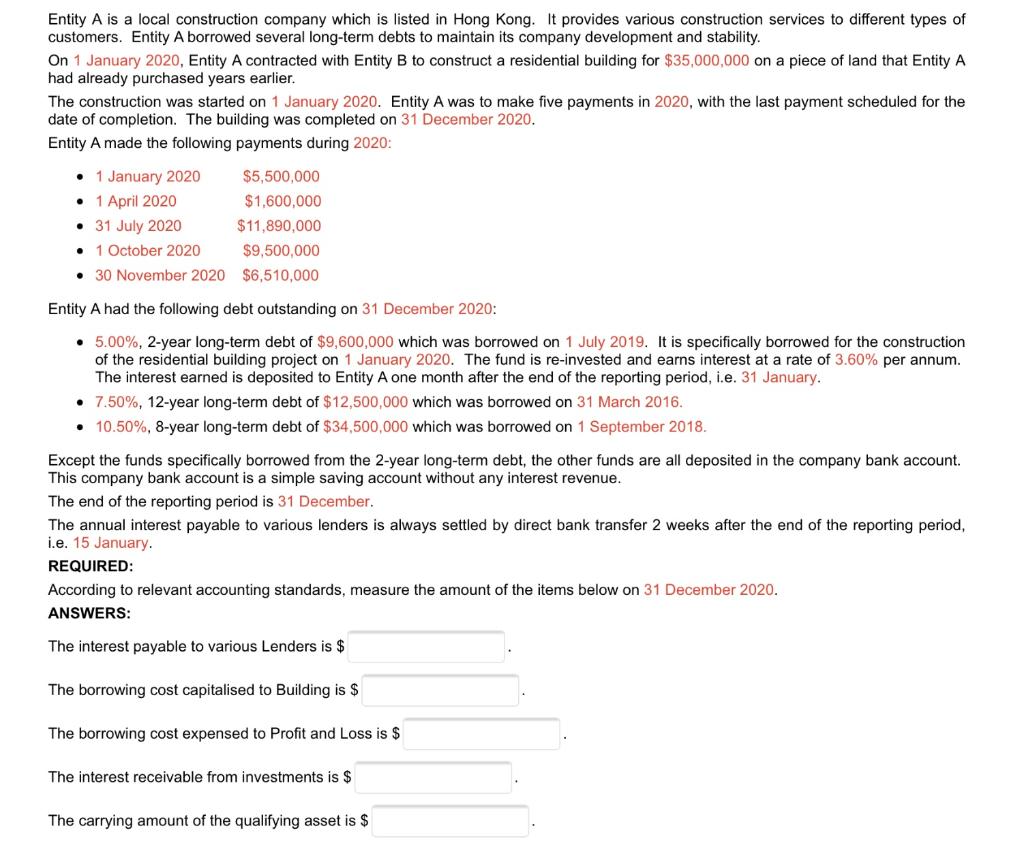

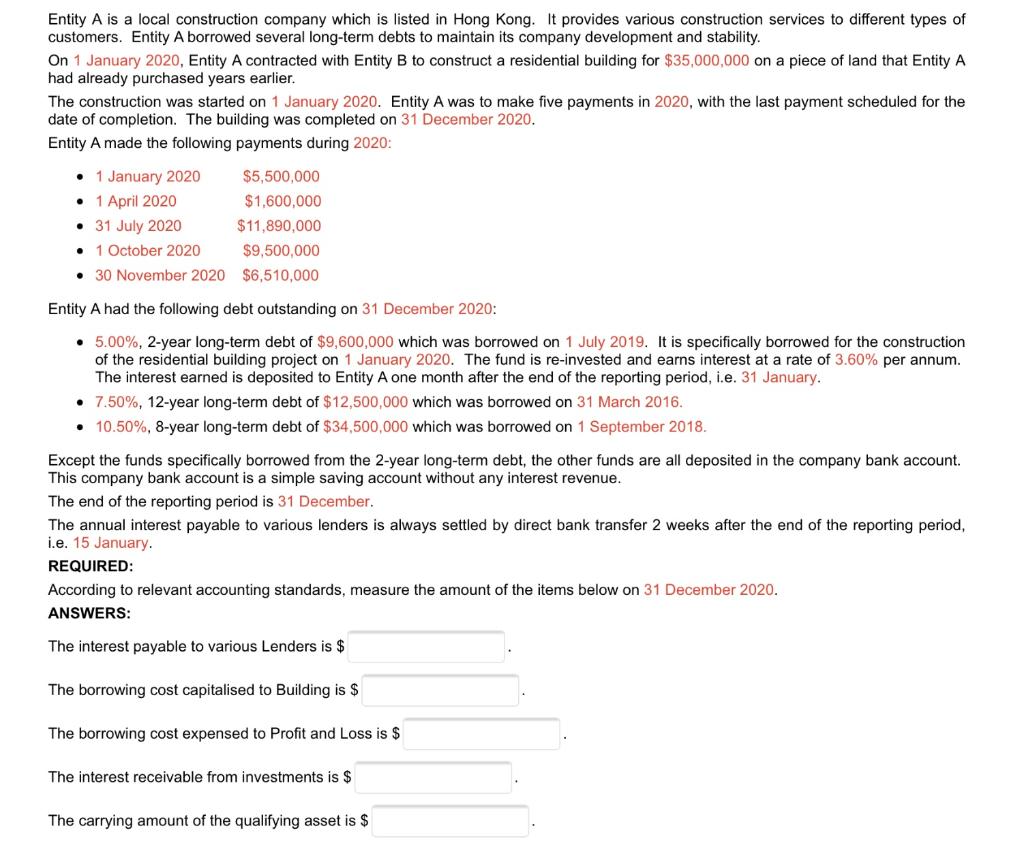

Entity A is a local construction company which is listed in Hong Kong. It provides various construction services to different types of customers. Entity A borrowed several long-term debts to maintain its company development and stability. On 1 January 2020, Entity A contracted with Entity B to construct a residential building for $35,000,000 on a piece of land that Entity A had already purchased years earlier. The construction was started on 1 January 2020. Entity A was to make five payments in 2020, with the last payment scheduled for the date of completion. The building was completed on 31 December 2020. Entity A made the following payments during 2020: 1 January 2020 $5,500,000 . 1 April 2020 $1,600,000 31 July 2020 $11,890,000 1 October 2020 $9,500,000 30 November 2020 $6,510,000 . Entity A had the following debt outstanding on 31 December 2020: 5.00%, 2-year long-term debt of $9,600,000 which was borrowed on 1 July 2019. It is specifically borrowed for the construction of the residential building project on 1 January 2020. The fund is re-invested and earns interest at a rate of 3.60% per annum. The interest earned is deposited to Entity A one month after the end of the reporting period, i.e. 31 January. 7.50%, 12-year long-term debt of $12,500,000 which was borrowed on 31 March 2016. 10.50%, 8-year long-term debt of $34,500,000 which was borrowed on 1 September 2018 Except the funds specifically borrowed from the 2-year long-term debt, the other funds are all deposited in the company bank account. This company bank account is a simple saving account without any interest revenue. The end of the reporting period is 31 December. The annual interest payable to various lenders is always settled by direct bank transfer 2 weeks after the end of the reporting period, i.e. 15 January REQUIRED: According to relevant accounting standards, measure the amount of the items below on 31 December 2020. ANSWERS: The interest payable to various Lenders is $ The borrowing cost capitalised to Building is $ The borrowing cost expensed to Profit and Loss is $ The interest receivable from investments is $ The carrying amount of the qualifying asset is $