Answered step by step

Verified Expert Solution

Question

1 Approved Answer

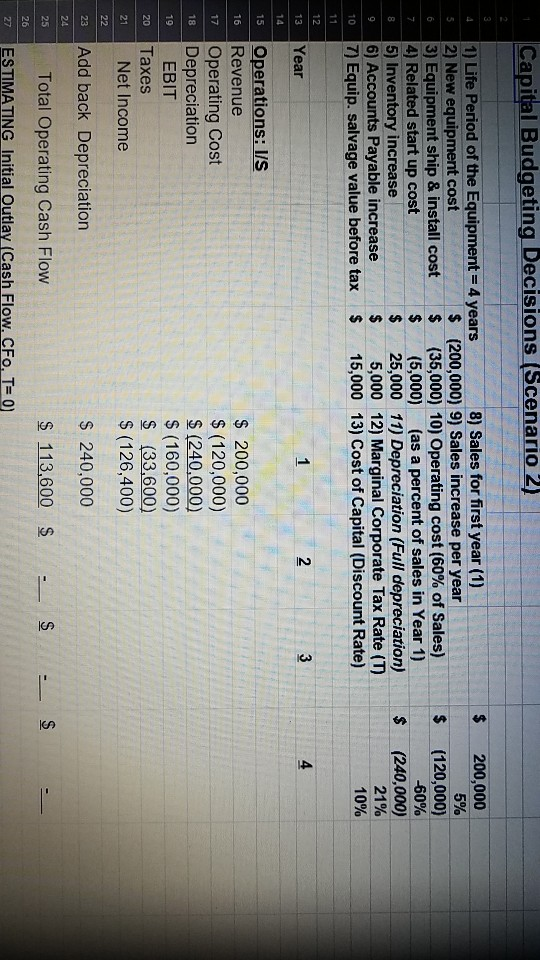

enter missing values for years 2 through 4 Capital Budgeting Decisions (Scenario 2) $ $ 4. 1) Life Period of the Equipment = 4 years

enter missing values for years 2 through 4

Capital Budgeting Decisions (Scenario 2) $ $ 4. 1) Life Period of the Equipment = 4 years 8) Sales for first year (1) 5 2) New equipment cost $ (200,000) 9) Sales increase per year o 3) Equipment ship & install cost $ (35,000) 10) Operating cost (60% of Sales) 7 4) Related start up cost $ (5,000) (as a percent of sales in Year 1) 8 5) Inventory increase $ 25,000 11) Depreciation (Full depreciation) 9 6) Accounts Payable increase $ 5,000 12) Marginal Corporate Tax Rate (T) 107) Equip. salvage value before tax $ 15,000 13) Cost of Capital (Discount Rate) 200,000 5% (120,000) -60% (240,000) $ 21% 10% 12 13 Year 14 15 Operations: I/S 16 Revenue 17 Operating Cost 18 Depreciation 19 EBIT 20 Taxes 21 Net Income $ 200,000 $ (120,000) $ (240,000) $ (160,000) $ (33,600) $ (126,400) 22 Add back Depreciation Total Operating Cash Flow ESTIMATING Initial Outlay Cash Flow. CFO. T=0 $ 240,000 $ 113,600 $ - S - $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started