.2 Manufacture of aerospace products Telephone central office equipment Electric utility steam production plant Gas utility distribution facilities 10 10 18 10 18 48.12 28 20 28 49.13 35 20 35 49.21 10 10 79.0 Recreation 55 977 7O5 757 7 7O 7 Discrete Compounding; i 10 % Single Payment Compound Uniform Series Compound Amount Sinking Fund Capital Recovery Factor Present Worth Factor Amount Present Worth Factor Factor Factor Factor To Find P Given F PIF To Find F Given P To Find F Given A To Find P To Find A To Find A Given A PIA Given F Given P FIP FIA AIF AIP 1.1000 0.9091 1 1.0000 0.9091 1.0000 1.1000 1.2100 0.8264 2 2.1000 1.7355 0.4762 0.5762 1.3310 0.7513 3.3100 2.4869 0.3021 0.4021 1.4641 0.6830 4.6410 3.1699 0.2155 0.3155 1.6105 0.6209 6.1051 3.7908 0.1638 0.2638 0.5645 6 1.7716 7.7156 4.3553 0.1296 0.2296 1.9487 0.5132 9.4872 11.4359 4.8684 0.1054 0.2054 8 2.1436 0.4665 5.3349 0.0874 0.1874 2.3579 13.5795 0.0736 0.4241 5.7590 0.1736 10 2.5937 0.3855 0.0627 0.1627 15.9374 6.1446 45 O7 C0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts