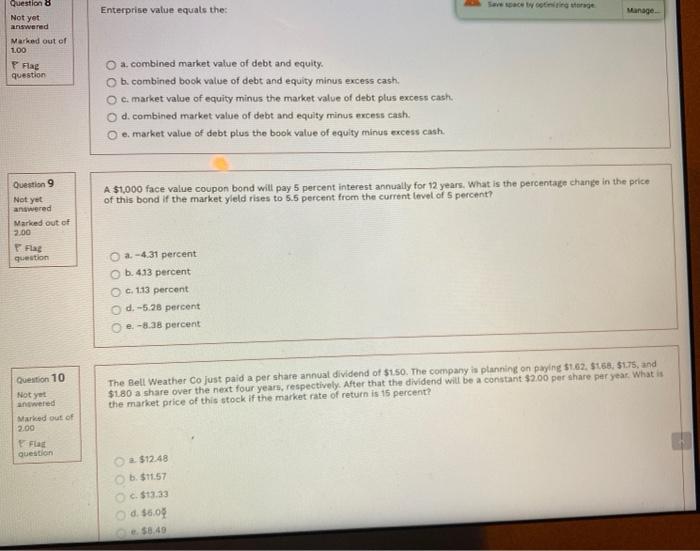

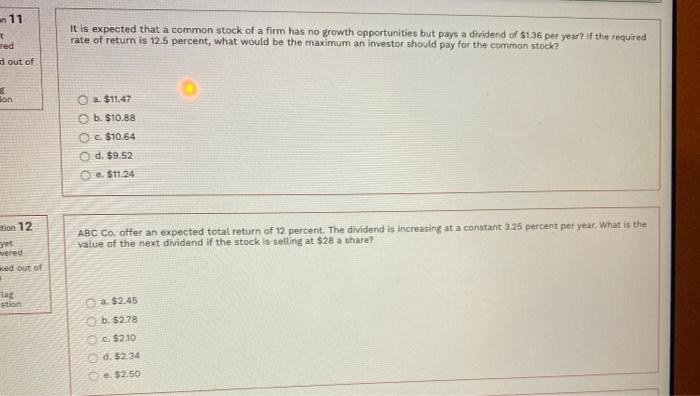

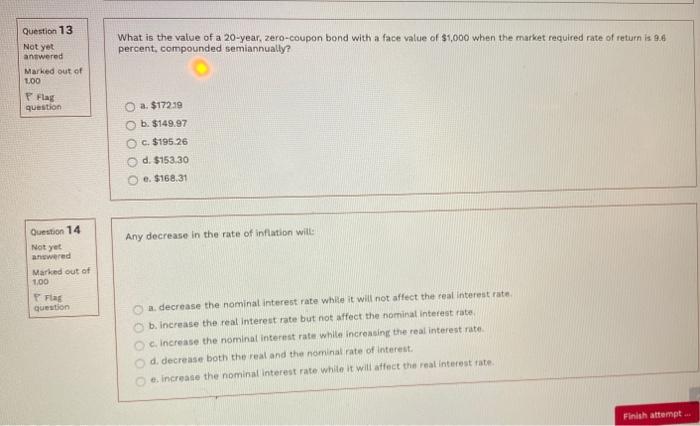

Enterprise value equals the: Manage Question 8 Not yet answered Marked out of 1.00 Flag question a combined market value of debt and equity. b.combined book value of debt and equity minus excess cash. c. market value of equity minus the market value of debt plus excess cash d. combined market value of debt and equity minus excess cash. e market value of debt plus the book value of equity minus excess cash. Question 9 Not yet answered Marked out of 2.00 A $1,000 face value coupon bond will pay 5 percent interest annually for 12 years. What is the percentage change in the price of this bond if the market yield rises to 5.5 percent from the current level of 5 percent? Flag question a.-4.31 percent b. 433 percent c. 1.13 percent d. -5.28 percent e.-8.38 percent The Bell Weather Co just paid a per share annual dividend of $150. The company is planning on paying $162. $168. $1.75, and $180 a share over the next four years, respectively. After that the dividend will be a constant $2.00 per share per year. What is the market price of this stock if the market rate of return is 15 percent? Question 10 Not yet wered Marked out of 2.00 Flag Question $12.48 b. $11:57 C$13.33 d. 56.09 $8.49 n 11 It is expected that a common stock of a firm has no growth opportunities but pays a dividend of $1.36 per year? if the required rate of retum is 12.5 percent, what would be the maximum an investor should pay for the common stock? sed out of lon a. $11.47 b. $10.88 c. $10.64 d. $9.52 e. $11.24 tion 12 ABC Co. offer an expected total return of 12 percent. The dividend is increasing at a constant 3.25 percent per year. What is the value of the next dividend if the stock is selling at $28 a share? yet wered ed out of stion a $2.45 b. $2.78 c. $2.10 d. $2.34 e. $2.50 Question 13 Not yet What is the value of a 20-year, zero-coupon bond with a face value of $1,000 when the market required rate of return is 9.6 percent, compounded semiannually? antwered Marked out of 1.00 Flas question a. $172:39 b. $149.97 O c. $195.26 d. $153.30 e. $168.31 Question 14 Any decrease in the rate of inflation will Not yet anwered Marked out of 100 Flas question a decrease the nominal interest rate while it will not affect the real interest rate b. Increase the real Interest rate but not affect the nominal interest rate Increase the nominal Interest rate while increasing the real interest rate d. decrease both the real and the nominal rate of interest . Increase the nominal interest rate while it will affect the real interest rate: Finish attempt