Question

Entity A is a listed company in Hong Kong and the end of the reporting period is on 31 December. On 31 December 2020, the

Entity A is a listed company in Hong Kong and the end of the reporting period is on 31 December.

On 31 December 2020, the balances of Deferred tax liability and Deferred tax asset were $256,000 and $125,400 respectively.

In order to improve the financial stability of the local government, on 28 February 2021, the local government announced that the profits tax rate was increased from 20% to 35% which is effective from 1 Jan 2021.

REQUIRED:

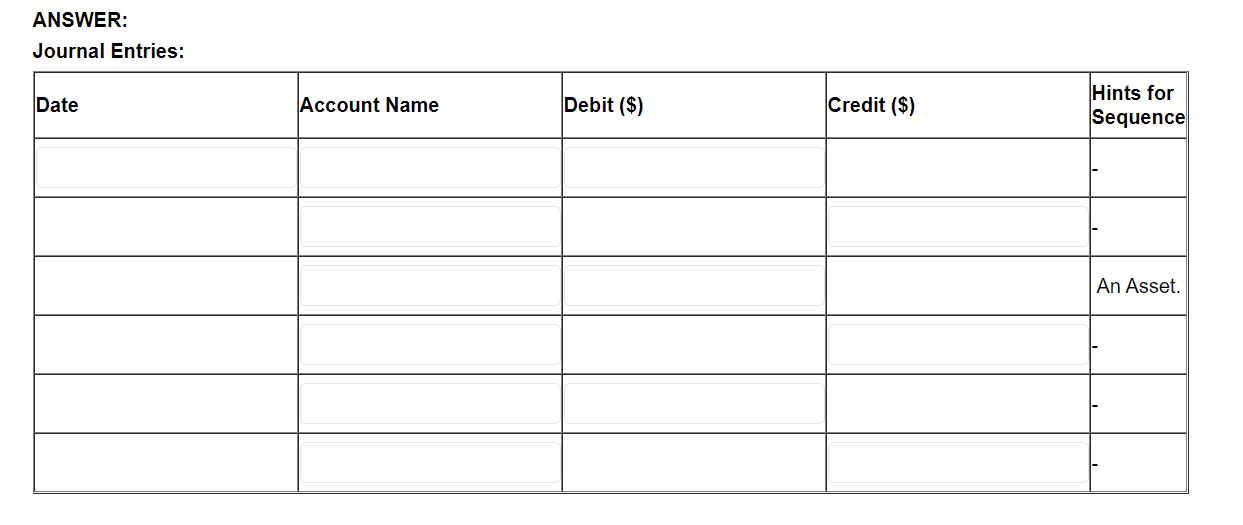

Prepare journal entries to recognise the change in the profits tax rate for the year 2021 on an appropriate date.

DATES FOR INPUT:

| 31 Dec 2020 | 1 Jan 2021 | 28 Feb 2021 | 31 Dec 2021 | Any date |

ACCOUNTS FOR INPUT:

| Current tax liability | Income tax expense | Deferred tax asset | Deferred tax liability |

| Over-provision of tax | Under-provision of tax | Bank | Retained earnings |

| Revaluation reserve | No entry |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started