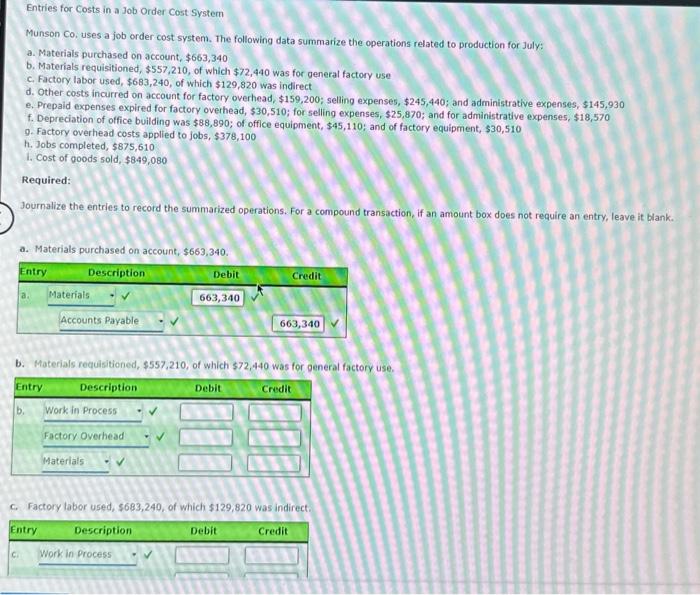

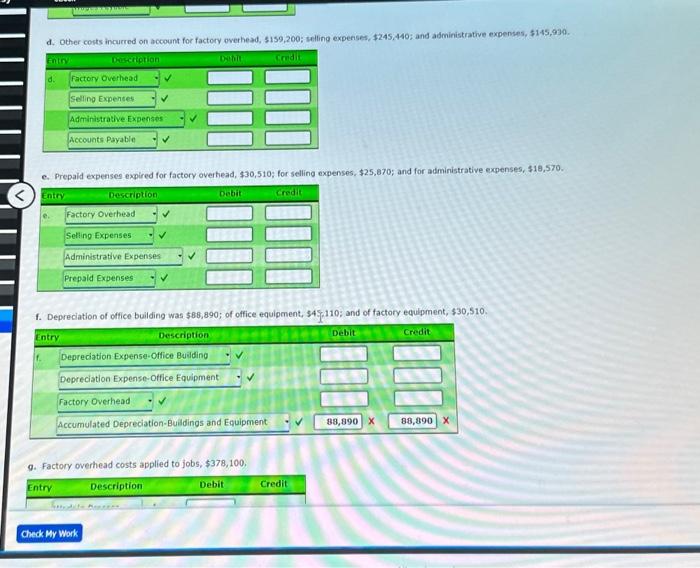

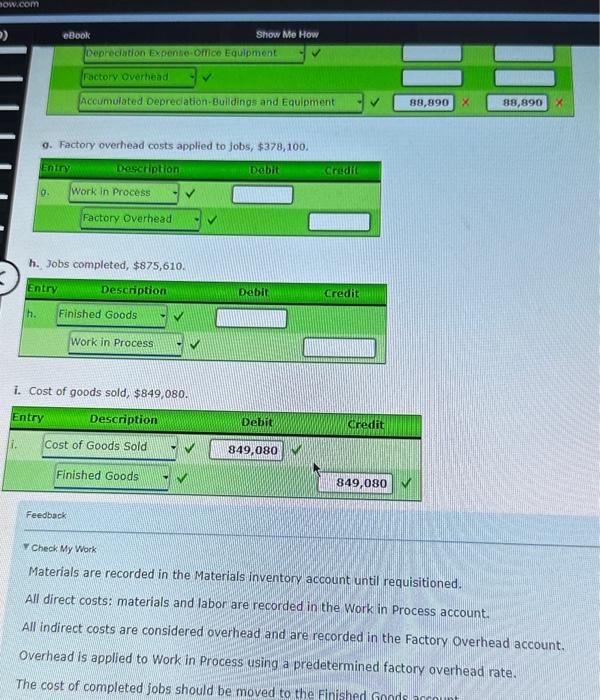

Entries for Costs in a Job Order Cost System Munson Co, uses a job order cost system. The following data summarize the operations related to production for July: a. Materials purchased on account, $663,340 b. Materials requisitioned, $557,210, of which $72,440 was for general factory use c. Factory labor used, $683,240, of which $129,820 was indirect d. Other costs incurred on account for factory overhead, $159,200; seling expenses, $245,440; and administrative expenses, $145,930 e. Prepaid expenses expired for factory overhead, $30,510; for selling expenses, $25,870; and for administrative expenses, $18,570 f. Depreciation of office building was $88,890; of offlce equipment, $45,110; and of factory equipment, $30,510 9. Factory overhead costs applied to jobs, $378,100 h. Jobs completed, $875,610 1. Cost of goods sold, $849,080 Required: Journalize the entries to record the summarized operations. For a compound transaction, if an amount box does not require an entry, leave it blan a. Materials purchased on account, $663,340. b. Materials requisitioned, $557,210, of which $72,440 was for general factory use. c. Factory tabor used, $683,240, of which $129,820 was indirect. d. Other costs incurred on account for factory owerhead, 5159,200 ; selling expenses, $245,440; and administrative expenses, $145,930. e. Prepaid expenses expired for factory overhead, $30,510; for selling expenses, $25,870; and for administrative expenses, $18,570. f. Depreciation of office building was $88,890; of office equipment, $45,110; and of factory equipment, $30,510. g. Factory overhead costs applied to jobs, $378,100, o. Factory overhead costs applied to jobs, $378,100. h. Jobs completed, $875,610. i. Cost of goods sold, $849,080. Feedback Theck Wy Work Materials are recorded in the Materials inventory account until requisitioned. All direct costs: materials and labor are recorded in the Work in Process account. All indirect costs are considered overhead and are recorded in the Factory Overhead account. Overhead is applied to Work in Process using a predetermined factory overhead rate. The cost of completed jobs should be moved to the