Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Entrereneur i is endowed with a risky business project. The project requires investing 1 and generates stochastic revenue 1 + R(0), which is distributed

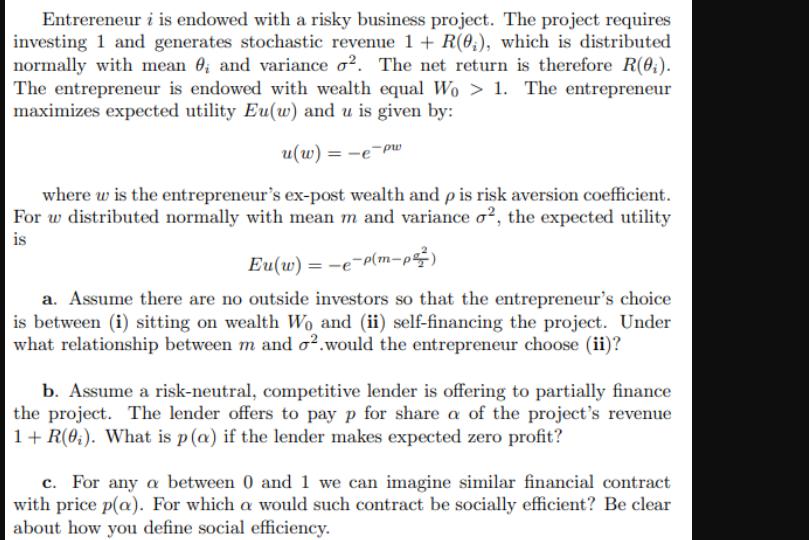

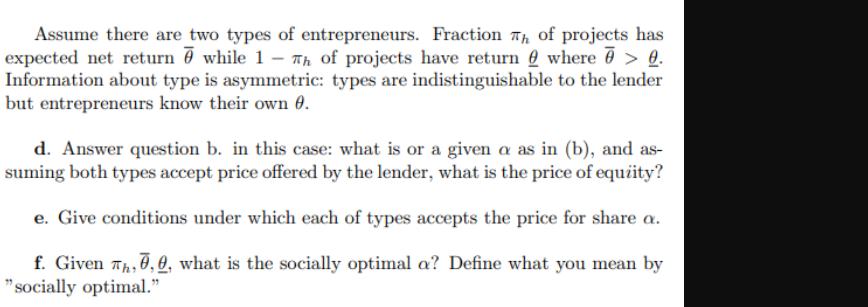

Entrereneur i is endowed with a risky business project. The project requires investing 1 and generates stochastic revenue 1 + R(0), which is distributed normally with mean 0, and variance o2. The net return is therefore R(0). The entrepreneur is endowed with wealth equal Wo> 1. The entrepreneur maximizes expected utility Eu(w) and u is given by: u(w) = -epw where w is the entrepreneur's ex-post wealth and p is risk aversion coefficient. For w distributed normally with mean m and variance o2, the expected utility is Eu(w)=-e-p(m-p) a. Assume there are no outside investors so that the entrepreneur's choice is between (i) sitting on wealth Wo and (ii) self-financing the project. Under what relationship between m and o2.would the entrepreneur choose (ii)? b. Assume a risk-neutral, competitive lender is offering to partially finance the project. The lender offers to pay p for share a of the project's revenue 1+R(0). What is p (a) if the lender makes expected zero profit? c. For any a between 0 and 1 we can imagine similar financial contract with price p(a). For which a would such contract be socially efficient? Be clear about how you define social efficiency. Assume there are two types of entrepreneurs. Fraction of projects has expected net return while 1 - Th of projects have return where > 0. Information about type is asymmetric: types are indistinguishable to the lender but entrepreneurs know their own 0. d. Answer question b. in this case: what is or a given a as in (b), and as- suming both types accept price offered by the lender, what is the price of equiity? e. Give conditions under which each of types accepts the price for share a. f. Given Th, 0, 0, what is the socially optimal a? Define what you mean by "socially optimal."

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a To determine when the entrepreneur would choose to selffinance the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started