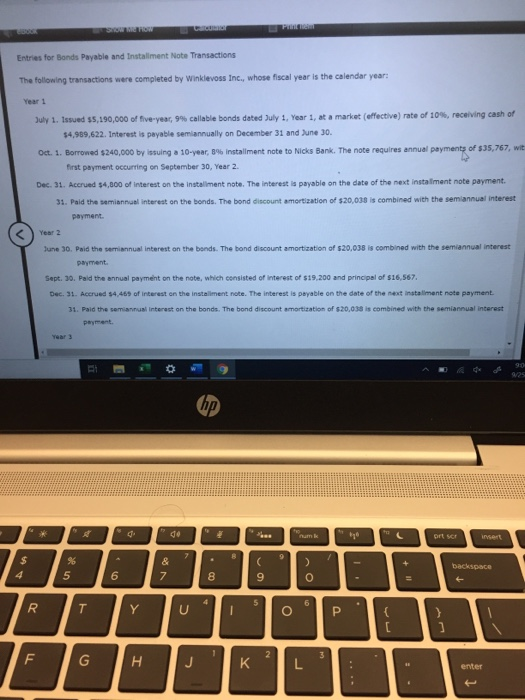

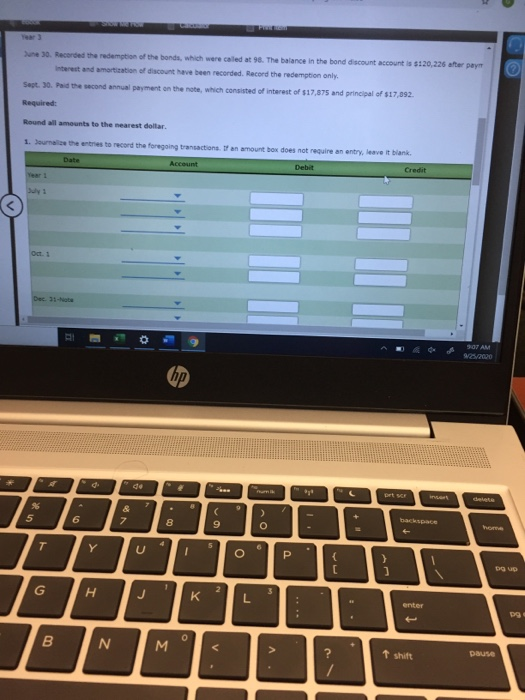

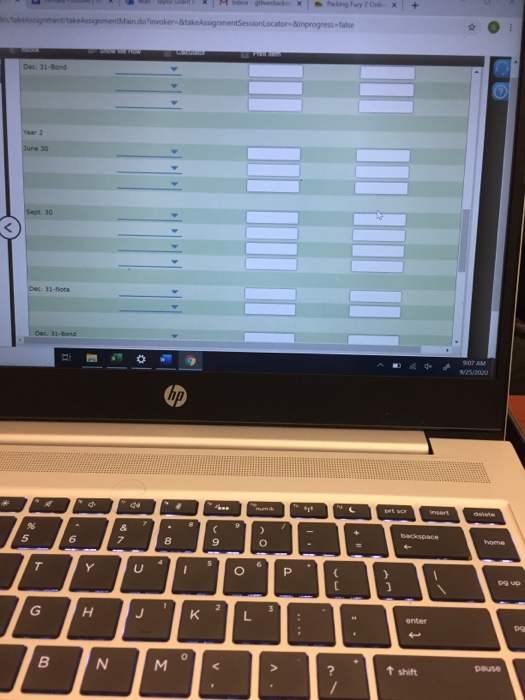

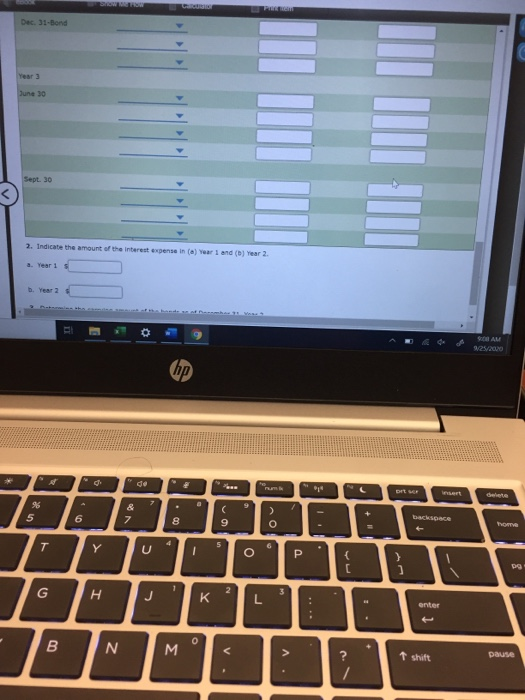

Entries for Bonds Payable and installment Note Transactions The following transactions were completed by Winklevoss Inc., whose fiscal year is the calendar year: Year 1 payments July 1. Issued $5,190,000 of five-year, 9% cailable bonds dated July 1, Year 1, at a market (effective) rate of 10%, receiving cash of $4,989,622. Interest is payable semiannually on December 31 and June 30. Oct. 1. Borrowed $240,000 by issuing a 10-year, 8% installment note to Nicks Bank. The note requires annual payments of $35,767, wit first payment occurring on September 30, Year 2. Dec. 31. Accrued $4,000 of interest on the installment note. The interest is payable on the date of the next installment note payment. 31. Paid the manual interest on the bonds. The bond discount amortization of $20,038 is combined with the semiannual interest payment Year 2 June 30. Paid the semiannual interest on the bonds. The band discount amortization of $20.038 is combined with the semiannual interest payment Sept. 30. Paid the annual payment on the note, which consisted of interest of $19.200 and principal of $16,567. Dec. 31. Accrued 94.469 of interest on the installment note. The interest is payable on the date of the next installment note payment. 31. Paid the semiannus Interest on the bonds. The bond discount amortization of $20,038 is combined with the semiannual interest payment Years 90 925 ho * C OSO insert 7 $ 4 & 7 ) 0 backspace 5 6 8 9 5 R T Y U I O P [ ] F 2 H G 3 J enter Dne 30. Recorded the redemption of the bonds, which were caled at 98. The balance in the band discount account is $120,226 after pay Interest and amortization of discount have been recorded. Record the redemption only Sept. 30. Pad the second annual payment on the note, which consisted of interest of $17,875 and principal of $17,092. Required: Round all amounts to the nearest dollar 1. Journal the tries to record the foregoing transactions. If an amount box does not require an entry leave it blank. Account Debit Credit Year July Oct 1 Dec 11 habe 30 AM N/2020 hp . nun 7 . 5 & 7 8 9 O T Y 5 6 1 O P [ ) ] Dup G H 1 2 J 3 enter DO B N. . ? t shift pause Moto X Parking luy 2 X ment/sigmentando invoker-takeAssignmentSessionLocatorinprogress-false Dec. 31-Bond June 30 Sept. 30 Dec 11-habe Dat 31-Bond 07 AM hop . BESC insert anlate 7 % 5 6 7 C 9 ) O 8 home T Y 5 U O { [ } ] DOUD G 2 H 3 J K enter DO B N M A > ? t shift pause 1 Dec 31-Bond Year June 30 Sept. 30 2. Indicate the amount of the interestegensein (a) Year 1 and (b) Year 2 a. Year 1 b. Year 2 12/20 hp Dit ( 1 + 5 & 7 6 8 ) o backspace home 7 pause t shift V. 2. Indicate the amount of the interest expense in (a) Year 1 and (b) Year 2. a. Year 1 b. Year 2 3. Determine the carrying amount of the bonds as of December 31, Year 2. hp * To nunk 9110 7 8 9 5 6 & 7 00 ( 9 > o T Y 5 U O { [ I N J 3 K L B N M ? t shift pause Moto X Parking luy 2 X ment/sigmentando invoker-takeAssignmentSessionLocatorinprogress-false Dec. 31-Bond June 30 Sept. 30 Dec 11-habe Dat 31-Bond 07 AM hop . BESC insert anlate 7 % 5 6 7 C 9 ) O 8 home T Y 5 U O { [ } ] DOUD G 2 H 3 J K enter DO B N M A > ? t shift pause 1 Dec 31-Bond Year June 30 Sept. 30 2. Indicate the amount of the interestegensein (a) Year 1 and (b) Year 2 a. Year 1 b. Year 2 12/20 hp Dit ( 1 + 5 & 7 6 8 ) o backspace home 7 pause t shift V. 2. Indicate the amount of the interest expense in (a) Year 1 and (b) Year 2. a. Year 1 b. Year 2 3. Determine the carrying amount of the bonds as of December 31, Year 2. hp * To nunk 9110 7 8 9 5 6 & 7 00 ( 9 > o T Y 5 U O { [ I N J 3 K L B N M