Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Entity A is a mobile phone producer listed in Hong Kong. It produces different types of mobile phones for various customers. To prepare for the

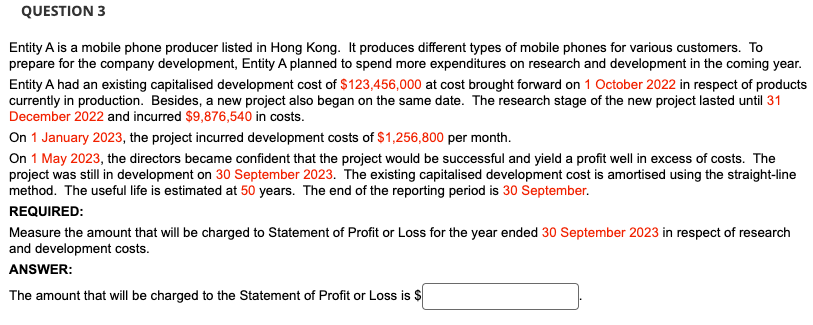

Entity A is a mobile phone producer listed in Hong Kong. It produces different types of mobile phones for various customers. To prepare for the company development, Entity A planned to spend more expenditures on research and development in the coming year. Entity A had an existing capitalised development cost of $123,456,000 at cost brought forward on 1 October 2022 in respect of products currently in production. Besides, a new project also began on the same date. The research stage of the new project lasted until 31 December 2022 and incurred $9,876,540 in costs. On 1 January 2023, the project incurred development costs of $1,256,800 per month. On 1 May 2023, the directors became confident that the project would be successful and yield a profit well in excess of costs. The project was still in development on 30 September 2023. The existing capitalised development cost is amortised using the straight-line method. The useful life is estimated at 50 years. The end of the reporting period is 30 September. REQUIRED: Measure the amount that will be charged to Statement of Profit or Loss for the year ended 30 September 2023 in respect of research and development costs. ANSWER: The amount that will be charged to the Statement of Profit or Loss is $

Entity A is a mobile phone producer listed in Hong Kong. It produces different types of mobile phones for various customers. To prepare for the company development, Entity A planned to spend more expenditures on research and development in the coming year. Entity A had an existing capitalised development cost of $123,456,000 at cost brought forward on 1 October 2022 in respect of products currently in production. Besides, a new project also began on the same date. The research stage of the new project lasted until 31 December 2022 and incurred $9,876,540 in costs. On 1 January 2023, the project incurred development costs of $1,256,800 per month. On 1 May 2023, the directors became confident that the project would be successful and yield a profit well in excess of costs. The project was still in development on 30 September 2023. The existing capitalised development cost is amortised using the straight-line method. The useful life is estimated at 50 years. The end of the reporting period is 30 September. REQUIRED: Measure the amount that will be charged to Statement of Profit or Loss for the year ended 30 September 2023 in respect of research and development costs. ANSWER: The amount that will be charged to the Statement of Profit or Loss is $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started