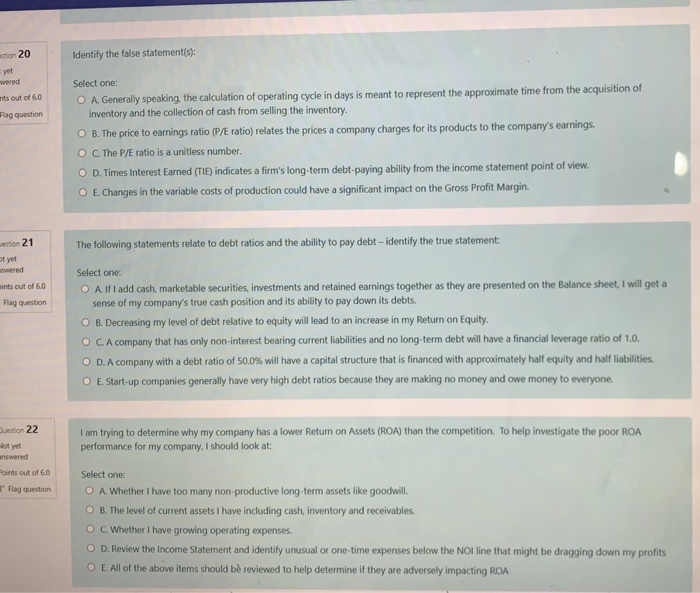

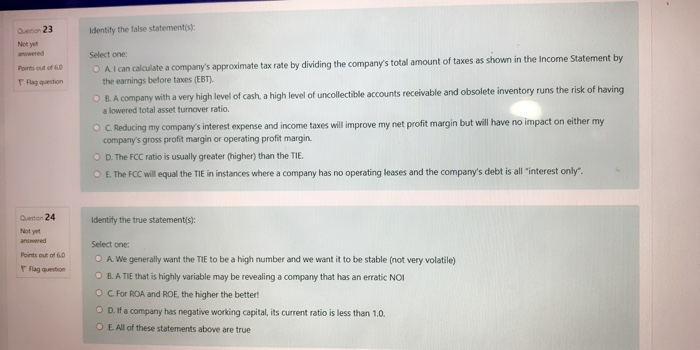

ention 20 Identify the false statement(s); yet Select one: nts out of 60 Flag question O A. Generally speaking the calculation of operating cycle in days is meant to represent the approximate time from the acquisition of inventory and the collection of cash from selling the inventory. O B. The price to earnings ratio (P/E ratio) relates the prices a company charges for its products to the company's earnings. O C. The P/E ratio is a unitless number. O D. Times Interest Earned (TIE) indicates a firm's long-term debt-paying ability from the income statement point of view. O E. Changes in the variable costs of production could have a significant impact on the Gross Profit Margin. ention 21 The following statements relate to debt ratios and the ability to pay debt - identify the true statement: ot yet wints out of 6.0 Flag question Select one: O Alfl add cash, marketable securities, investments and retained earnings together as they are presented on the Balance sheet, I will get a sense of my company's true cash position and its ability to pay down its debts. O B. Decreasing my level of debt relative to equity will lead to an increase in my Return on Equity. O C. A company that has only non-interest bearing current liabilities and no long-term debt will have a financial leverage ratio of 1.0. O D. A company with a debt ratio of 50.0% will have a capital structure that is financed with approximately half equity and half liabilities. O E. Start-up companies generally have very high debt ratios because they are making no money and owe money to everyone. Question 22 I am trying to determine why my company has a lower Return on Assets (ROA) than the competition. To help investigate the poor ROA performance for my company, I should look at: Not yet answered Points out of 6.0 Flag question Select one: O A. Whether I have too many non-productive long-term assets like goodwill. OB. The level of current assets I have including cash, inventory and receivables. O C. Whether I have growing operating expenses. O D. Review the income Statement and identify unusual or one-time expenses below the NOI line that might be dragging down my profits O E. All of the above items should be reviewed to help determine if they are adversely impacting ROA 23 Identify the false statements: Not yet Points out of F Flag question Select one: O A I can calculate a company's approximate tax rate by dividing the company's total amount of taxes as shown in the Income Statement by the earnings before taxes (EBT). B. A company with a very high level of cash, a high level of uncollectible accounts receivable and obsolete inventory runs the risk of having a lowered total asset turnover ratio. O C. Reducing my company's interest expense and income taxes will improve my net profit margin but will have no impact on either my company's gross profit margin or operating profit margin D. The FCC ratio is usually greater (higher than the TIE. E The FCC will equal the Tie in instances where a company has no operating leases and the company's debt is all interest only". Identify the true statement(s); Quer 24 Not yet arred Points out of 6.0 Flag question Select one: O A We generally want the TIE to be a high number and we want it to be stable (not very volatile) OB. A TIE that is highly variable may be revealing a company that has an erratic NOI O C For RCA and ROE, the higher the better! OD. If a company has negative working capital, its current ratio is less than 1.0. O E. All of these statements above are true