enter the adjusting entries PLEASE DO ONLY 30-46

DO ALL OF 30-46 please

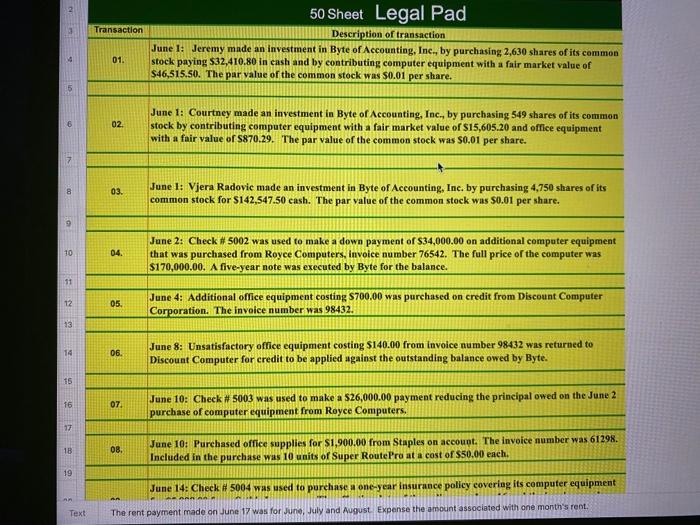

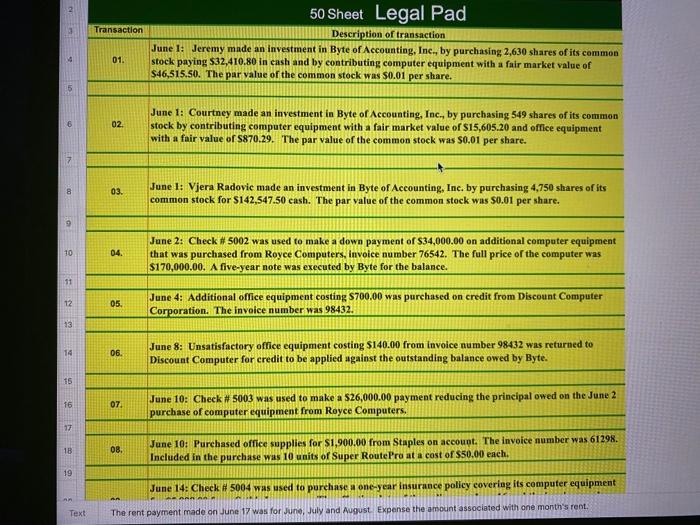

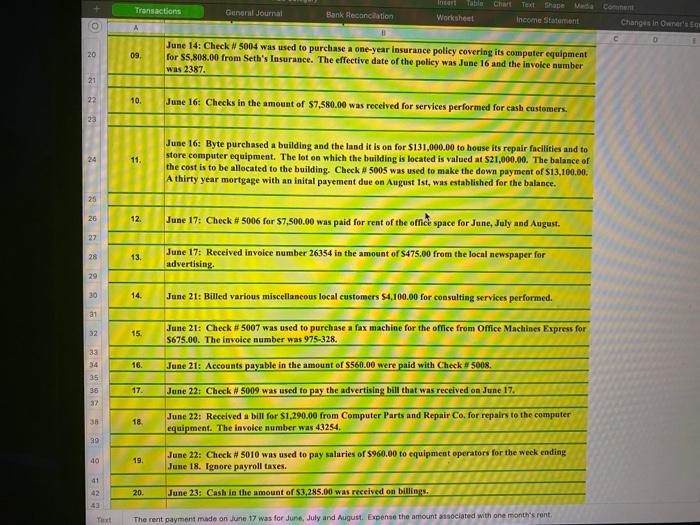

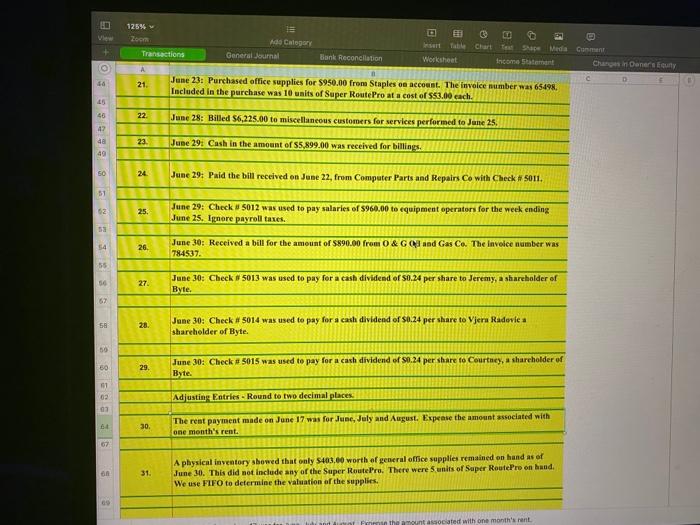

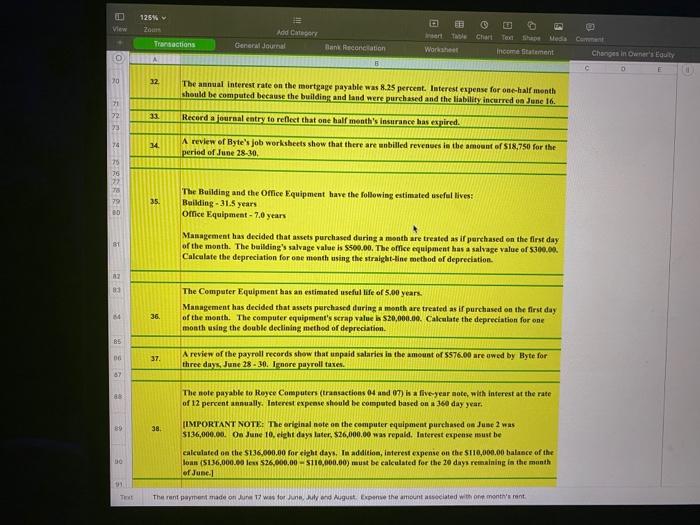

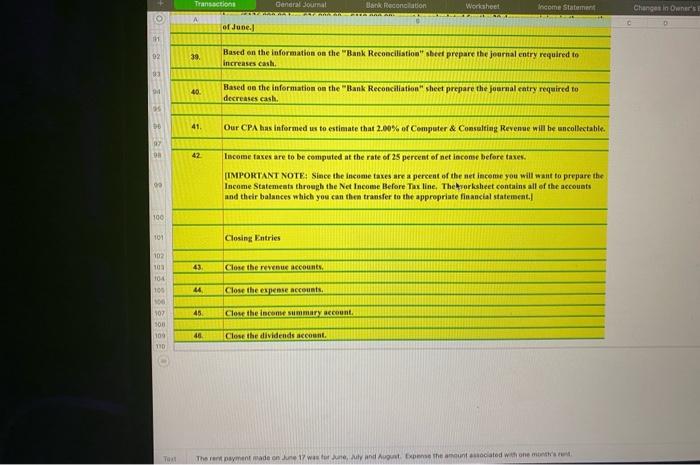

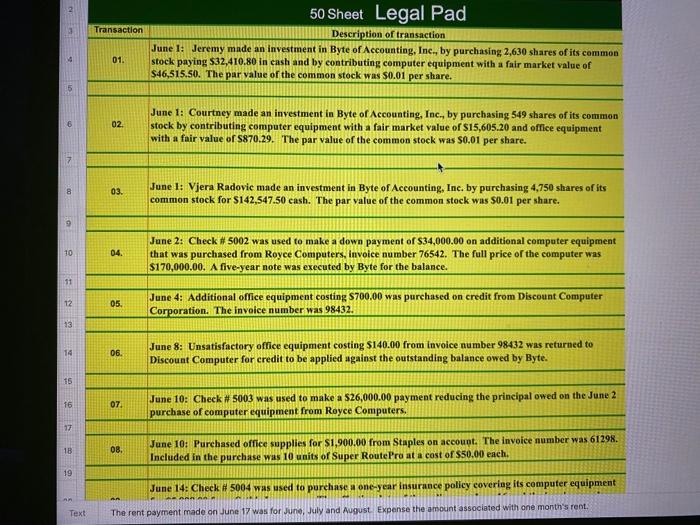

50 Sheet Legal Pad Transaction Description of transaction June 1: Jeremy made an investment in Byte of Accounting, Inc., by purchasing 2,630 shares of its common 01. stock paying $32,410.80 in cash and by contributing computer equipment with a fair market value of $46,515.50. The par value of the common stock was $0.01 per share. 02 June 1: Courtney made an investment in Byte of Accounting, Inc., by purchasing 549 shares of its common stock by contributing computer equipment with a fair market value of $15,605.20 and office equipment with a fair value of $870.29. The par value of the common stock was 0.01 per share. DO 03. June 1: Vjera Radovic made an investment in Byte of Accounting, Inc. by purchasing 4,750 shares of its common stock for $142,547.50 cash. The par value of the common stock was $0.01 per share. 10 04 June 2: Check # 5002 was used to make a down payment of S34,000.00 on additional computer equipment that was purchased from Royce Computers, Invoice number 76542. The full price of the computer was $170,000.00. A five-year note was executed by Byte for the balance. 11 12 05. June 4: Additional office equipment costing S700.00 was purchased on credit from Discount Computer Corporation. The invoice number was 98432. 13 14 06. June 8: Unsatisfactory office equipment costing $140.00 from invoice number 98432 was returned to Discount Computer for credit to be applied against the outstanding balance owed by Byte. 15 16 07 June 10: Check # 5003 was used to make a $26,000.00 payment reducing the principal owed on the June 2 purchase of computer equipment from Royce Computers. 17 18 08. June 10: Purchased office supplies for $1,900.00 from Staples on account. The invoice number was 61298. Included in the purchase was 10 units of Super Route Pro at a cost of $50.00 each. 19 June 14: Check #5004 was used to purchase a one-year insurance policy covering its computer equipment Text The rent payment made on June 17 was for June July and August Expense the amount associated with one month's rent ITE Transactions General Journal Bank Reconciliation Worksheet Chart Text Shape Media Content Income Statement Changes in Owners D 20 09 June 14: Check 5004 was used to purchase a one-year insurance policy covering its computer equipment for 55,808.00 from Seth's Insurance. The effective date of the policy was June 16 and the invoice number was 2387. 21 22 10. June 16: Checks in the amount of $7,580.00 was received for services performed for cash customers. 23 24 11. June 16: Byte purchased a building and the land it is on for $131,000.00 to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at $21,000.00. The balance of the cost is to be allocated to the building. Check # 5005 was used to make the down payment of $13,100.00 A thirty year mortgage with an inital payement due on August 1st, was established for the balance. 26 12. June 17: Check #5006 for $7,500.00 was paid for rent of the office space for June July and August 27 28 13. June 17: Received invoice number 26354 in the amount of $475,00 from the local newspaper for advertising. 29 30 14. June 21: Billed various miscellaneous local customers 54,100.00 for consulting services performed. a1 32 15. June 21: Check #5007 was used to purchase a fax machine for the office from Office Machines Express for S675.00. The invoice number was 975-328. 33 34 16. 35 June 21: Accounts payable in the amount of 5560.00 were paid with Check 5008. June 22: Check # 5009 was used to pay the advertising bill that was received on June 17. 17 32 18. June 22: Received a bill for $1.290.00 from Computer Parts and Repair Co, for repairs to the computer equipment. The invoice number was 43254 39 40 19 June 22: Check 5010 was used to pay salaries of S960.00 to equipment operators for the week ending June 18. Ignore payroll taxes. 41 20 June 23: Cash in the amount of $3,285,00 was received on billings. 43 Text The rent payment made on June 17 was for June, July and August Expense the amount asociated with one month's rent View 125% Zoom Transactions Ad Category General Journal Char! Bank Reconciation Worksheet Test SM Media Comment Income Statement Chain Donery A 16 21. June 23: Purchased office supplies for $950.00 from Staples on account. The invoice number was 65498 Included in the purchase was 10 units of Super RoutePro at a cost of 553.00 each. & B 22 June 28: Billed $6,225.00 to miscellaneous customers for services performed to June 25 42 da 40 23. June 29: Cash in the amount of 55,899.00 was received for billings 50 24 June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co with Check 5011. 51 62 25. June 29: Check w 5012 was used to pay salaries of S960.00 te equipment operators for the week ending June 25. Ignore payroll taxes. 54 26. June 30: Received a bill for the amount of $890.00 from O&Gol and Gas Ce. The invoice number was 784537 55 50 27 June 30: Check #5013 was used to pay for a cash dividend of S0.24 per share to Jeremy, a shareholder of Byte 2 58 28. June 30: Check #5014 was used to pay for a cash dividend of $0.24 per share to Vjera Radovica shareholder of Byte. 50 29. June 30: Check 5015 was used to pay for a cash dividend of 80.24 per share to Courtney, a shareholder of Byte 2 35 35 36 02 Adjusting Entries Round to two decimal places 03 30. The rent payment made on June 17 was for June July and August. Expense the amount associated with one month's rent. 07 31. A physical inventory showed that only $403.00 worth of general office supplies remained on hand as of June 30. This did not include any of the Super RoutePro. There were 5 units of Super RoutePro on hund. We use FIFO to determine the valuation of the supplies. 09 Finnsn the amount associated with one month's rent View 125% 200 Transactions Add Category General Journal EE Table Chari Tee Bank Reconciation Work Income ftatuent Changes in Owner's Equity O B 10 32 The annual interest rate on the mortgage payable was 8.25 percent. Interest expense for one-half month should be computed because the building and land were purchased and the liability incurred on June 16 71 72 73 33 Record a journal entry to reflect that one half month's Insurance has expired. 74 14 A review of Ryte's job worksheets show that there are unbilled revenues is the amount of $18.750 for the period of June 28-30, 75 75 79 35. The Building and the Office Equipment have the following estimated useful lives: Building - 31.5 years Office Equipment - 20 years BD Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's salvage value is $500.00. The office equipment has a salvage value of $300.00 Calculate the depreciation for one month using the straight-line method of depreciation 22 83 The Computer Equipment has an estimated useful life of 5.00 years. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The computer equipment's serap value is $20,000.00. Calculate the depreciation for one month using the double declining method of depreciation. M 36 85 00 37 A review of the payroll records show that unpaid salaries in the amount of 5576.00 are owed by Byte for three days, June 28 - 30. Ignore payroll taxes. The note payable to Royce Computers (transactions 04 and OT) is a five-year mote, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. 8 38 IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was S136,000.00. On June 10. eight days later, 526,000.00 was repald. Interest expense must be calculated on the S136,000.00 for eight days. In addition, interest expense on the $110,000.00 balance of the lous (5136,000.00 lens 526,000.00 - $110,000.00) must be calculated for the 20 days remaining in the month of June DO 11 The rent payment made on June 17 was for June July and August Expense the amount associated with one month's rent