Answered step by step

Verified Expert Solution

Question

1 Approved Answer

English Bay Limited (EBL) has recently decided to go public and has hired you as their independent accountant. They wish to adhere to IFRS

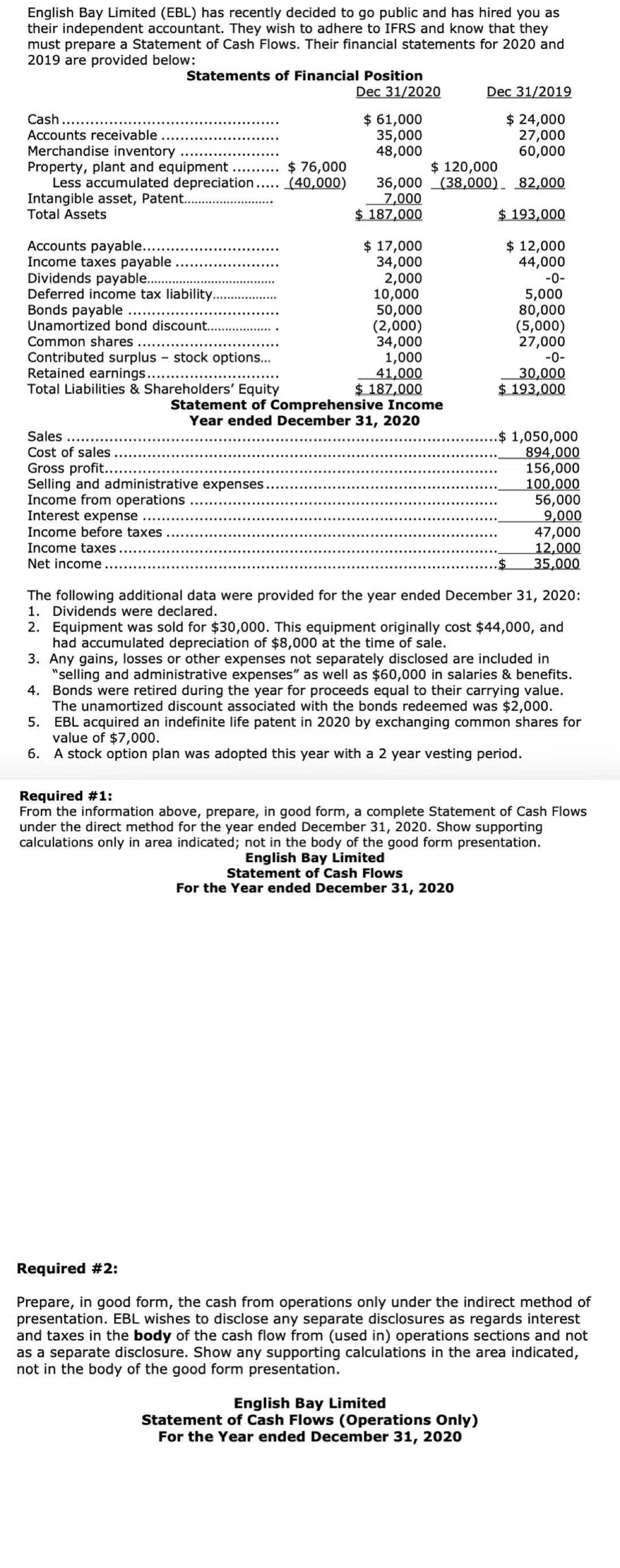

English Bay Limited (EBL) has recently decided to go public and has hired you as their independent accountant. They wish to adhere to IFRS and know that they must prepare a Statement of Cash Flows. Their financial statements for 2020 and 2019 are provided below: Statements of Financial Position Dec 31/2020 Dec 31/2019 $ 61,000 35,000 48,000 $ 24,000 27,000 60,000 Cash Accounts receivable Merchandise inventory Property, plant and equipment Less accumulated depreciation. Intangible asset, Patent.... Total Assets $ 76,000 (40,000) $ 120,000 36,000 (38,000). 82,000 7,000 $ 187,000 $ 193,000 Accounts payable... Income taxes payable Dividends payable.. Deferred income tax liability.. Bonds payable Unamortized bond discount. $ 17,000 34,000 2,000 10,000 50,000 (2,000) 34,000 1,000 41,000 $ 187,000 Statement of Comprehensive Income Year ended December 31, 2020 $ 12,000 44,000 -0- 5,000 80,000 (5,000) 27,000 -0- Common shares Contributed surplus - stock options... Retained earnings.... Total Liabilities & Shareholders' Equity 30,000 $ 193,000 Sales ..... Cost of sales .... Gross profit...... Selling and administrative expenses Income from operations Interest expense .. $1,050,000 894,000 156,000 100,000 56,000 9,000 47,000 12,000 %2$ Income before taxes Income taxes Net income.. 35,000 The following additional data were provided for the year ended December 31, 2020: 1. Dividends were declared. 2. Equipment was sold for $30,000. This equipment originally cost $44,000, and had accumulated depreciation of $8,000 at the time of sale. 3. Any gains, losses or other expenses not separately disclosed are included in "selling and administrative expenses" as well as $60,000 in salaries & benefits. 4. Bonds were retired during the year for proceeds equal to their carrying value. The unamortized discount associated with the bonds redeemed was $2,000. EBL acquired an indefinite life patent in 2020 by exchanging common shares for value of $7,000. A stock option plan was adopted this year with a 2 year vesting period. 5. 6. Required #1: From the information above, prepare, in good form, a complete Statement of Cash Flows under the direct method for the year ended December 31, 2020. Show supporting calculations only in area indicated; not in the body of the good form presentation. English Bay Limited Statement of Cash Flows For the Year ended December 31, 2020 Required #2: Prepare, in good form, the cash from operations only under the indirect method of presentation. EBL wishes to disclose any separate disclosures as regards interest and taxes in the body of the cash flow from (used in) operations sections and not as a separate disclosure. Show any supporting calculations in the area indicated, not in the body of the good form presentation. English Bay Limited Statement of Cash Flows (Operations Only) For the Year ended December 31, 2020

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1Direct Method English Bay Limited Statement of Cash Flows for the year ended D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started