Answered step by step

Verified Expert Solution

Question

1 Approved Answer

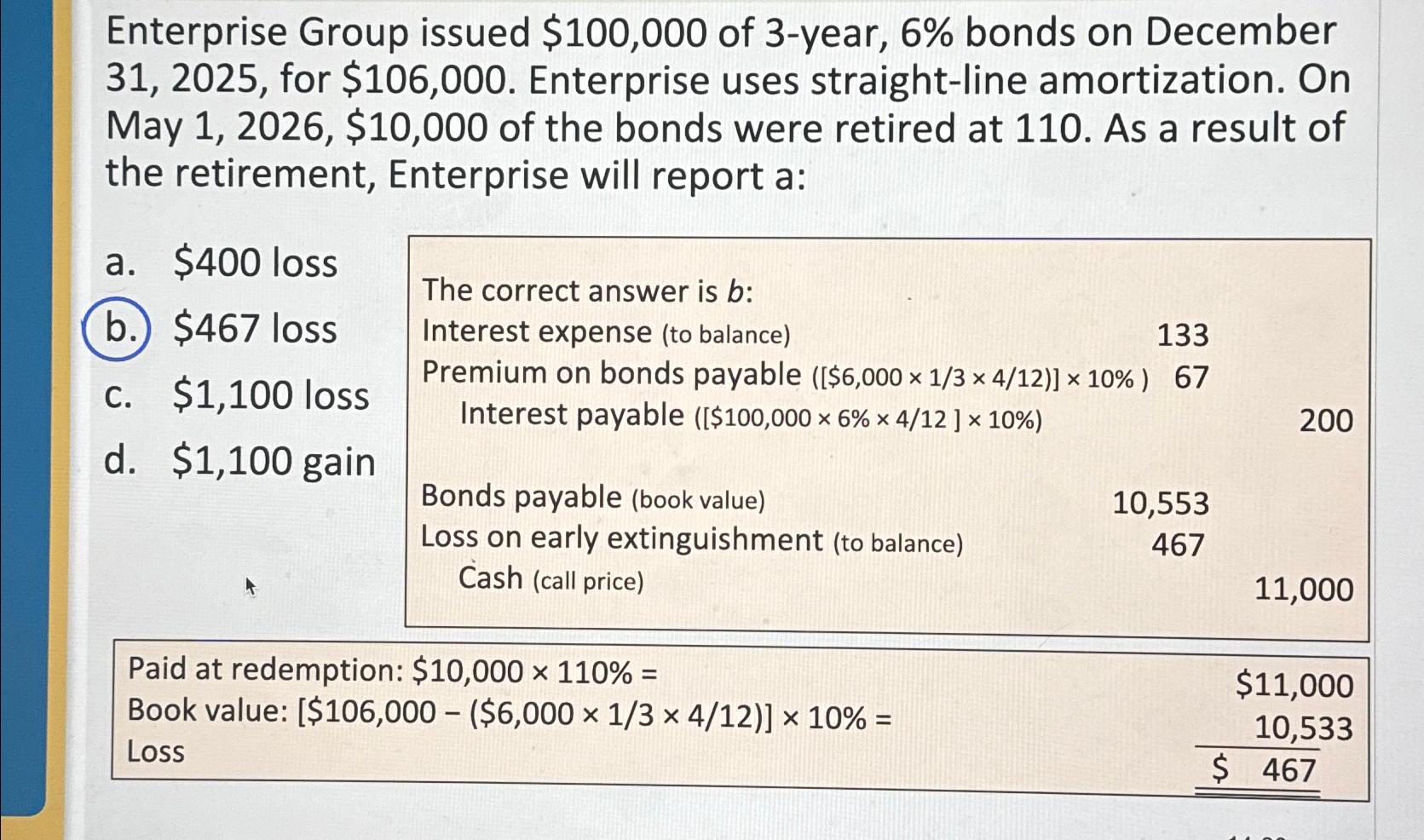

Enterprise Group issued $100,000 of 3-year, 6% bonds on December 31,2025 , for $106,000 . Enterprise uses straight-line amortization. On May 1,2026,$10,000 of the bonds

Enterprise Group issued

$100,000of 3-year,

6%bonds on December 31,2025 , for

$106,000. Enterprise uses straight-line amortization. On May

1,2026,$10,000of the bonds were retired at 110 . As a result of the retirement, Enterprise will report a:\ a.

$400loss\ b.

$467loss\ c.

$1,100loss\ The correct answer is

b:\ d.

$1,100gain Interest expense (to balance) 133 Premium on bonds payable

([$6,000\\\\times (1)/(3)\\\\times (4)/(12))]\\\\times 10%Interest payable

([$100,000\\\\times 6%\\\\times (4)/(12)]\\\\times 10%)\ Bonds payable (book value) 10,553\ Loss on early extinguishment (to balance)\ 467\ Cash (call price)\ 11,000\ Paid at redemption:

$10,000\\\\times 110%=\ Book value:

[$106,000-($6,000\\\\times (1)/(3)\\\\times (4)/(12))]\\\\times 10%=Loss\

$11,000\ 10,533\

$,467

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started