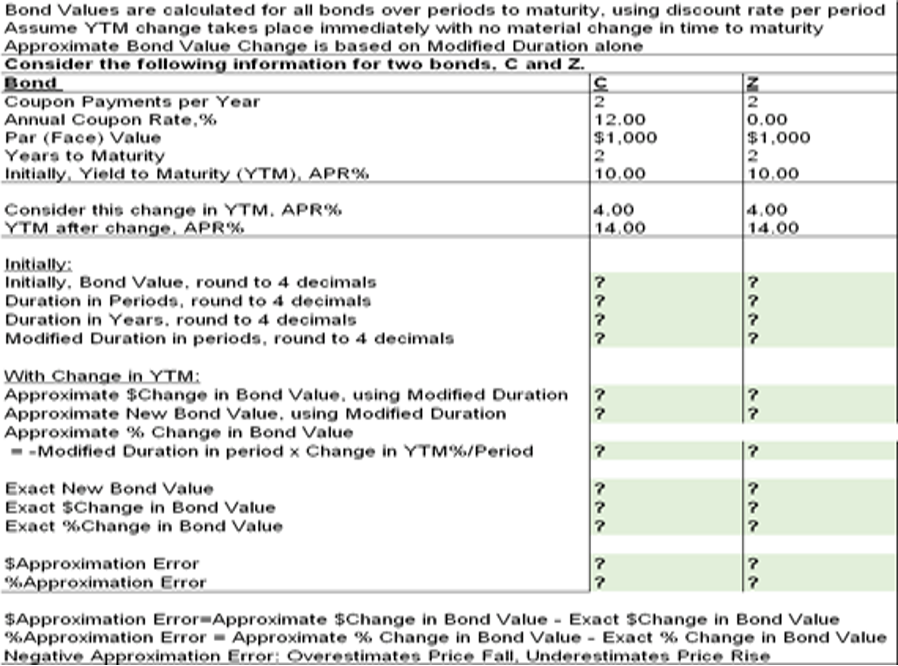

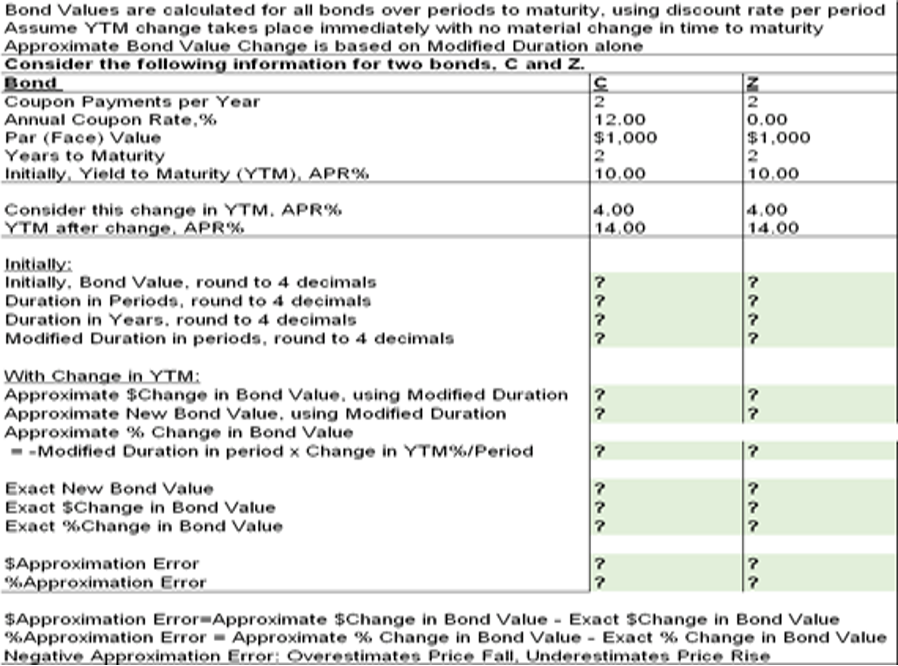

Enter figures in the cells marked with ?.

Bond Values are calculated for all bonds over periods to maturity, using cliscount rate per period Assume YTM change takes place immediately with no material change in time to maturity Approximate Bond Value Change is based on Modified Duration alone Consider the following information for two bonds, C and Z. Bond s Coupon Payments per Year 2 2 Annual Coupon Rate,% 12.00 0.00 Par (Face) Value $1,000 $1,000 Years to Maturity 2 2 Initially, Yield to Maturity (YTM), APR% 10.00 10.00 Consider this change in YTM. APR% 4.00 4.00 YTM after change. APR% 14.00 14.00 Initially: Initially. Bond Value, round to 4 decimals Duration in Periods, round to 4 decimals ? Duration in Years, round to 4 decimals 2 2 Modified Duration in periods, round to 4 decimals 7 With Change in YTM: Approximate $Change in Bond Value, using Modified Duration Approximate New Bond Value, using Modified Duration ? Approximate % Change in Bond Value --Modified Duration in period x Change in YTM%/Period Exact New Bond Value Exact $Change in Bond Value 2 Exact %Change in Bond Value ? $Approximation Error ? % Approximation Error $Approximation Error-Approximate $Change in Bond Value - Exact $Change in Bond Value % Approximation Error - Approximate % Change in Bond Value - Exact % Change in Bond Value Negative Approximation Frror: Overestimates Price Fall Underestimates Price Rise Bond Values are calculated for all bonds over periods to maturity, using cliscount rate per period Assume YTM change takes place immediately with no material change in time to maturity Approximate Bond Value Change is based on Modified Duration alone Consider the following information for two bonds, C and Z. Bond s Coupon Payments per Year 2 2 Annual Coupon Rate,% 12.00 0.00 Par (Face) Value $1,000 $1,000 Years to Maturity 2 2 Initially, Yield to Maturity (YTM), APR% 10.00 10.00 Consider this change in YTM. APR% 4.00 4.00 YTM after change. APR% 14.00 14.00 Initially: Initially. Bond Value, round to 4 decimals Duration in Periods, round to 4 decimals ? Duration in Years, round to 4 decimals 2 2 Modified Duration in periods, round to 4 decimals 7 With Change in YTM: Approximate $Change in Bond Value, using Modified Duration Approximate New Bond Value, using Modified Duration ? Approximate % Change in Bond Value --Modified Duration in period x Change in YTM%/Period Exact New Bond Value Exact $Change in Bond Value 2 Exact %Change in Bond Value ? $Approximation Error ? % Approximation Error $Approximation Error-Approximate $Change in Bond Value - Exact $Change in Bond Value % Approximation Error - Approximate % Change in Bond Value - Exact % Change in Bond Value Negative Approximation Frror: Overestimates Price Fall Underestimates Price Rise