Insurance. Do deduct Union Dues for the appropriate employees. Do deduct Simple Plan savings deduction for the appropriate employees. Begin the sequence with Check

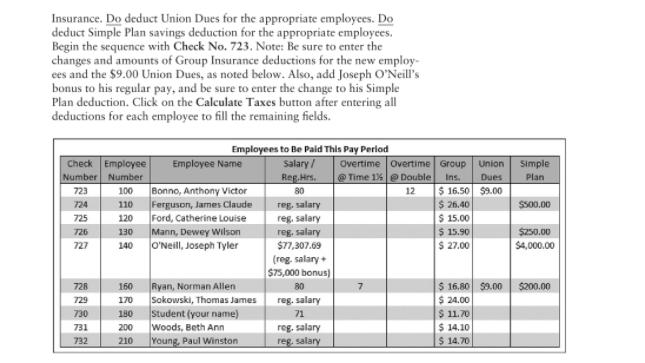

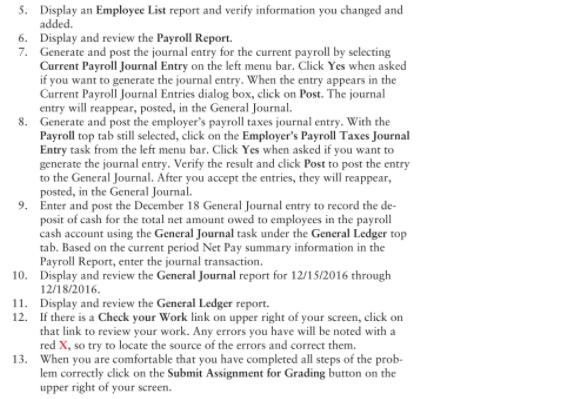

Insurance. Do deduct Union Dues for the appropriate employees. Do deduct Simple Plan savings deduction for the appropriate employees. Begin the sequence with Check No. 723. Note: Be sure to enter the changes and amounts of Group Insurance deductions for the new employ- ees and the $9.00 Union Dues, as noted below. Also, add Joseph O'Neill's bonus to his regular pay, and be sure to enter the change to his Simple Plan deduction. Click on the Calculate Taxes button after entering all deductions for each employee to fill the remaining fields. Check Employee Employee Name Number Number 723 100 724 110 725 120 Ford, Catherine Louise 130 Mann, Dewey Wilson 140 O'Neill, Joseph Tyler 726 727 728 729 730 731 732 160 170 Employees to Be Paid This Pay Period Salary/ Reg.Hrs. 80 180 200 210 Bonno, Anthony Victor Ferguson, James Claude Ryan, Norman Allen Sokowski, Thomas James Student (your name) Woods, Beth Ann Young, Paul Winston reg, salary reg, salary reg, salary $77,307.69 (reg. salary + $75,000 bonus) 80 reg. salary 71 reg, salary reg, salary Overtime @Time 1% 7 Overtime Group Union Double Ins. Dues 12 $16.50 $9.00 $26.40 $ 15.00 $15.90 $ 27.00 $16.80 $9.00 $ 24,00 $11.70 $ 14.10 $ 14.70 Simple Plan $500.00 $250.00 $4,000.00 $200.00 5. Display an Employee List report and verify information you changed and added. 6. Display and review the Payroll Report. 7. Generate and post the journal entry for the current payroll by selecting Current Payroll Journal Entry on the left menu bar. Click Yes when asked if you want to generate the journal entry. When the entry appears in the Current Payroll Journal Entries dialog box, click on Post. The journal entry will reappear, posted, in the General Journal. 8. Generate and post the employer's payroll taxes journal entry. With the Payroll top tab still selected, click on the Employer's Payroll Taxes Journal Entry task from the left menu bar. Click Yes when asked if you want to generate the journal entry. Verify the result and click Post to post the entry to the General Journal. After you accept the entries, they will reappear, posted, in the General Journal. 9. Enter and post the December 18 General Journal entry to record the de- posit of cash for the total net amount owed to employees in the payroll cash account using the General Journal task under the General Ledger top tab. Based on the current period Net Pay summary information in the Payroll Report, enter the journal transaction. Display and review the General Journal report for 12/15/2016 through 12/18/2016. 10. 11. 12. Display and review the General Ledger report. If there is a Check your Work link on upper right of your screen, click on that link to review your work. Any errors you have will be noted with a red X, so try to locate the source of the errors and correct them. 13. When you are comfortable that you have completed all steps of the prob- lem correctly click on the Submit Assignment for Grading button on the upper right of your screen.

Step by Step Solution

3.61 Rating (205 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started