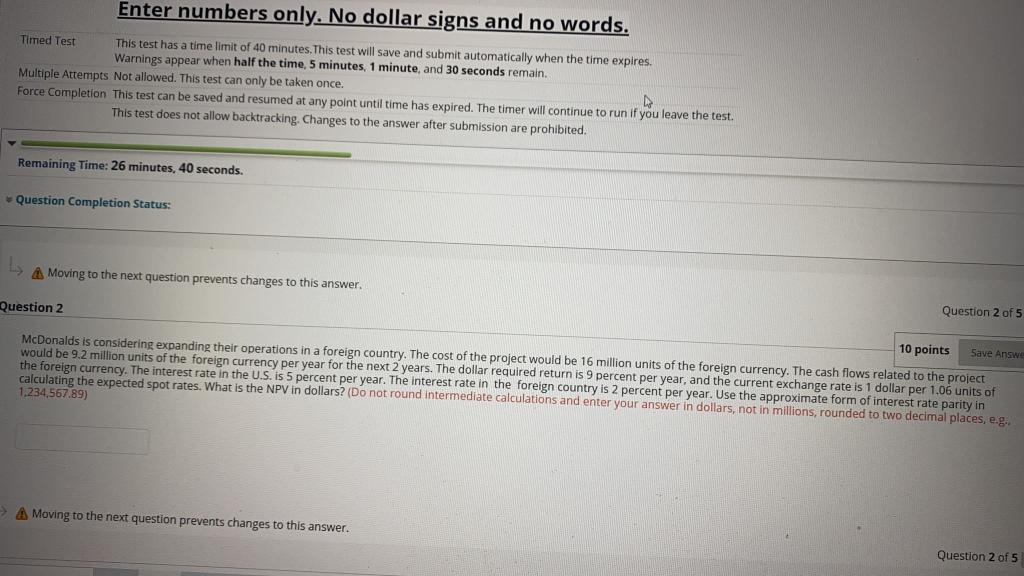

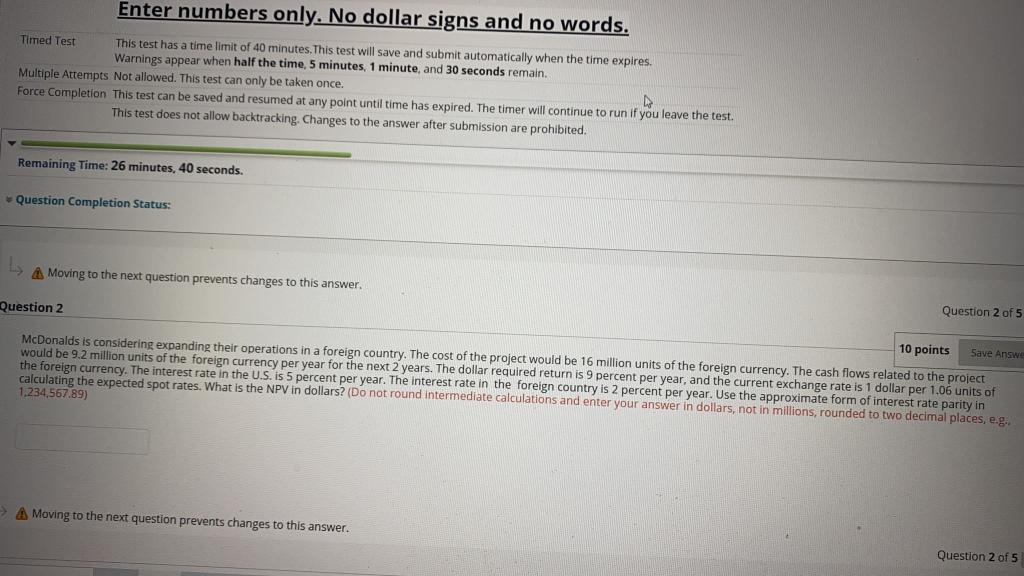

Enter numbers only. No dollar signs and no words. Timed Test This test has a time limit of 40 minutes. This test will save and submit automatically when the time expires. Warnings appear when half the time, 5 minutes, 1 minute, and 30 seconds remain Multiple Attempts Not allowed. This test can only be taken once. Force Completion This test can be saved and resumed at any point until time has expired. The timer will continue to run if you leave the test. This test does not allow backtracking. Changes to the answer after submission are prohibited. Remaining Time: 26 minutes, 40 seconds. Question Completion Status: Moving to the next question prevents changes to this answer. Question 2 Question 2 of 5 10 points Save Answe McDonalds is considering expanding their operations in a foreign country. The cost of the project would be 16 million units of the foreign currency. The cash flows related to the project would be 9.2 million units of the foreign currency per year for the next 2 years. The dollar required return is 9 percent per year, and the current exchange rate is 1 dollar per 1.06 units of the foreign currency. The interest rate in the U.S. is 5 percent per year. The interest rate in the foreign country is 2 percent per year. Use the approximate form of interest rate parity in calculating the expected spot rates. What is the NPV in dollars? (Do not round intermediate calculations and enter your answer in dollars, not in millions, rounded to two decimal places, eg.. 1,234,567.89) A Moving to the next question prevents changes to this answer. Question 2 of 5 Enter numbers only. No dollar signs and no words. Timed Test This test has a time limit of 40 minutes. This test will save and submit automatically when the time expires. Warnings appear when half the time, 5 minutes, 1 minute, and 30 seconds remain Multiple Attempts Not allowed. This test can only be taken once. Force Completion This test can be saved and resumed at any point until time has expired. The timer will continue to run if you leave the test. This test does not allow backtracking. Changes to the answer after submission are prohibited. Remaining Time: 26 minutes, 40 seconds. Question Completion Status: Moving to the next question prevents changes to this answer. Question 2 Question 2 of 5 10 points Save Answe McDonalds is considering expanding their operations in a foreign country. The cost of the project would be 16 million units of the foreign currency. The cash flows related to the project would be 9.2 million units of the foreign currency per year for the next 2 years. The dollar required return is 9 percent per year, and the current exchange rate is 1 dollar per 1.06 units of the foreign currency. The interest rate in the U.S. is 5 percent per year. The interest rate in the foreign country is 2 percent per year. Use the approximate form of interest rate parity in calculating the expected spot rates. What is the NPV in dollars? (Do not round intermediate calculations and enter your answer in dollars, not in millions, rounded to two decimal places, eg.. 1,234,567.89) A Moving to the next question prevents changes to this answer. Question 2 of 5