Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Entrepreneurship and financial management 1. On 1st June 2022, BabaYaga decided to open up a sole proprietorship with the following items; Cash RM4900; Inventories RM3700;

Entrepreneurship and financial management

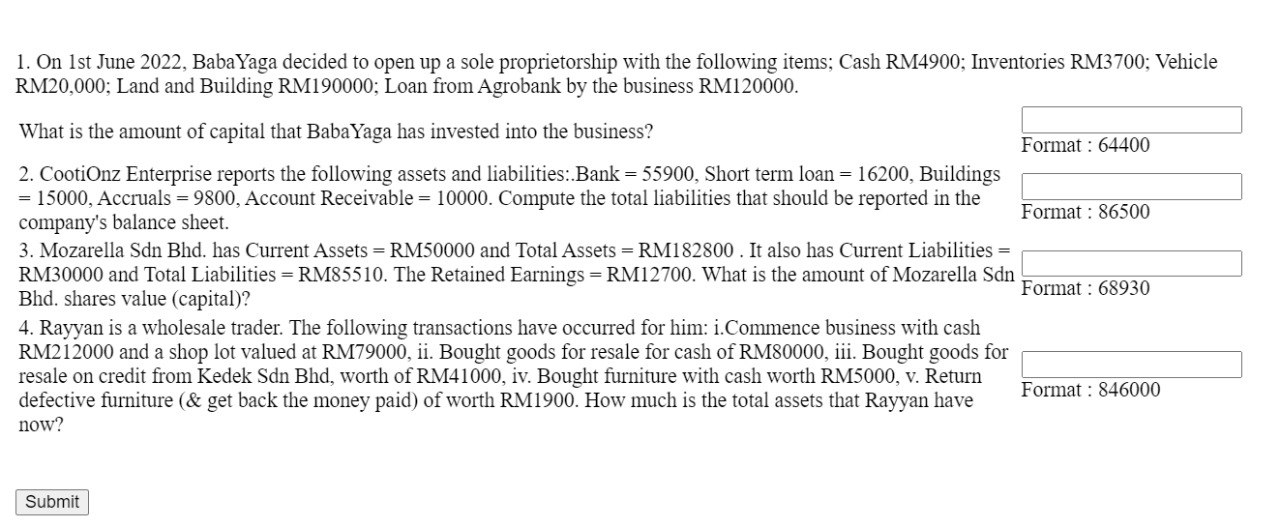

1. On 1st June 2022, BabaYaga decided to open up a sole proprietorship with the following items; Cash RM4900; Inventories RM3700; Vehicle RM20,000; Land and Building RM190000; Loan from Agrobank by the business RM120000. What is the amount of capital that BabaYaga has invested into the business? Format : 64400 2. CootiOnz Enterprise reports the following assets and liabilities:. Bank =55900, Short term loan =16200, Buildings =15000, Accruals =9800, Account Receivable =10000. Compute the total liabilities that should be reported in the company's balance sheet. 3. Mozarella Sdn Bhd. has Current Assets = RM50000 and Total Assets = RM182800 . It also has Current Liabilities = RM30000 and Total Liabilities = RM85510. The Retained Earnings = RM12700. What is the amount of Mozarella Sdn Bhd. shares value (capital)? Format : 86500 4. Rayyan is a wholesale trader. The following transactions have occurred for him: i.Commence business with cash RM212000 and a shop lot valued at RM79000, ii. Bought goods for resale for cash of RM80000, iii. Bought goods for resale on credit from Kedek Sdn Bhd, worth of RM41000, iv. Bought furniture with cash worth RM5000, v. Return defective furniture (\& get back the money paid) of worth RM1900. How much is the total assets that Rayyan have Format : 846000 now

1. On 1st June 2022, BabaYaga decided to open up a sole proprietorship with the following items; Cash RM4900; Inventories RM3700; Vehicle RM20,000; Land and Building RM190000; Loan from Agrobank by the business RM120000. What is the amount of capital that BabaYaga has invested into the business? Format : 64400 2. CootiOnz Enterprise reports the following assets and liabilities:. Bank =55900, Short term loan =16200, Buildings =15000, Accruals =9800, Account Receivable =10000. Compute the total liabilities that should be reported in the company's balance sheet. 3. Mozarella Sdn Bhd. has Current Assets = RM50000 and Total Assets = RM182800 . It also has Current Liabilities = RM30000 and Total Liabilities = RM85510. The Retained Earnings = RM12700. What is the amount of Mozarella Sdn Bhd. shares value (capital)? Format : 86500 4. Rayyan is a wholesale trader. The following transactions have occurred for him: i.Commence business with cash RM212000 and a shop lot valued at RM79000, ii. Bought goods for resale for cash of RM80000, iii. Bought goods for resale on credit from Kedek Sdn Bhd, worth of RM41000, iv. Bought furniture with cash worth RM5000, v. Return defective furniture (\& get back the money paid) of worth RM1900. How much is the total assets that Rayyan have Format : 846000 now Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started