Answered step by step

Verified Expert Solution

Question

1 Approved Answer

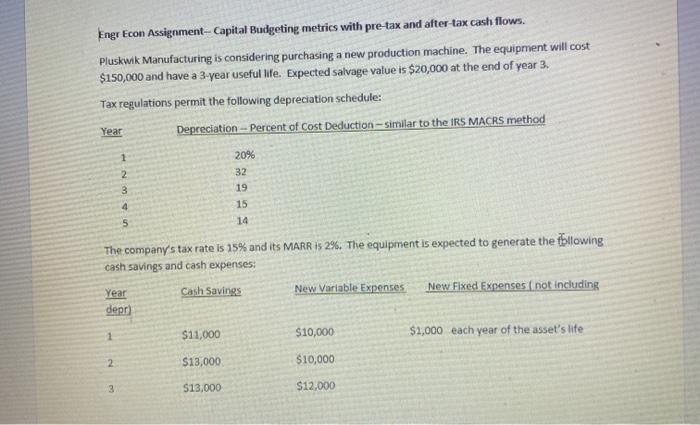

Engr Econ Assignment- Capital Budgeting metrics with pre-tax and after-tax cash flows. Pluskwik Manufacturing is considering purchasing a new production machine. The equipment will

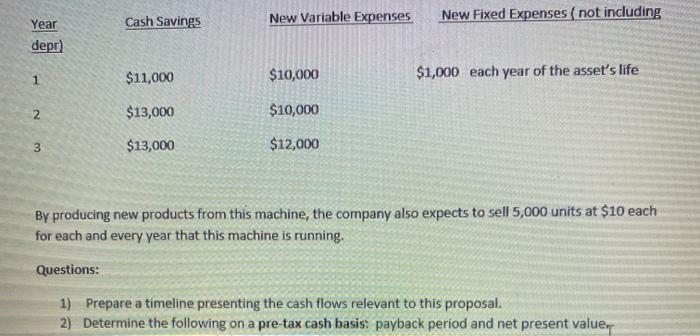

Engr Econ Assignment- Capital Budgeting metrics with pre-tax and after-tax cash flows. Pluskwik Manufacturing is considering purchasing a new production machine. The equipment will cost $150,000 and have a 3-year useful life. Expected salvage value is $20,000 at the end of year 3. Tax regulations permit the following depreciation schedule: Year Depreciation - Percent of Cost Deduction-similar to the IRS MACRS method 20% 2 32 19 4. 15 14 The company's tax rate is 15% and its MARR is 2%. The equipment is expected to generate the tbllowing cash savings and cash expenses: Cash Savings New Fixed Expenses ( not including Year New Variable Expenses depr) 1. $11,000 $10,000 $1,000 each year of the asset's life 2. $13,000 $10,000 3. S13,000 $12,000 Cash Savings New Variable Expenses New Fixed Expenses ( not including Year depr) $11,000 $10,000 $1,000 each year of the asset's life 2. $13,000 $10,000 3 $13,000 $12,000 By producing new products from this machine, the company also expects to sell 5,000 units at $10 each for each and every year that this machine is running. Questions: 1) Prepare a timeline presenting the cash flows relevant to this proposal. 2) Determine the following on a pre-tax cash basis: payback period and net present valuer

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

answers 1 Timeline 0 2 Pretax Cash flows 1 5000 10 50000 5000 10 50000 3 5000 a 10 b 50000 a x b 500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started