Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Entity A is a listed company in Hong Kong for more than fifty years. It sells products of food and beverage. The business of

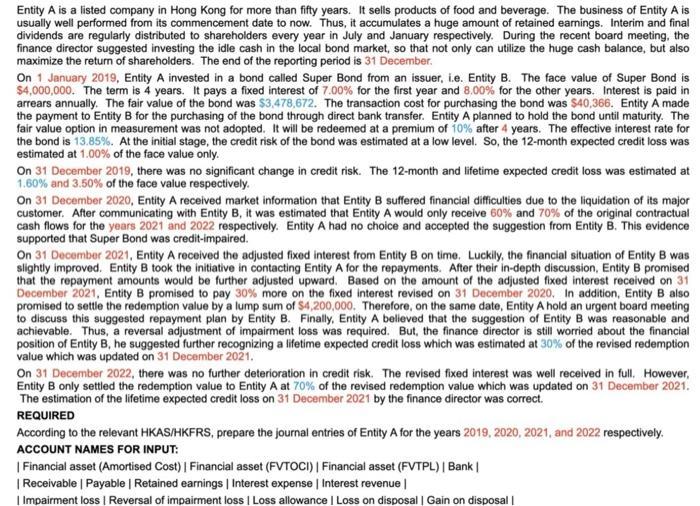

Entity A is a listed company in Hong Kong for more than fifty years. It sells products of food and beverage. The business of Entity A is usually well performed from its commencement date to now. Thus, it accumulates a huge amount of retained earnings. Interim and final dividends are regularly distributed to shareholders every year in July and January respectively. During the recent board meeting, the finance director suggested investing the idle cash in the local bond market, so that not only can utilize the huge cash balance, but also maximize the return of shareholders. The end of the reporting period is 31 December. On 1 January 2019, Entity A invested in a bond called Super Bond from an issuer, i.e. Entity B. The face value of Super Bond is $4,000,000. The term is 4 years. It pays a fixed interest of 7.00% for the first year and 8.00% for the other years. Interest is paid in arrears annually. The fair value of the bond was $3,478,672. The transaction cost for purchasing the bond was $40,366. Entity A made the payment to Entity B for the purchasing of the bond through direct bank transfer. Entity A planned to hold the bond until maturity. The fair value option in measurement was not adopted. It will be redeemed at a premium of 10 % after 4 years. The effective interest rate for the bond is 13.85%. At the initial stage, the credit risk of the bond was estimated at a low level. So, the 12-month expected credit loss was estimated at 1.00% of the face value only. On 31 December 2019, there was no significant change in credit risk. The 12-month and lifetime expected credit loss was estimated at 1.60% and 3.50% of the face value respectively. On 31 December 2020, Entity A received market information that Entity B suffered financial difficulties due to the liquidation of its major customer. After communicating with Entity B, it was estimated that Entity A would only receive 60% and 70% of the original contractual cash flows for the years 2021 and 2022 respectively. Entity A had no choice and accepted the suggestion from Entity B. This evidence supported that Super Bond was credit-impaired. On 31 December 2021, Entity A received the adjusted fixed interest from Entity B on time. Luckily, the financial situation of Entity B was slightly improved. Entity B took the initiative in contacting Entity A for the repayments. After their in-depth discussion, Entity B promised that the repayment amounts would be further adjusted upward. Based on the amount of the adjusted fixed interest received on 31 December 2021, Entity B promised to pay 30% more on the fixed interest revised on 31 December 2020. In addition, Entity B also promised to settle the redemption value by a lump sum of $4,200,000. Therefore, on the same date, Entity A hold an urgent board meeting to discuss this suggested repayment plan by Entity B. Finally, Entity A believed that the suggestion of Entity B was reasonable and achievable. Thus, a reversal adjustment of impairment loss was required. But, the finance director is still worried about the financial position of Entity B, he suggested further recognizing a lifetime expected credit loss which was estimated at 30% of the revised redemption value which was updated on 31 December 2021. On 31 December 2022, there was no further deterioration in credit risk. The revised fixed interest was well received in full. However, Entity B only settled the redemption value to Entity A at 70% of the revised redemption value which was updated on 31 December 2021. The estimation of the lifetime expected credit loss on 31 December 2021 by the finance director was correct. REQUIRED According to the relevant HKAS/HKFRS, prepare the journal entries of Entity A for the years 2019, 2020, 2021, and 2022 respectively. ACCOUNT NAMES FOR INPUT: | Financial asset (Amortised Cost) | Financial asset (FVTOCI) | Financial asset (FVTPL) | Bank | | Receivable | Payable | Retained earnings | Interest expense | Interest revenue | |Impairment loss | Reversal of impairment loss | Loss allowance | Loss on disposal | Gain on disposal |

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Solution Here are the journal entries for Entity A for the years 2019 2020 2021 and 2022 2019 1 Fina...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started