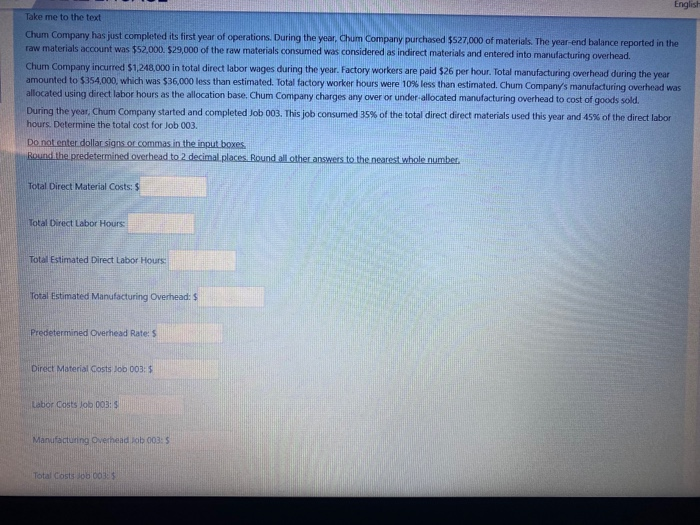

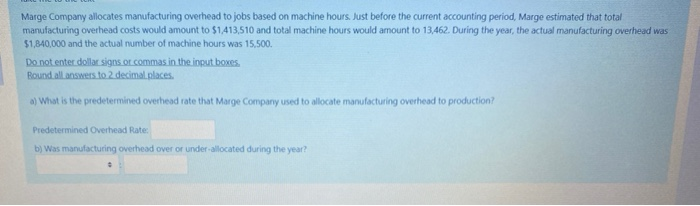

English Take me to the text Chum Company has just completed its first year of operations. During the year, Chum Company purchased $27.000 of materials. The year-end balance reported in the raw materials account was $52,000. $29,000 of the raw materials consumed was considered as indirect materials and entered into manufacturing overhead. Chum Company incurred $1,248,000 in total direct labor wages during the year. Factory workers are paid $26 per hour. Total manufacturing overhead during the year amounted to $354,000, which was $36,000 less than estimated. Total factory worker hours were 10% less than estimated. Chum Company's manufacturing overhead was allocated using direct labor hours as the allocation base. Chum Company charges any over or under-allocated manufacturing overhead to cost of goods sold. During the year, Chum Company started and completed Job 003. This job consumed 35% of the total direct direct materials used this year and 45% of the direct labor hours. Determine the total cost for Job 003. Do not enter dollar signs or commas in the input boxes Round the predetermined overhead to 2 decimal places. Round all other answers to the nearest whole number Total Direct Material Costs: $ Total Direct Labor Hours: Total Estimated Direct Labor Hours: Total Estimated Manufacturing Overhead: S Predetermined Overhead Rate: S Direct Material costs lob 003: Labor Costs Job 003: Manufacturing Overhead lob 003:5 Total Costs soos Marge company allocates manufacturing overhead to jobs based on machine hours. Just before the current accounting period, Marge estimated that total manufacturing overhead costs would amount to $1,413,510 and total machine hours would amount to 13,462. During the year, the actual manufacturing overhead was 51,840,000 and the actual number of machine hours was 15,500. Do not enter dollar signs or commas in the input boxes. Round all answers to 2 decimal.places. a) What is the predetermined overhead rate that Marge Company used to allocate manufacturing overhead to production? Predetermined Overhead Rate: by Was manufacturing overhead over or under-allocated during the year