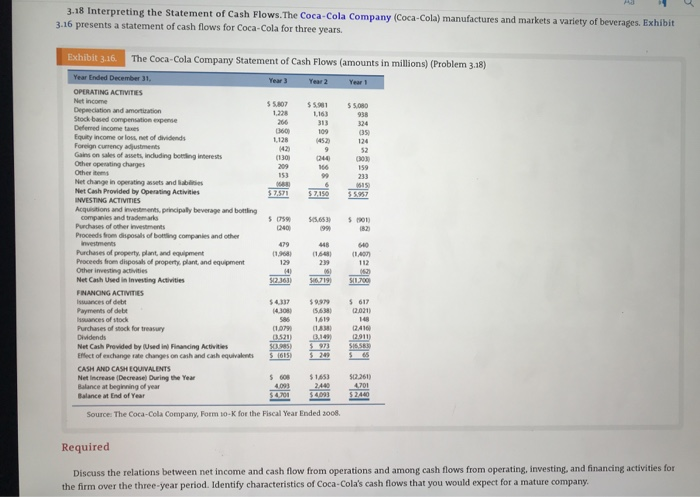

ent of Cash Flows.The Coca-Cola Company (Coca-Cola) manufactures and markets a variety of beverages. Exhibit 3.16 presents a statement of cash flows for Coca-Cola for three years Exhibit 3.16. The Coca-Cola Company Statement of Cash Flows (amounts in millions) (Problem 3.18) Year 3 Year 2 Year OPERATING ACTIVITIES Net income Depeeciation and amortization Stock based compensation expense Defermed income tane Equity income or loss, net of dividends Foreign cumency adjustments Gains on sales of assets, induding boting inberests Other openating charges 5807 5 5,080 1163 452) (130) Net change in operating assets and Sabilities Net Cash Provided by Operating Activities INVESTING ACTIVITIES Acquisitions and inesments principaly beverage and bottling ompanies and trademarks Purchases of other inestments Proceeds from diposals of bottling companies and other 5 5.653 01) Purchases of property,plant, and equipment Proceeds from dihposah of property plant, and equipment Other investing activities Net Cash Uned in Investing Activities FNANONG ACTIVITIES Issuances of debt Payments of debe ssuances of stock Purchanes of stock for treasury 1968)1648)107) 239 230 43085638) (2021 Net Cash Provided by Used in) Financing Activites Effiect of exchange tate changes on cash and cash equivalents 161522 5 CASH AND CASH EQUIVALENTS Net Increase (Decrease) During the Year Balance at beginning of year Balance at End of Year 5608 $153$2261) Source. The Coca-Cola Company, Form to-K foe the Fiscal Year Ended 2008 Required Discuss the relations between net income and cash flow from operations and among cash flows from operating, investing, and financing activities for the firm over the three-year period. Identify characteristics of Coca-Cola's cash flows that you would expect for a mature company. ent of Cash Flows.The Coca-Cola Company (Coca-Cola) manufactures and markets a variety of beverages. Exhibit 3.16 presents a statement of cash flows for Coca-Cola for three years Exhibit 3.16. The Coca-Cola Company Statement of Cash Flows (amounts in millions) (Problem 3.18) Year 3 Year 2 Year OPERATING ACTIVITIES Net income Depeeciation and amortization Stock based compensation expense Defermed income tane Equity income or loss, net of dividends Foreign cumency adjustments Gains on sales of assets, induding boting inberests Other openating charges 5807 5 5,080 1163 452) (130) Net change in operating assets and Sabilities Net Cash Provided by Operating Activities INVESTING ACTIVITIES Acquisitions and inesments principaly beverage and bottling ompanies and trademarks Purchases of other inestments Proceeds from diposals of bottling companies and other 5 5.653 01) Purchases of property,plant, and equipment Proceeds from dihposah of property plant, and equipment Other investing activities Net Cash Uned in Investing Activities FNANONG ACTIVITIES Issuances of debt Payments of debe ssuances of stock Purchanes of stock for treasury 1968)1648)107) 239 230 43085638) (2021 Net Cash Provided by Used in) Financing Activites Effiect of exchange tate changes on cash and cash equivalents 161522 5 CASH AND CASH EQUIVALENTS Net Increase (Decrease) During the Year Balance at beginning of year Balance at End of Year 5608 $153$2261) Source. The Coca-Cola Company, Form to-K foe the Fiscal Year Ended 2008 Required Discuss the relations between net income and cash flow from operations and among cash flows from operating, investing, and financing activities for the firm over the three-year period. Identify characteristics of Coca-Cola's cash flows that you would expect for a mature company