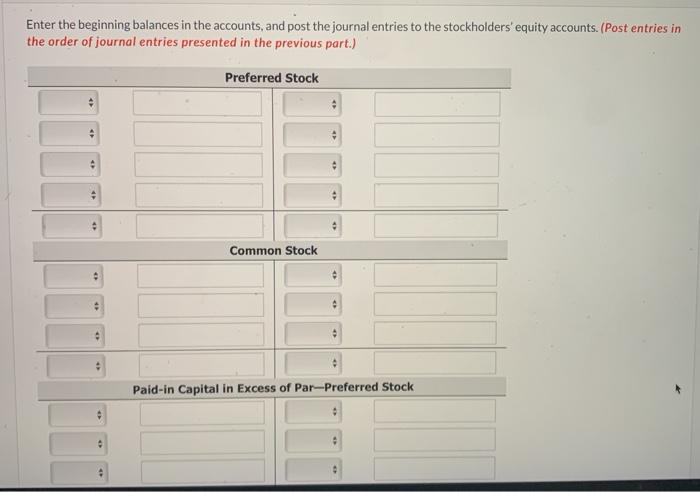

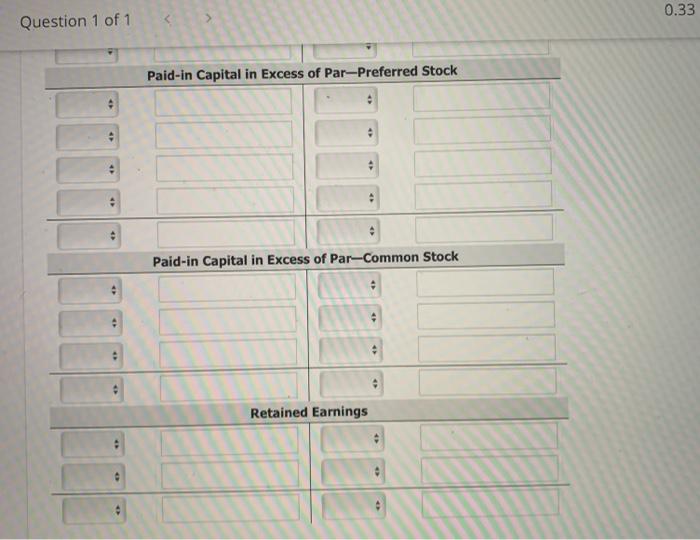

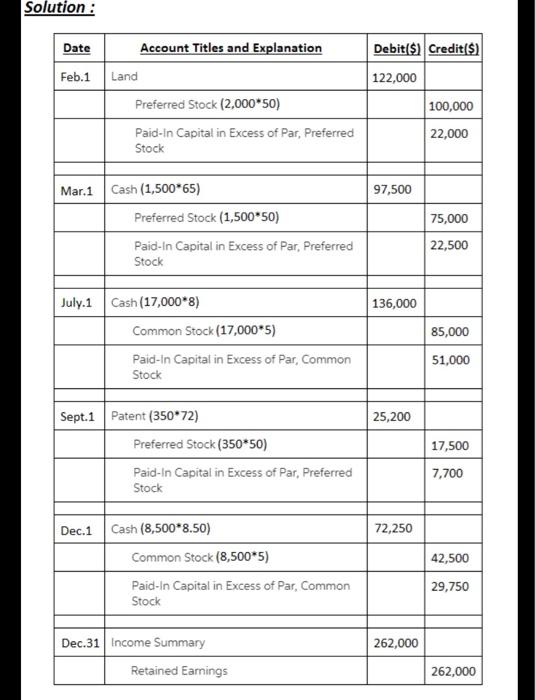

Enter the beginning balances in the accounts, and post the journal entries to the stockholders' equity accounts. (Post entries in the order of journal entries presented in the previous part.) Preferred Stock . . 4 Common Stock Paid-in Capital in Excess of Par-Preferred Stock 0.33 Question 1 of 1 Paid-in Capital in Excess of Par-Preferred Stock Paid-in Capital in Excess of Par-Common Stock Retained Earnings Solution : Date Debit($) Credit($) Feb.1 122,000 Account Titles and Explanation Land Preferred Stock (2,000*50) Paid-in Capital in Excess of Par, Preferred Stock 100,000 22,000 97,500 Mar.1 Cash (1,500*65) Preferred Stock (1,500*50) Paid-In Capital in Excess of Par, Preferred Stock 75,000 22,500 136,000 July 1 Cash (17,000*8) Common Stock (17,000*5) Paid-In Capital in Excess of Par, Common Stock 85,000 51,000 25,200 Sept.1 Patent (350*72) Preferred Stock (350*50) Paid-In Capital in Excess of Par, Preferred Stock 17,500 7,700 72,250 Dec.1 Cash (8,500*8.50) Common Stock (8,500*5) Paid-In Capital in Excess of Par, Common Stock 42,500 29,750 Dec.31 Income Summary 262,000 Retained Earnings 262,000 Enter the beginning balances in the accounts, and post the journal entries to the stockholders' equity accounts. (Post entries in the order of journal entries presented in the previous part.) Preferred Stock . . 4 Common Stock Paid-in Capital in Excess of Par-Preferred Stock 0.33 Question 1 of 1 Paid-in Capital in Excess of Par-Preferred Stock Paid-in Capital in Excess of Par-Common Stock Retained Earnings Solution : Date Debit($) Credit($) Feb.1 122,000 Account Titles and Explanation Land Preferred Stock (2,000*50) Paid-in Capital in Excess of Par, Preferred Stock 100,000 22,000 97,500 Mar.1 Cash (1,500*65) Preferred Stock (1,500*50) Paid-In Capital in Excess of Par, Preferred Stock 75,000 22,500 136,000 July 1 Cash (17,000*8) Common Stock (17,000*5) Paid-In Capital in Excess of Par, Common Stock 85,000 51,000 25,200 Sept.1 Patent (350*72) Preferred Stock (350*50) Paid-In Capital in Excess of Par, Preferred Stock 17,500 7,700 72,250 Dec.1 Cash (8,500*8.50) Common Stock (8,500*5) Paid-In Capital in Excess of Par, Common Stock 42,500 29,750 Dec.31 Income Summary 262,000 Retained Earnings 262,000