Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Entries for Costs in Job Order Costing Royal Technology Company uses job order costing. The following data summarize the operations related to production for March:

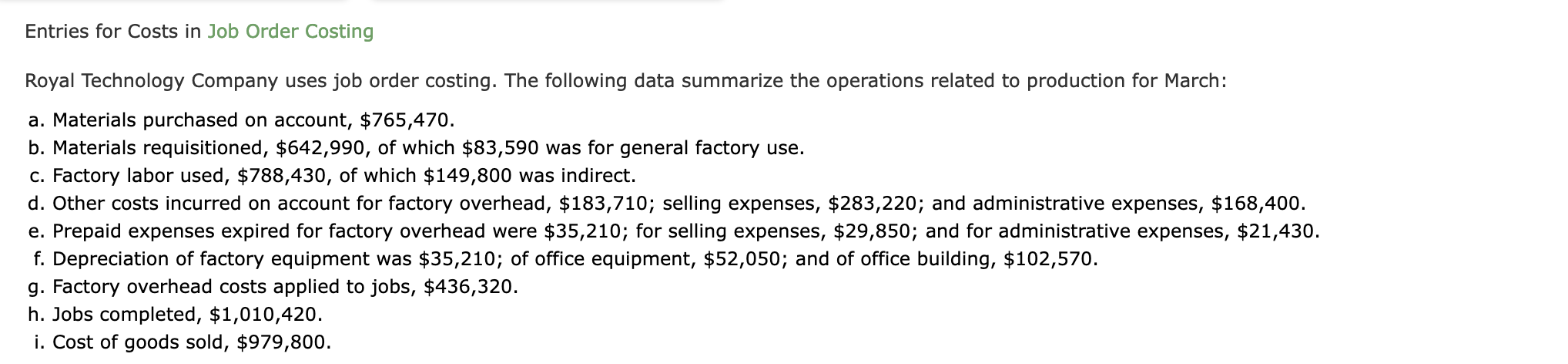

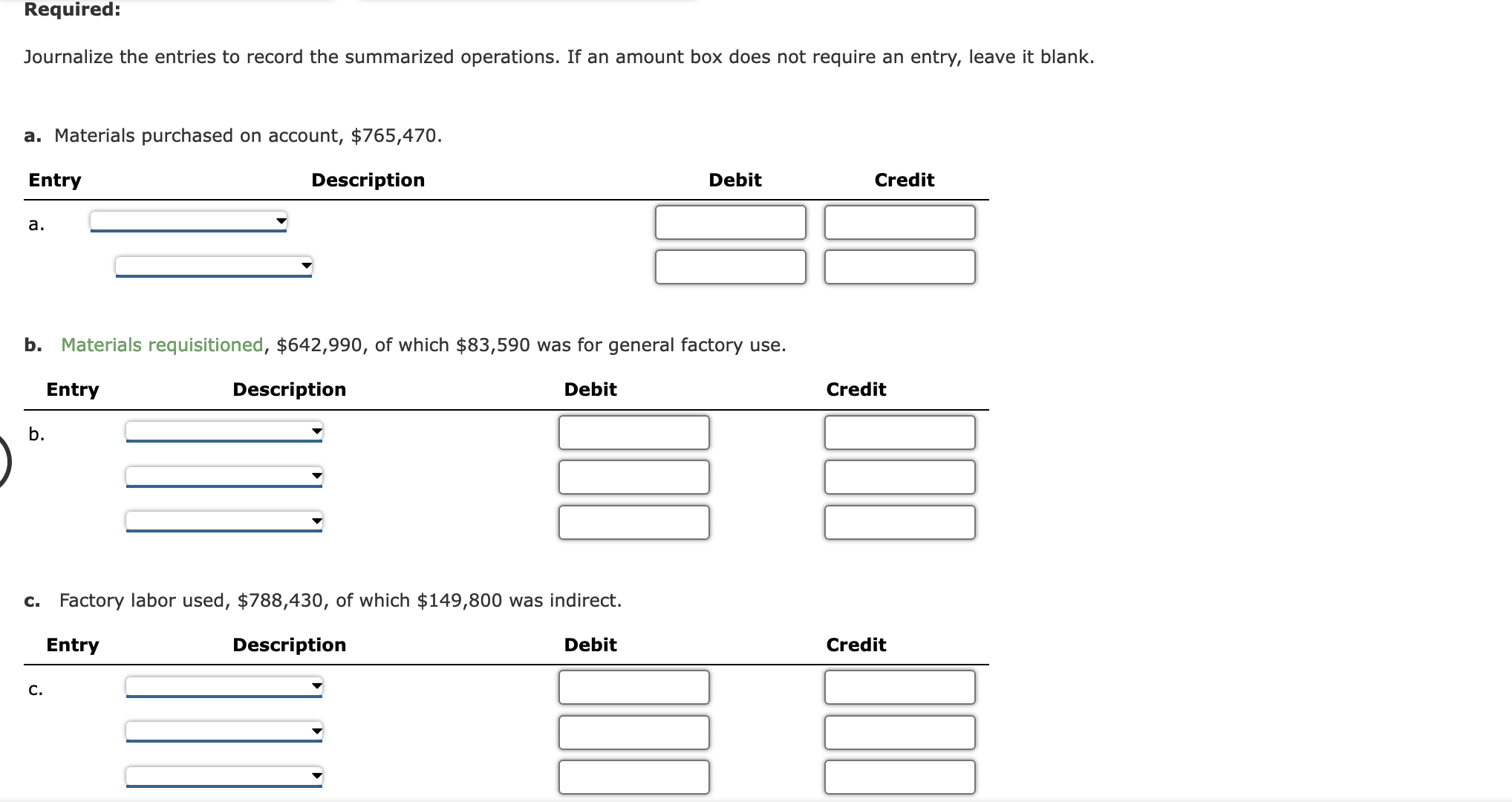

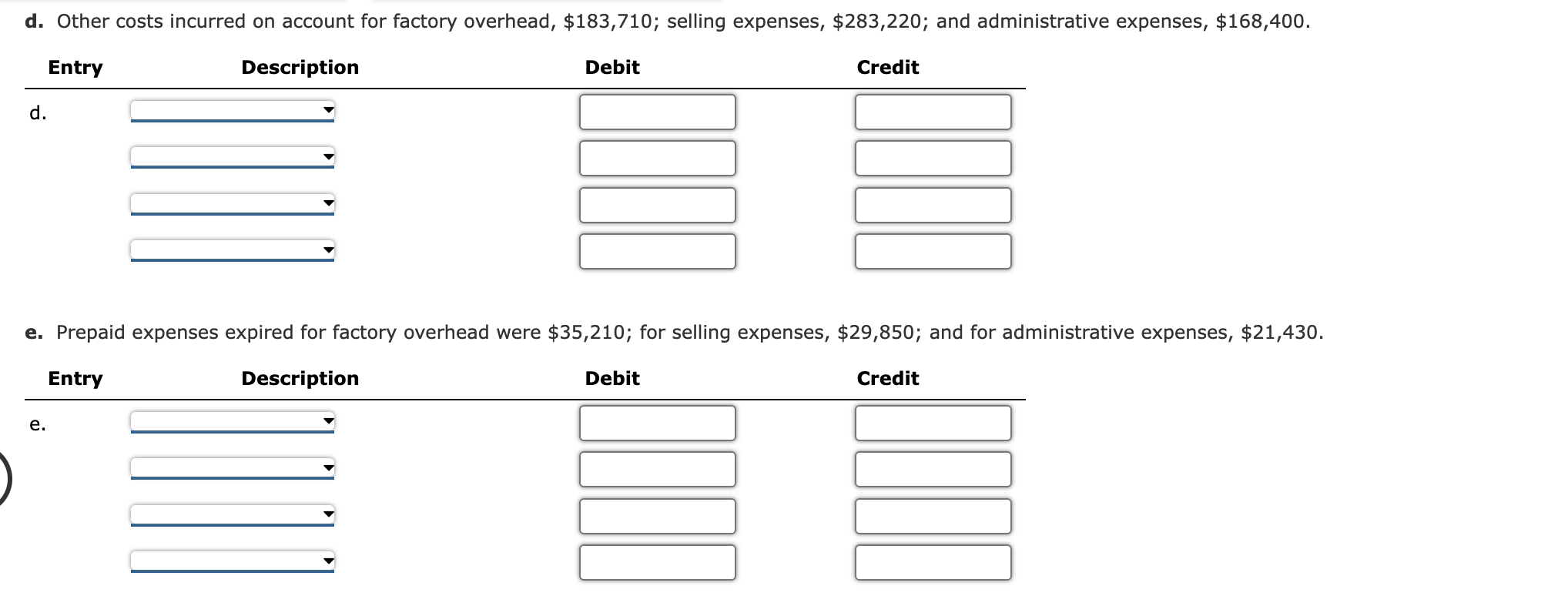

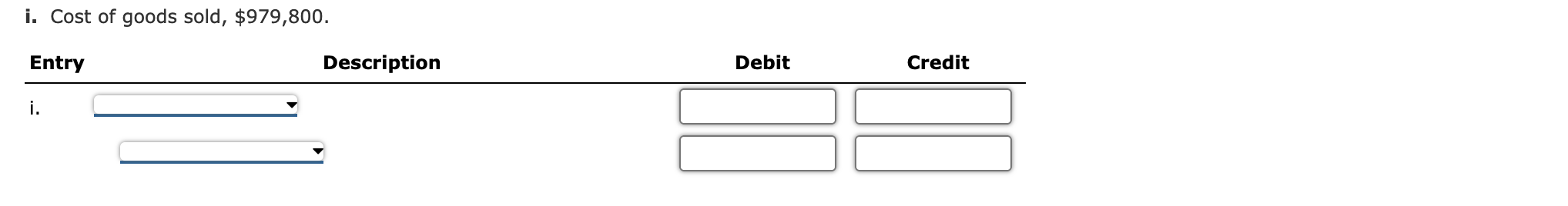

Entries for Costs in Job Order Costing Royal Technology Company uses job order costing. The following data summarize the operations related to production for March: a. Materials purchased on account, $765,470. b. Materials requisitioned, $642,990, of which $83,590 was for general factory use. c. Factory labor used, $788,430, of which $149,800 was indirect. d. Other costs incurred on account for factory overhead, $183,710; selling expenses, $283,220; and administrative expenses, $168,400. e. Prepaid expenses expired for factory overhead were $35,210; for selling expenses, $29,850; and for administrative expenses, $21,430. f. Depreciation of factory equipment was $35,210; of office equipment, $52,050; and of office building, $102,570. g. Factory overhead costs applied to jobs, $436,320. h. Jobs completed, $1,010,420. i. Cost of goods sold, $979,800. Journalize the entries to record the summarized operations. If an amount box does not require an entry, leave it blank. a. Materials purchased on account, $765,470. b. Materials requisitioned, $642,990, of which $83,590 was for general factory use. c. Factory labor used, $788,430, of which $149,800 was indirect. d. Other costs incurred on account for factory overhead, $183,710; selling expenses, $283,220; and administrative expenses, $168,400. e. Prepaid expenses expired for factory overhead were $35,210; for selling expenses, $29,850; and for administrative expenses, $21,430. g. Factory overhead costs applied to jobs, $436,320. i. Cost of goods sold, $979,800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started